Currently, there are only seven companies in the world with market capitalizations exceeding $1 trillion. This exclusive club includes six of the “Magnificent Seven”: Microsoft, Apple, Nvidia, Alphabet, AmazonAnd Metaplatforms.

Nvidia is currently the only purely semiconductor and data center services company with a multi-billion dollar valuation. But as Advanced microsystems, Intel, Qualcommand others compete to meet global demand for cutting-edge processors, I wouldn’t be surprised to see more chip stocks enter the trillion-dollar club.

But I don’t expect any of these three to become the next chip stock to reach a $1 trillion market cap. I rather predict that it will be Taiwan Semiconductor (NYSE:TSM)currently the ninth most valuable company in the world, worth $806 billion.

The hidden gem of the chip industry

Nvidia and AMD each develop sophisticated chips called graphics processing units (GPUs). GPUs provide the computing power for myriad generative AI applications, including machine learning, training large language models, accelerated computing, and more.

While this puts Nvidia and its competitors at the forefront of the artificial intelligence (AI) revolution, investors might be surprised to learn that they – and many other chip companies – are relying strongly on Taiwan Semiconductor.

While Nvidia, AMD, and many others design GPUs and other chips, they actually outsource most of their manufacturing. Taiwan Semiconductor, the world’s most productive third-party chipmaker, brings its chips to life. It also claims Amazon, BroadcomIntel, Qualcomm and Sony as major customers.

Remember to think long term

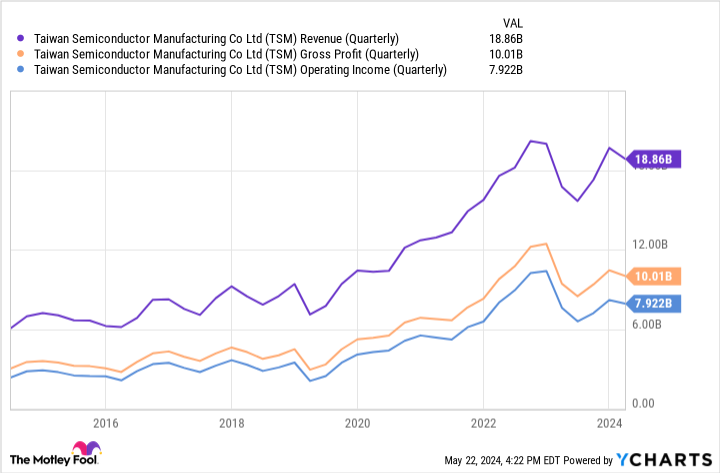

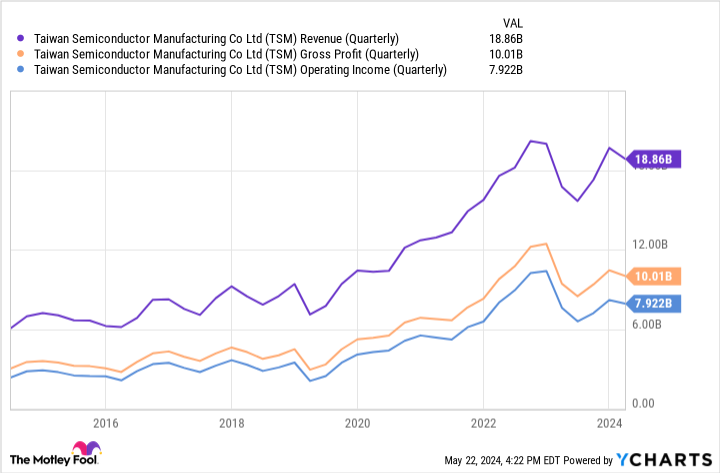

In the first quarter, the company’s revenue rose 13% year over year to $18.7 billion, a result that was at the high end of management’s forecast range.

One thing you may notice in the chart above is that Taiwan Semiconductor’s revenue and operating profits have fluctuated over the past few quarters. It’s natural. The semiconductor industry is cyclical and Taiwan Semiconductor is not immune to business conditions that affect its customers.

During the first quarter earnings conference call, management highlighted the seasonality of the smartphone industry, in particular, as being responsible for some fluctuations in revenue and profit margins.

Nonetheless, its long-term outlook remains strong.

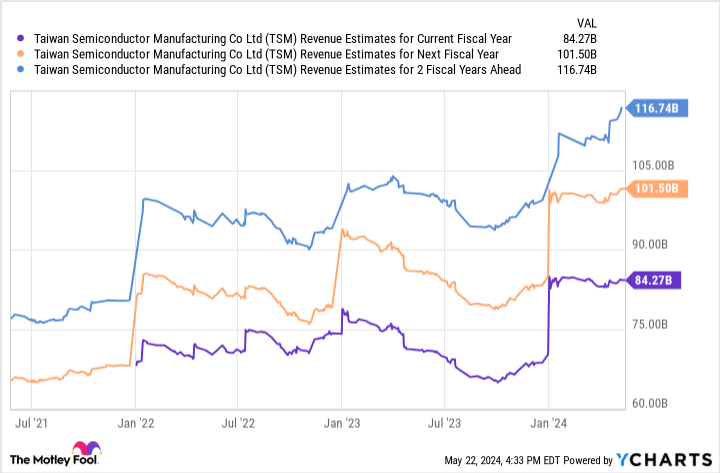

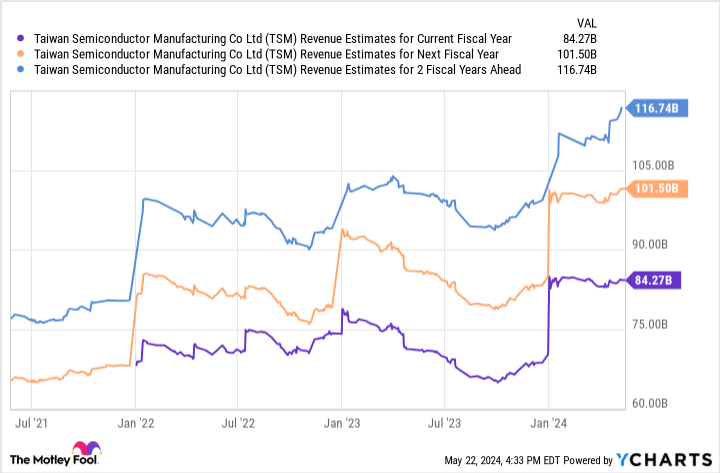

The consensus analyst estimate for Taiwan Semiconductor’s 2024 revenue is around $84 billion, representing 21% year-over-year growth.

It is clear that GPU demand will change in the short term. Indeed, many companies that have purchased the most powerful chips are still figuring out exactly how AI will play into their long-term roadmaps. For this reason, while I expect companies to allocate more capital to these chips over time, market growth will not be linear.

Although fluctuations in demand will impact Taiwan Semiconductor’s business, the long-term secular trends fueling AI are expected to continue to benefit the company. The key theme here is that investors will need to remain patient, as Taiwan Semiconductor’s new growth story is only in its early chapters.

Is Now a Good Time to Buy Taiwan Semiconductor Stock?

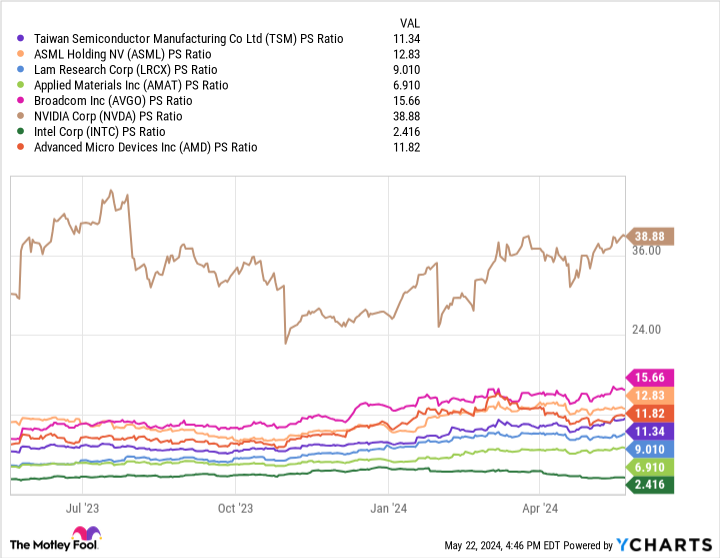

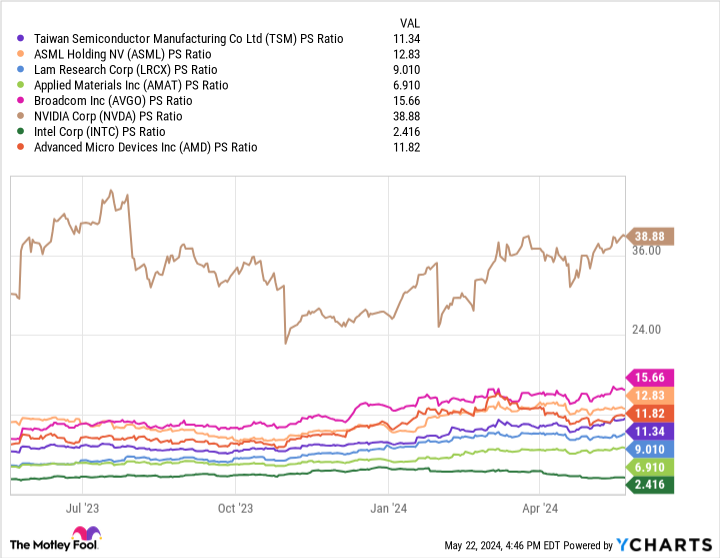

The chart below compares Taiwan Semiconductor to a wide range of players operating in various aspects of the semiconductor landscape.

Trading at a price-to-sales (P/S) ratio of 11.3, Taiwan Semiconductor stock has a valuation right in the middle of this pack. I find Nvidia’s high-end stocks fascinating now. While the company is certainly experiencing record growth thanks to its leading GPUs and data center services, its relationship with Taiwan Semiconductor might be underappreciated.

Indeed, given how many chip designers rely on Taiwan Semiconductor in one way or another, one could argue that the company’s role in the chip space is being overlooked.

I am optimistic about AI in the long term and believe Taiwan Semiconductor will continue to play a vital role in its advancement. I believe that as companies like Nvidia and AMD continue to innovate and release new products, it will increasingly catch the radar of more investors.

Given this dynamic, I see Taiwan Semiconductor following Nvidia to a trillion-dollar valuation sooner rather than later.

Should you invest $1,000 in semiconductor manufacturing in Taiwan right now?

Before buying Taiwan Semiconductor Manufacturing stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Taiwan Semiconductor Manufacturing was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $652,342!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 values »

*Stock Advisor returns May 28, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Adam Spatacco holds positions at Alphabet, Amazon, Apple, Meta Platforms, Microsoft and Nvidia. The Motley Fool holds positions and recommends ASML, Advanced Micro Devices, Alphabet, Amazon, Apple, Applied Materials, Lam Research, Meta Platforms, Microsoft, Nvidia, Qualcomm and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Broadcom and Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short January 2026 $405 calls on Microsoft, and short 47 calls $ in May 2024 on Intel. The Motley Fool has a disclosure policy.

Prediction: This will be the next semiconductor company to join Nvidia in the trillion-dollar club (hint: it’s not AMD) was originally published by The Motley Fool