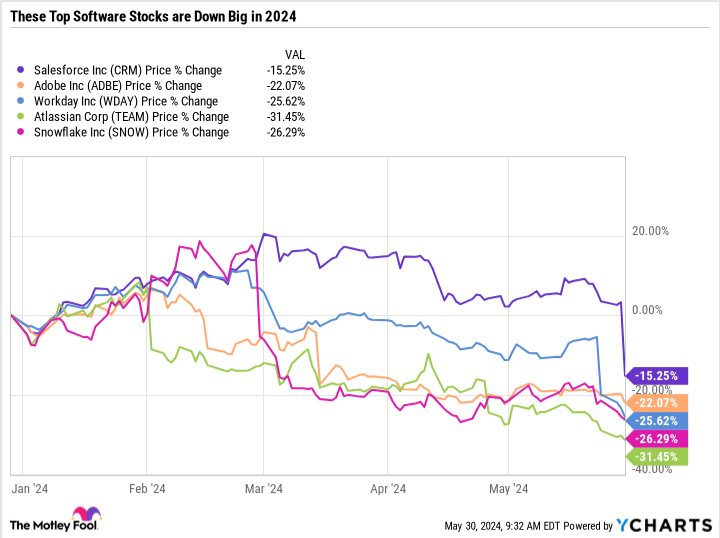

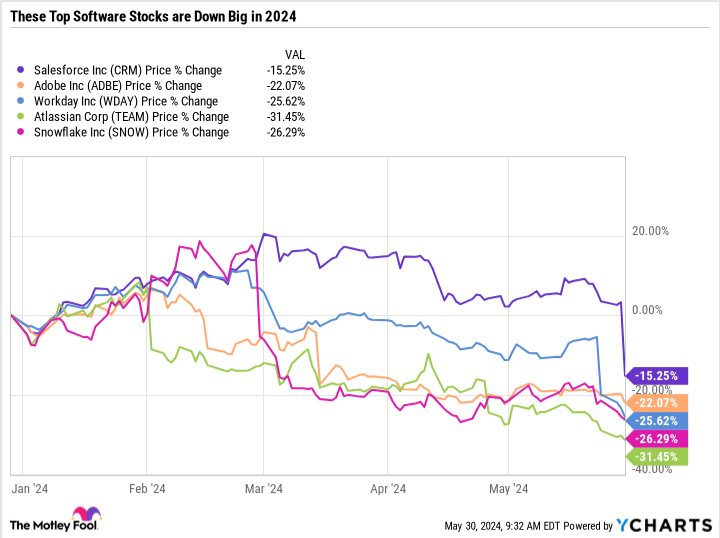

Selling power (NYSE:CRM) the stock was crushed on May 30, a day after issuing weak guidance for the second quarter of fiscal 2025. Salesforce and other top software stocks – from Adobe has Working day, Atlassian, Snowflake, and others are hovering around their lowest levels so far this year. The liquidation of software applications and infrastructure companies, which are part of the technology sector, may be surprising, given the strength of the semiconductor industry.

Here’s what’s driving the selloff in software stocks, why it’s a wake-up call for the broader market rally, and a simple exchange-traded fund (ETF) to consider if you want to buy the dip in the space.

Salesforce slows down

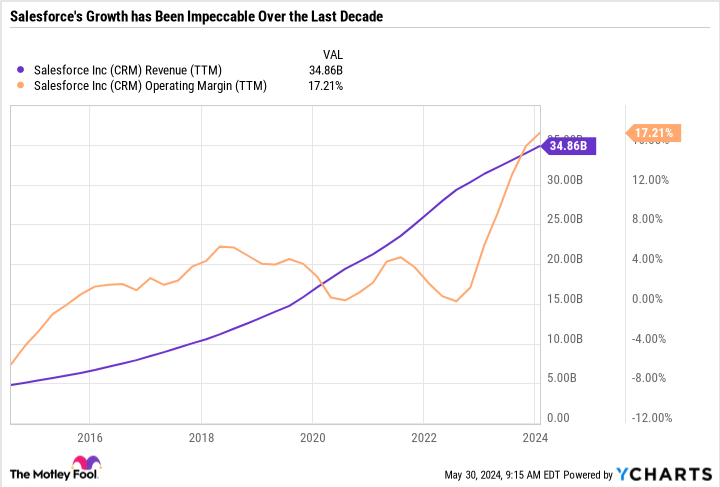

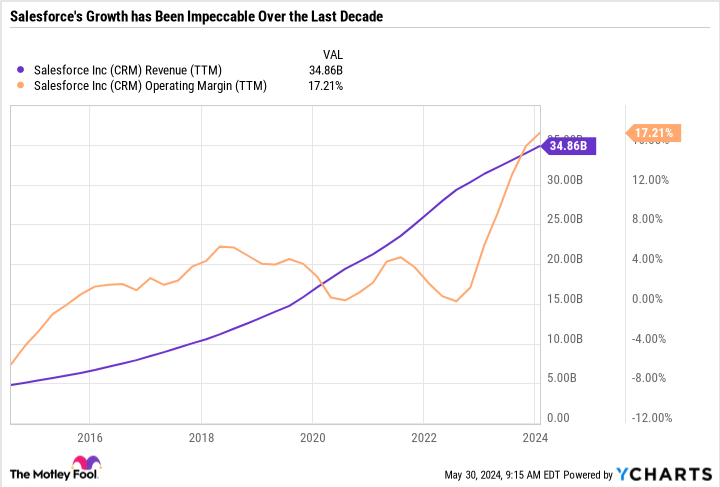

Salesforce is all about growth. The software-as-a-service (SaaS) company has seen tremendous growth regardless of the market cycle. Over the past decade, Salesforce has grown from $5 billion in annual revenue to over $30 billion, while improving profitability by increasing margins.

Even after the recent selloff, Salesforce is the third most valuable software company behind Microsoft And Oracle. So when something unexpected happens in his business, the market listens.

Salesforce reported strong results and maintained its revenue guidance for full fiscal 2025. However, it lowered its fiscal 2025 guidance for subscription and support revenue growth and operating margin according to generally accepted accounting principles (GAAP).

Given the slowdown, analysts wondered why Salesforce didn’t simply cut its revenue guidance and reset its expectations so it could once again underpromise and overdeliver. But Salesforce seemed confident it could still achieve its goal despite the weak quarter ahead.

Long term, Salesforce is extremely optimistic about the growth of artificial intelligence (AI) and its impact on its business. Salesforce CEO Marc Benioff said the following during his opening remarks during the earnings call:

But the only thing every business needs for AI to work is its customer data, along with the metadata that describes the data, that provides the attributes and context that AI models need to generate precise and relevant results. And customer data and metadata is the new gold for these companies, and Salesforce now manages, as I mentioned, 250 petabytes of this valuable hardware. We have one of the largest and broadest front-office enterprise data and metadata repositories in the world. And every day, more and more companies are adopting Salesforce as their front office, bringing all their structured and unstructured data onto our platform.

In short, Salesforce believes that it can use AI to run its business better and AI models will also depend on Salesforce tools and data, resulting in a win-win scenario.

That’s all well and good, but the short-term challenges are glaring – hence the sharp sell-off. Chief Operating Officer Brian Millham said the following during his opening remarks on the call: “We continue to see measured purchasing behavior similar to what we have experienced over the past two years and, with the exception of the fourth quarter where we saw stronger bookings, the momentum we have The fourth quarter results moderated in the first quarter and we saw lengthened transaction cycles, compression of transactions and high levels of budgetary control.

In other words, Salesforce says its fourth-quarter fiscal 2024 results are timely and the mid-term trend of sluggish growth persists. Revenue growth in the second quarter is expected to be only 7-8% higher than the same quarter last fiscal year. And the current nominal growth in the remaining performance obligation (cRPO) is expected to be only 9%. Salesforce defines cRPO as its contracted revenue expected to be recognized within the next 12 months. This is essentially the SaaS version of a backlog. Single-digit sales growth and CRPO suggest that Salesforce is growing at a much slower pace than in previous years, which is why its full-year guidance could be in jeopardy.

Cracks throughout the industry

Salesforce’s guidance and comments on the earnings call add to the theme of slowing growth for many large software companies. Adobe experienced a massive sell-off in March after issuing weak near-term forecasts. The company is investing heavily in AI and making major product improvements, but it has not been able to monetize AI significantly enough to offset higher spending. Adobe’s situation is very similar to Salesforce’s. Both companies are experiencing a disconnect between investments in AI and the profitability of those investments.

Workday’s results for the first quarter of 2024 beat expectations, but forecasts predict slowing revenue growth due to a weak order backlog. The stock is now down more than 23% year to date.

Atlassian is down more than 30% year to date, despite strong growth and effective cost management. Concerns about its valuation, the departure of its co-CEO and the growth of its cloud segment continue to put pressure on the stock.

Snowflake’s revenue has held up fairly well, but its margins and profits are full of red flags. It also did not manage its capital well, notably by buying back its shares at a price that now seems high. The stock is down more than 25% since the start of the year.

All told, many large software companies are facing a combination of growth and valuation challenges, which were amplified by the selloff in Salesforce shares on Thursday.

An ETF to consider

With over $6 billion in net assets and an expense ratio of 0.41%, The iShares ETF for the broad technology software sector (NYSEMKT: IGV) is a great way to buy the dip in the software industry. The fund was created at the time of the dot-com collapse in 2001, giving it a long track record of performance throughout periods of market volatility.

Microsoft, Oracle, Salesforce, Adobe and Intuition represent 40.5% of the fund. In addition to these top holdings, the fund is well balanced between enterprise software companies and key cybersecurity leaders.

Some large cybersecurity companies like Crowd strike are hovering around all-time highs and doing better than enterprise software companies. Broad exposure to software applications and infrastructure companies that cater to diverse end markets makes the fund’s expense ratio well worth its price.

Despite the strength of Microsoft and Oracle, the ETF has remained roughly flat year-to-date, showing the extent of the selloff in other software stocks.

Proceed with caution

Although SaaS companies benefit from recurring revenue streams, their long-term growth depends on adding new customers and increasing spending from existing customers. Innovation is a key driver of customer retention and expansion, just like the business cycle.

The customers of these SaaS companies span the entire economy, making SaaS companies particularly vulnerable to the ripple effects of a broader downturn. Guidance from Salesforce and other companies suggests that customers are keeping spending tight and being cost conscious – which is a theme worth watching for the health of the broader market recovery.

The investment thesis for many of these companies has not changed, but their valuations are based on sustained growth, so volatility could persist in a prolonged downturn. Investors with a three to five year time horizon and high risk tolerance may want to consider the iShares Expanded Tech-Software Sector ETF as a catch-all way to invest in software while still gaining diversification benefits .

Should you invest $1,000 in Salesforce right now?

Before buying shares in Salesforce, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Salesforce wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $677,040!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 values »

*Stock Advisor returns May 28, 2024

Daniel Foelber has no position in any of the stocks mentioned. The Motley Fool features and recommends Adobe, Atlassian, CrowdStrike, Intuit, Microsoft, Oracle, Salesforce, Snowflake, and Workday. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

My best ETF to buy the dip in falling software stocks like Salesforce was originally published by The Motley Fool