Investors looking for dividend income should look to business development companies, limited partnerships and the Dividend Kings list.

One of the cornerstones of a diversified portfolio should be dividend stocks.

Dividend stocks are important because the passive income they generate can mitigate some of the losses you might incur due to stock price volatility. Additionally, supplementing your portfolio with a steady stream of dividend income can come in handy when you need cash.

Let’s explore five stocks that are reliable, proven dividend payers and evaluate why now seems like a good time to acquire shares in each of them.

1. Hercules Capital: dividend yield of 9.9%

One of the best sources of dividend income comes from business development companies (BDCs). BDCs are structured so that 90% of their taxable income is paid to shareholders each year as a dividend.

Capital Hercules (HTGC 1.02%) is a leading BDC specializing in high-interest loans to companies in the technology, life sciences and energy sectors. Since BDCs make loans, it is imperative that portfolio companies are able to repay principal and interest.

According to company filings, a debt investment is classified as a non-accrual investment “when it is probable that principal, interest or fees will not be received in accordance with the contractual terms.”

The table below illustrates non-accruals as a percentage of Hercules’ total portfolio:

| Category | Q1 2023 | Q2 2023 | Q3 2023 | Q4 2023 | Q1 2024 |

|---|---|---|---|---|---|

| Non-accumulation loans as a % of total investments at cost | 0.6% | 0.4% | 2.7% | 1% | 1.2% |

Data Source: Hercules Investor Relations

Given that only about 1% of Hercules’ total portfolio is considered at risk, I’d say the company is pretty well managed.

HTGC Total Return Price Data by YCharts

Not only does Hercules offer a juicy 9.9% dividend yield, but the stock’s overall long-term performance is equally impressive. Over the past 10 years, Hercules stock has delivered a total return of 278%.

The chart above shows that a $10,000 investment in Hercules ten years ago would be worth over $37,000 today. Not only does this highlight the importance of dividend reinvestment, but it also makes a good argument for Hercules as a long-term prospect.

2. Horizon Technology: 11.4% dividend yield

Typically, start-ups initially seek funding from private equity or venture capital firms in their early stages. However, with each round of financing, the start-up’s employees and founders become diluted as investment companies acquire shares in the company in exchange for capital.

This is what makes BDCs so attractive. Since debt is non-dilutive, companies often forgo raising capital when the business matures.

Horizon Technology (HRZN 0.17%) is another BDC in the technology and healthcare space. The company competes heavily with Hercules and offers a similar line of subprime debt term loans used for acquisition capital or cash flow.

A unique feature of Horizon is that the terms of its transactions are often accompanied by warrants. While Horizon earns its living from interest on its loan repayments, warrants provide an added benefit to benefit from an upside if one of its portfolio companies is acquired or goes public.

Currently, Horizon Technology trades at a price-to-book (P/B) multiple of 1.2. In contrast, its rival Hercules Capital has a P/B of 1.6.

At just $11 per share, Horizon stock is trading in the middle of its 52-week range. Given its discount to the company’s closest competitor and a blistering 11% yield, now seems a tempting time to scoop up shares.

Image source: Getty Images.

3. Ares Capital: 8.9% dividend yield

The last BDC on my list is Ares Capital (ARCC 0.70%). While BDCs like Hercules and Horizon focus on high-growth sectors, Ares takes a different approach.

The company typically works with lower middle market companies that are overlooked by large investment banks or consulting firms. The other feature that makes Ares unique is that it offers a wider variety of financial instruments compared to most BDCs.

While BDCs tend to specialize in term loans and revolving lines of credit, Ares has the financial muscle to execute more sophisticated transactions, including leveraged buyouts, recapitalizations and restructurings.

Similar to Hercules, Ares’ portfolio is still strong. As of March 31, the company’s non-accrual rate was just 1.7%. This rate is well below the average rate of 3.8% across the BDC.

This performance speaks volumes about the quality of Ares’ due diligence and the company’s ability to execute a broad range of financial products.

Over the past decade, Ares has recorded a total return of 230%, far exceeding the S&P500.

Given its differentiators compared to other leading BDCs, coupled with strong long-term performance and an ultra-high 9% dividend yield, Ares stock could be worth putting on your radar .

4. Altria: dividend yield of 8.5%

There are many other ways to find dividend stocks outside of BDCs. A good place to start is the Dividend Kings list.

Dividend Kings are an extremely rare breed of companies that have both paid and increased their dividends for at least 50 consecutive years.

Among the oldest dividend kings is the tobacco company Altria (MO 1.78%). Altria owns a number of cigarette and tobacco brands, including Marlboro and Black & Mild.

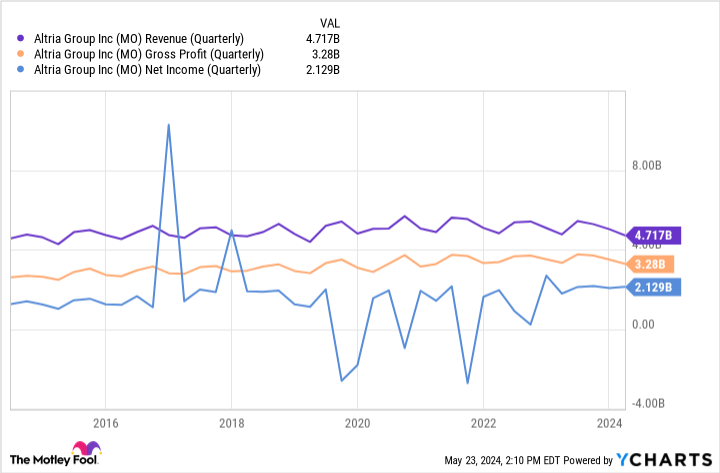

MO Revenue Data (Quarterly) by YCharts

I would understand if the table above gives you some apprehension. The ebb and flow of Altria’s revenue and operating profits does not bode well for the company.

However, Altria is currently going through something of a renaissance. While sales of traditional tobacco products such as cigarettes are declining, the company has identified new growth opportunities that are showing encouraging progress.

Altria notably invests heavily in “smokeless tobacco” products such as vaping and nicotine sachets. These products open new sources of growth for Altria, helping the company penetrate retail markets and begin writing the first chapters of a turnaround.

Although it will take Altria some time to return to accelerating sales and profits, I believe the company is taking the necessary strategic steps to maintain its position as a leading tobacco brand. More importantly, given that this is not the first time in Altria’s history that it has been needed to address changes in consumer trends, I am optimistic that the company will maintain its dividend on the long term.

5. Western Midstream Partners: 9.3% dividend yield

Another good source of passive income can be found in master limited partnerships (MLPs). MLPs are intriguing businesses because they essentially act as pass-through entities for investors (limited partners).

Investors in MLPs can enjoy certain tax benefits because any losses the company faces are passed on to the LPs. Additionally, MLPs pay out a good portion of their income to investors each quarter. These payments are called distributions and are essentially the same as a dividend.

I recently wrote an article about West of the intermediate sector (WE S 2.44%) stock, and why I think billionaire investor Bill Gross might view the stock as a hedge against fixed income. Gross has made his name in the bond industry, so it’s likely that when he invests in stocks, he’s looking for opportunities for steady growth.

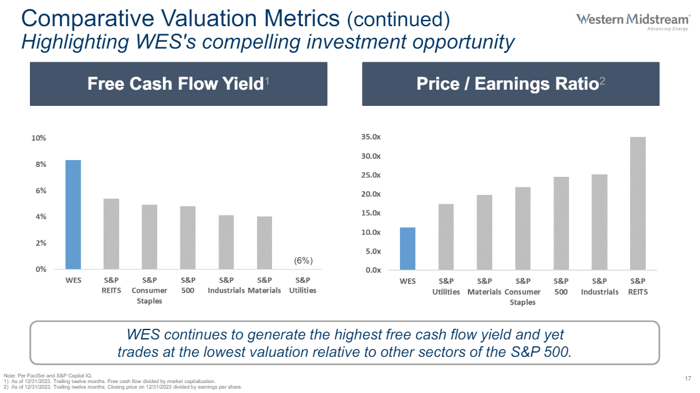

Image Source: Western Midstream Partners Investor Relations

Another characteristic that makes MLPs attractive for investment is that they tend to be more insulated from commodity-related volatility in the broader energy sector because they enter into long-term contracts at fixed costs with their customers.

The charts above illustrate Western Midstream’s price-to-earnings (P/E) ratio as well as its free cash flow yield. The obvious theme here is that the Western midstream sector generally has significantly higher free cash flow than adjacent industrial opportunities in utilities, industrial products and materials. Yet despite these results, Western Midstream’s P/E trades at a notable discount.

I think this dynamic makes Western Midstream particularly attractive because the company is constantly generating cash flow, which it then uses to periodically increase distribution payments. However, the disparity between Western Midstream’s valuation multiples and those of other cash flow-generating opportunities is hard to ignore.

Given that the company offers a 9% dividend yield and trades at a significant discount to its cohorts, investors may want to acquire some shares.