When Nvidia (NASDAQ:NVDA) After reporting results for its first fiscal quarter 2025 (ended April 28), the company delivered record results that exceeded Wall Street’s expectations. However, shareholders were more intrigued by another development.

Along with its earnings release, Nvidia management revealed a significant 10-for-1 stock split. Since its announcement on May 22, shares have soared more than 14% (as of this writing). , and the stock has already gained 117% so far this year. This is a clear indication that investor interest remains strong, likely fueled by Nvidia’s strong ties to artificial intelligence (AI).

The stock split is expected to take place after the market close on Friday, June 7. Does the upcoming stock split make Nvidia a once-in-a-generation investment opportunity? Let’s see what the evidence shows.

Stock Split Summary

A brief recap of the reason behind a stock split can help give perspective to this process. If a company performs well over the long term, that performance is reflected in its rising stock price, putting high-priced stocks out of reach for some potential investors.

To correct this inequity, management may engage in a stock split to reduce the stock price. Nvidia noted in its announcement that the move was intended to “make stock ownership more accessible to employees and investors.” As a result, ordinary investors can afford to purchase whole shares rather than fractional shares offered by some brokerage firms.

Once the stock split is completed, shareholders will receive nine additional Nvidia shares for every share they already own. Even though there will be 10 times as many shares, they will trade at 1/10th the price, so basically nothing will change. The same factors that pushed Nvidia’s stock price to its current level will still be in play in the future.

Is Nvidia stock a buy?

Stock split mechanics aside, a key question remains: Does Nvidia represent an attractive investment opportunity ahead of its highly anticipated stock split? Let’s take a look at the company’s recent results.

In fiscal 2024 (ended January 28), Nvidia’s revenue soared 126% year-over-year to a record $60.9 billion. At the same time, earnings per share (EPS) of $11.93 jumped 586%. CEO Jensen Huang left no doubt about what’s driving this growth spurt. “Accelerated computing and generative AI have reached a tipping point. Demand is increasing all over the world, across companies, sectors and countries,” Huang said.

Nvidia’s results for the first quarter of 2025 were more of the same. Record revenue of $26 billion increased 262% year-over-year, while EPS of $5.98 jumped 629%. Management’s guidance suggests its growth will continue, with its forecast calling for revenue of $28 billion for the second quarter, which would represent year-over-year growth of 107%. It’s no exaggeration to say that these are clearly the results of a business operating at full capacity.

The staggering adoption of AI is driving the results, and most experts agree that the demand isn’t going to stop any time soon. Generative AI reduces time spent on tedious and mundane tasks, thereby increasing productivity. This economic boom is expected to add between $2.6 trillion and $4.4 trillion to the global economy over the coming decade, according to a study by McKinsey & Company.

Since Nvidia’s graphics processing units (GPUs) are the gold standard for running AI systems, the company should continue to benefit from the resulting windfall. These long-term tailwinds will blow in the company’s favor for the foreseeable future.

Some see Nvidia’s premium valuation as a sticking point, and that argument certainly has merit. The stock currently sells for 63 times earnings, which seems outrageous on the surface. The results aren’t as bad looking ahead, as Nvidia’s forward price-to-earnings (P/E) ratio stands at 39. For comparison, the S&P 500 has a multiple of 27 , so there is certainly a wide gap. That said, it is not Really an apples to apples comparison.

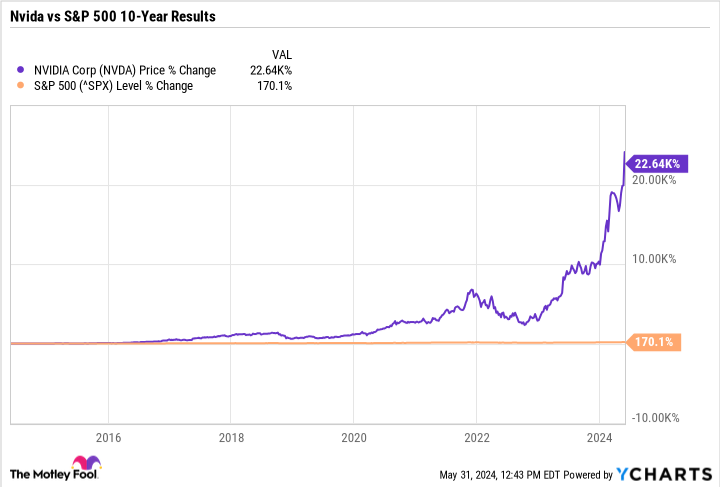

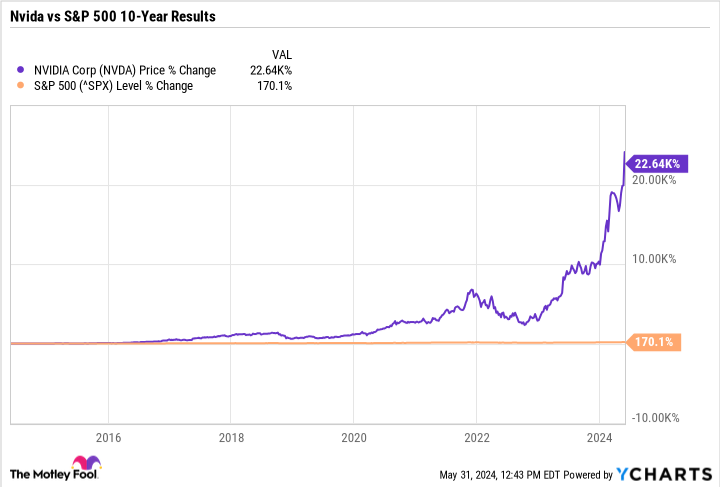

Over the past decade, Nvidia’s revenue has grown by 2,260% and its net profit by 11,530%. These results sent its stock price up 22,640%, while the S&P gained only 170%.

Clearly, Nvidia stock won’t appeal to all investors, especially those concerned about the stock’s valuation. For those in this camp, I would suggest buying the stock in the event of a major pullback or sign of weakness. However, given Nvidia’s strong earnings track record and the secular tailwinds blowing in its favor, I would say the evidence supports its premium valuation.

Overall, I think this clearly demonstrates that Nvidia is a once-in-a-generation investment opportunity. As for the question that started this missive, I don’t think it matters whether investors buy Nvidia stock before or after the stock split date, but as I explained above, I certainly think that it is a purchase.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider this:

THE Motley Fool Stock Advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $671,728!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 values »

*Stock Advisor returns May 28, 2024

Danny Vena holds positions at Nvidia. The Motley Fool Ranks and Recommends Nvidia. The Motley Fool has a disclosure policy.

Is Nvidia stock a unique investment opportunity ahead of its 10-for-1 stock split on June 7? was originally published by The Motley Fool