The continued claims also show growing economic weakness. Some say it’s just California. Let’s investigate.

New signs of economic weakness are appearing in the supposedly strong labor market.

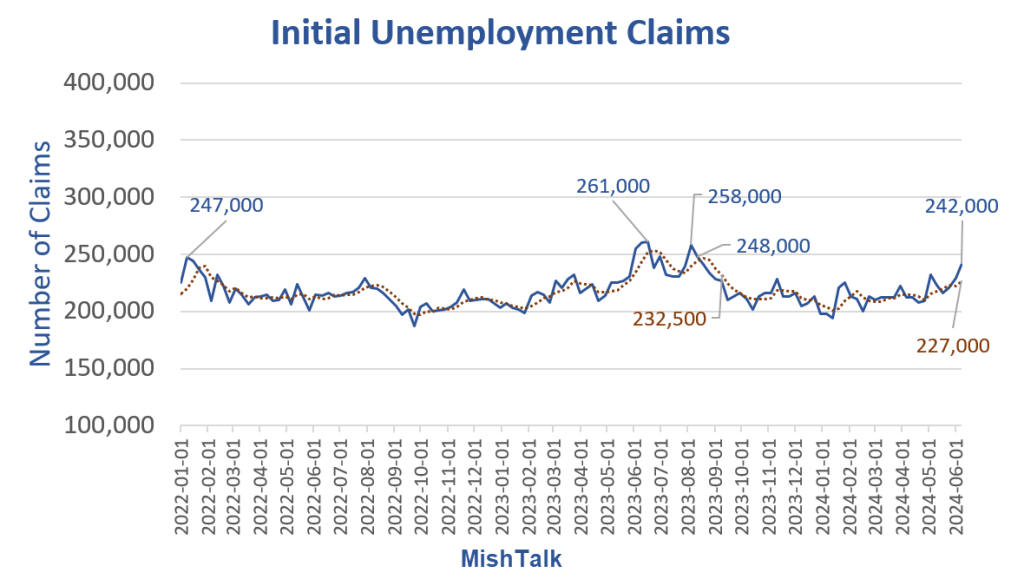

In the week ending June 8, the anticipated figure for seasonally adjusted initial claims was 242,000, an increase of 13,000 from the previous week’s unrevised level of 229,000.

The 4-week moving average was 227,000, an increase of 4,750 from the previous week’s unrevised average of 222,250.

A Californian anomaly?

The report shows that the unadjusted level for California increased from 40,799 to 51,110. This represents an increase of 10,311.

So it’s just California? Did this even happen in California.

State level data is not seasonally adjusted.

Rise in jobless claims in the United States, led by California

Bloomberg reports rising U.S. jobless claims, led by California

Initial claims for unemployment benefits in the United States reached their highest level in nine months, driven by a sharp increase in California, during a period when holidays and the end of the school year can lead to fluctuations in demands.

Initial claims increased by 13,000 to 242,000 in the week ended June 8, according to Labor Department data released Thursday. This figure was above all forecasts in a Bloomberg survey of economists.

New claims before adjusting for seasonal influences increased by 38,530 to 234,707 last week. Besides California, Pennsylvania and Minnesota saw significant gains for a second week. The release said that during the previous week, ending June 1, Pennsylvania saw layoffs in transportation and manufacturing, while job cuts occurred in education in Minnesota.

Two opinions

Stephen Stanley, chief U.S. economist at Santander US Capital Markets LLC, said in a note that some of the increases in states are “implausibly large” and could be linked to the end of the school year or volatility general seasonal.

“I view this more as noise than a signal, and I’m not going to worry for at least two weeks about the possibility that the layoffs will accelerate.“Stanley said in a note.

What Bloomberg Economics says…

“California saw the largest increase in unadjusted initial claims (+10.3K), leading us to believe that some of the nationwide increase may be due to weakening market conditions work. We estimate that raising California’s minimum wage for fast food workers could cost the state between 30,000 and 90,000 jobs. — Eliza Winger, economist

Continued unemployment claims

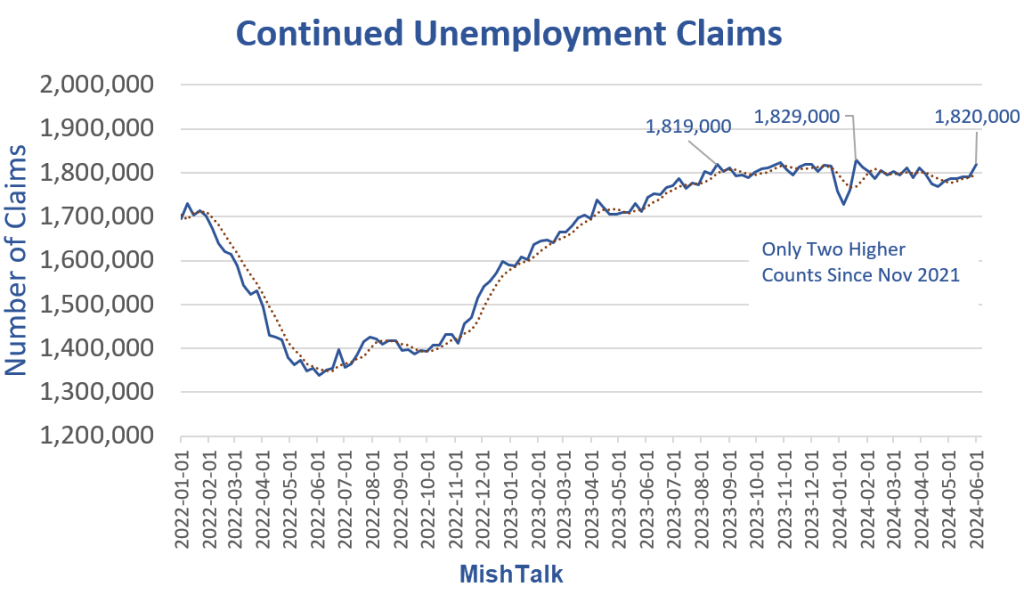

After falling from a low in June 2022 to around 1.82 million in August 2023, continuing claims have essentially reflected a sharp decline and then a reversal in January 2024.

Apart from a tally of 1.829 million in January 2024 and 1.823 million in October 2023, this is the highest number of continuing applications since November 2021.

Is this school year in California noisy?

This is according to Stephen Stanley, chief US economist at Santander US Capital Markets LLC.

I strongly disagree.

California is weakening as expected and reported in this corner.

California restaurants are cutting jobs as fast food wages are expected to rise

On March 26, I noted California restaurants are cutting jobs as fast food wages are expected to rise

California is not having a good week. State Farm has canceled 72,000 insurance policies and fast food chains are now laying off their workforce.

California fast food restaurants cut 10,000 jobs

On June 6, before this report, Fox News reported that a think tank said California fast food restaurants had cut 10,000 jobs.

The California Business and Industrial Alliance (CABIA) criticized Democratic Gov. Gavin Newsom for pushing through the law, which took effect April 1 — and was blamed for forcing a beloved taco chain to close 48 locations in state last week.

Goodbye Rubio’s Grill

The Wall Street Journal reports that Rubio’s Restaurants is filing for bankruptcy and considering selling the chain

Rubio’s Restaurants, operator of the fast-casual restaurant chain Rubio’s Coastal Grill, has filed for Chapter 11 bankruptcy for the second time in less than four years and is considering selling the business to its current lender.

Rubio’s said it recently closed 48 underperforming locations in California and that its remaining 86 locations in California, Arizona and Nevada would continue normal operations.

Red Lobster, the largest seafood restaurant chain in the United States, filed for bankruptcy last month after failing to recover from the decline in traffic it suffered during the pandemic as menu prices were increasing.

BurgerFi International, owner of the Anthony’s Coal Fired Pizza & Wings and BurgerFi chains, said last week it was exploring strategic alternatives in the face of liquidity concerns and had entered into a forbearance agreement and an amendment to its debt facilities. credit with TREW.

Victim of the business climate

Also Consider Rubio’s Coastal Grill: A Victim of California’s ‘Business Climate’

In California, the minimum wage of $20 an hour in fast food restaurants took effect two months ago, and the number of victims is increasing. Rubio’s Coastal Grill, famous for its fish tacos, closed 48 restaurants across the state on Friday.

“The closures were prompted by the rising costs of doing business in California,” the Carlsbad-based fast-casual chain said. He added that his decision to close the Golden State’s four dozen “underperforming locations” followed a review of operations and the “current business climate.”

Governor Gavin Newsom responded by blaming Rubio’s. Communications Deputy Brandon Richards tweeted that the chain faced other problems and filed for bankruptcy in 2020. A major culprit then was Mr. Newsom’s excessive Covid lockdowns. The criticism also suggests that the minimum wage isn’t doing any damage because Chipotle “just reported HUGE profits.”

But Chipotle executives also pointed out during an April earnings call that California’s wage mandate had led it to raise menu prices 6 to 7 percent in the state and said it would hurt businesses. restaurant margins. They noted that Chipotle’s competitors were worse off amid rising labor costs.

While California added 35,100 leisure and hospitality jobs last year, the total hours worked by all workers in the sector decreased by 3%. The average weekly wage for California leisure and hospitality workers decreased 2.6% due to a sharp decline in hours worked.

Congratulations to Newsom

Rubio’s went bankrupt in 2020 thanks to Newsom’s covid lockdowns.

Then in 2024, Newsom bankrupted the chain again.

What other governors can make such a claim?

It’s not a teacher’s business

I believe we understand what is happening in California and can reject the view of Stephen Stanley, Chief U.S. Economist at Santander.

I suggest he read this blog and broaden his horizons.

Just a California thing?

That’s the question here. My conclusion is no. The data is weakening on so many fronts simultaneously that it’s not just a problem for California.

QCEW and BLS jobs

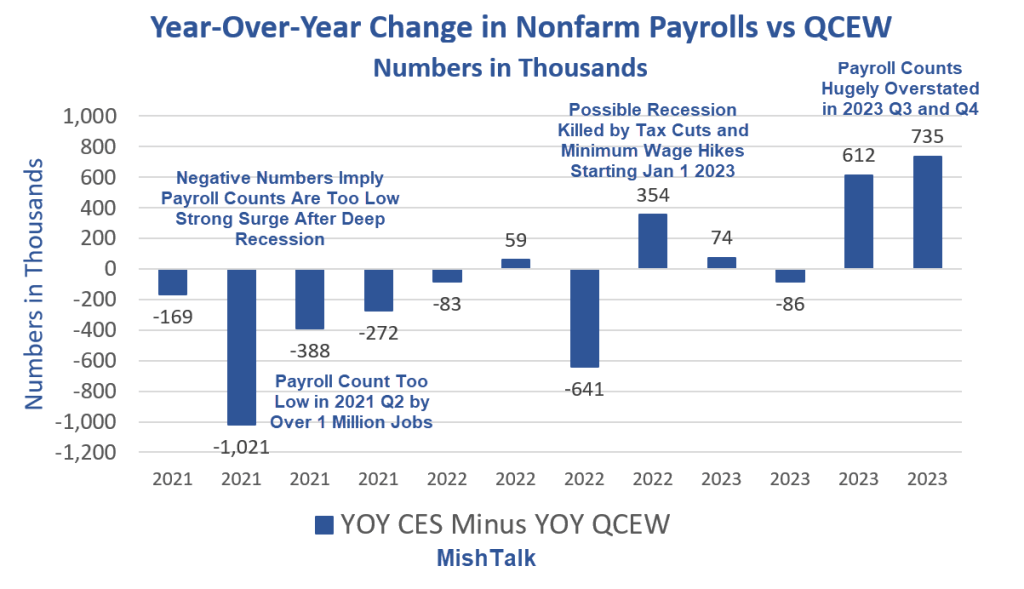

Note: The numbers in all my charts are not adjusted. They must be because the QCEW figures are not seasonally adjusted.

The QCEW (Quarterly Census of Employment and Wages) is a count of administrative unemployment insurance (UI) files submitted by 11.9 million establishments. This represents approximately 99 percent of the data.

Non-agricultural wages come from the Establishment Survey (CES). The sample survey was 666,000 individual construction sites in 2023. This represents approximately 5.6 percent of the data.

I discussed above the QCEW chart on June 6 in To what extent does the BLS overestimate monthly employment? Here is the answer

In retrospect, by “overestimate” I should say “defer”, although in this case I am convinced that overestimate is correct.

CES vs QCEW Full Year 2023

- CES: 155,211,000 to 158,269,000 (+3.06 million)

- QCEW: 152,525,000 to 154,848,000 (+2.32 million)

I don’t have confidence levels on QCEW but they should be much more accurate than CES.

For the full year, the difference between QCEW and CES is 735,000.

Payroll up by 272,000 Employment down by 408,000

The data is confusing and contradictory in many ways.

To discuss this, please see Another Bizarre Jobs Report: Payrolls Increased by 272,000, Employment Decreased by 408,000

Nonfarm employment and employment gains since May 2023

- Non-agricultural payroll: 2,756,000

- Employment level: +376,000

- Full-time employment: -1,163,000

Over the past year, jobs increased by 2.8 million while full-time employment decreased by 1.2 million.

Similarly, there is a huge gap between gross domestic product (GDP) and gross domestic income (GDI).

Real GDP vs real GNI

GDP and GNI are two measures of the same thing. The revenue received must correspond to the product produced.

However, incomes are historically low relative to GDP

For a discussion of the GDP-GDP gap, please see Weaker economic data, first quarter GDP revised downwards, fourth quarter GDI significantly lower

The GDI gives credence to the idea that the household survey (employment) is correct, and not the CES establishment survey (non-agricultural employment) with its presumed adjustments between births and deaths.

It is important to note that QCEW also fits into the picture.

QCEW, Household Survey employment figures and GDI are synchronized. The outlier is the nonfarm payroll report.

On this basis, coupled with the weakening of hard data, I reiterate my unpopular opinion: A recession in the second quarter of this year looks increasingly likely

The Fed seems confident in the short term. I suggest they should be as confident about 2024 as they are about 2025, which translates to no confidence at all.

Today I heard two prominent economists or analysts cite the noise (one mentioned above).

May I suggest that the data is so noisy in so many places and in so many ways that it may be nonfarm wages that are the real noise.