DNY59

Charlie Munger of Berkshire Hathaway (BRK.A)(BRK.B) was a firm believer in the power of concentrated portfolios, owning only a few stocks outside of his BRK.A stock, such as Alibaba (BABA) and Costco (COST). Personally, I I like to diversify beyond a few stocks and typically hold about two dozen stocks in my portfolio at any given time, since my the strategy relies heavily on opportunistic capital recycling rather than simply buying and holding stocks for decades to come. However, there is a lot to be said for Mr. Munger’s approach, because it simply requires making a few really smart decisions, then having the discipline to let time and the power of compounding do its work.

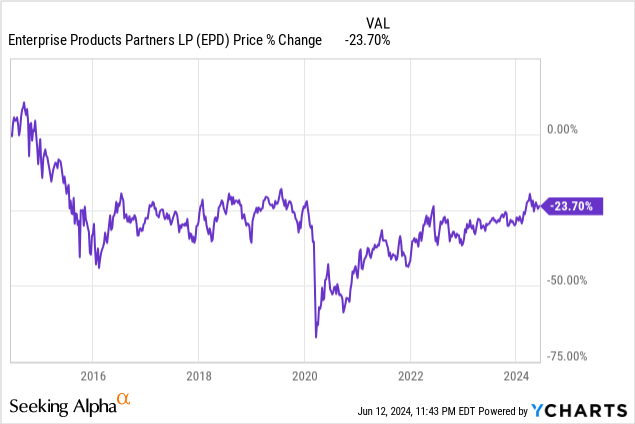

That being said, if I had to own just three stocks for the next decade, they would be Enterprise Products Partners (EPD), Newmont Corporation (NEM) and Virtu Financière (VIRT). Many investors may be wondering why I would choose these three stocks, particularly Virtu Financial and Newmont Corporation, which have been relatively underperforming in recent years and whose business models do not appear poised to deliver significant long-term outperformance. . That’s absolutely true, and even Enterprise Products Partners has been a bit of an underperformer in recent years, with its stock price down nearly 25% over the past decade.

My reasoning is that these three stocks appear undervalued, have strong balance sheets, are expected to return significant capital to shareholders in the coming years and, especially when held in combination, offer one of the best macroeconomic protections against this which I consider to be a major risk. storms likely to hit over the next decade.

#1. EPD stock

If I could only own one stock, it would be Enterprise Products Partners. EPD is the ultimate high-quality, high-yielding dividend growth stock, with a very strong balance sheet (A- credit rating), low leverage ratio, significant liquidity, well-staged debt maturities and a defensive and diversified business model in the midstream sector. energy value chain. With sufficient scale, proven and well-aligned management and an impressive track record of delivering double-digit returns on invested capital year after year through all manner of energy and macroeconomic cycles, EPD also has a strong growth profile and long-term contractual cash flow. flows.

It offers a very attractive current dividend yield of around 7.25%, which has been growing at a CAGR of around 5% and is expected to continue to do so in the coming years. When putting all this together, I consider it very unlikely that EPD will underperform over the next decade relative to the broader S&P 500 (SPY) and I think it has strong chance of outperforming. Combined with its very low risk profile, it makes an excellent core investment, especially for someone, like me, who values tax-deferred income.

#2. Out of stock

I would also own Newmont Corporation despite its very poor recent performance. Newmont has a very strong balance sheet that will only strengthen in the coming months as it sells non-core assets and prepares to repurchase several billion dollars of its stock, which should support the stock price. action. It has some of the world’s best assets in geopolitically low-risk regions and one of the cheapest valuations in the sector, comparing favorably to other blue-chip stocks like Agnico Eagle Mines (AEM).

Additionally, Newmont has significant exposure to gold and copper, two metals with high upside potential over the next decade. Copper could benefit from the electrification trend, while gold (GLD) should do well if the global economy stumbles, given excessive deficit spending, a weakening U.S. dollar and rising skyrocketing geopolitical risks. For example, if a war broke out in the Far East, gold would skyrocket. The fact that the Central Bank of China is purchasing gold en masse is also a major tailwind for gold prices over time, and Newmont, with its influence on gold prices and its geographic location in low-risk geopolitical regions, could be a major beneficiary.

#3. VIRT shares

Meanwhile, Virtu Financial is a market maker that has seen its periods of highest profitability following stock market crashes. Given my concerns about skyrocketing geopolitical risks, potential conflicts involving China that could plunge the world into a depression, and worries about the high valuations of the current S&P 500 alongside weakening economic conditions in the United States, Virtu Financial could thrive in a major economic crash.

Virtu Financial is also buying back stock very aggressively, with the CEO loading up on shares, and it pays a nice dividend. Finally, it is exposed to Bitcoin (BTC-USD) as a market maker, and if the crypto trend, options trading and increased digitalization of assets continue to grow significantly over the next decade, Virtu Financial could be a major beneficiary. Therefore, I see several viable paths to generating market-level or even above-market returns, even if there are no major stock market crashes that increase its profitability. As a result, this adds significant risk mitigation and complements the risk-reward ratio of my portfolio, giving me an asymmetrical position relative to the vast majority of stock investors who currently buy “Magnificent 7” stocks or the S&P 500 at the moment. broadly speaking at very high valuations. .

Takeaways for investors

As you can see, these three holdings are unorthodox and probably not what one would expect in a concentrated portfolio for the next decade. However, given my relatively pessimistic view of global geopolitics and the state of fiscal and economic affairs in the United States, it makes perfect sense to position my portfolio this way. Even as the world remains at peace and the economy continues to churn, Enterprise Products Partners, Newmont Corporation and Virtu Financial are well positioned to generate very strong total returns, particularly given their current attractive valuations and exposure to key long-term trends like the current infrastructure boom, the attractive outlook for copper and the rise of asset digitalization.

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Please be aware of the risks associated with these actions.