Nvidia shares have performed poorly following previous stock splits.

Nvidia (NVDA 1.75%) completed its 10-for-1 stock split after the market closed on Friday, June 7. Like most forward stock splits, this one follows a significant appreciation in the stock price. The stock has surged 225% over the past year and 850% since November 2022, when the launch of ChatGPT sparked the artificial intelligence (AI) gold rush.

Nvidia remains well-positioned to benefit from a growing number of companies investing in AI. Indeed, it is undoubtedly the best pure-play AI title. However, stock splits have always been bad news for Nvidia shareholders. The company’s value declined by an average of 23% in the 12 months following previous splits.

Here’s what investors should know.

Historically, stock splits have been bad news for Nvidia shareholders

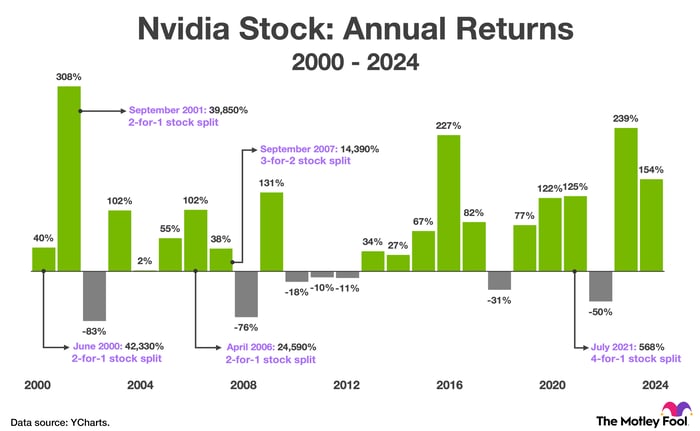

Excluding the most recent one, Nvidia has completed five stock splits as a public company, and shares have consistently declined afterward. The chart below details when each stock split took place and shows how the stock performed over the following six, 12, and 24 months.

|

Share split date |

Review over 6 months |

12 month review |

Looking back over 24 months |

|---|---|---|---|

|

June 2000 |

(50%) |

28% |

(52%) |

|

September 2001 |

44% |

(72%) |

(49%) |

|

April 2006 |

63% |

1% |

(6%) |

|

September 2007 |

(45%) |

(70%) |

(53%) |

|

July 2021 |

30% |

(4%) |

145% |

|

Average |

8% |

(23%) |

(3%) |

Data source: YCharts.

As noted above, following the last five stock splits, Nvidia saw an average return of 8% over the following six months. But shares fell an average of 23% in the 12 months following the split, and the stock was still down an average of 3% after 24 months. In short, history indicates that Nvidia could suffer a serious decline in the not-so-distant future.

Of course, past performance never guarantees future results, and that saying rings especially true here. Four of the last five stock splits have occurred in close proximity to severe bear markets. More precisely, the S&P500 decreased by 49% between March 2000 and October 2002 due to the Internet bubble, and by 57% between October 2007 and March 2009 due to the global financial crisis.

Despite these stock market crashes, there is always a silver lining for patient investors. Nvidia shares ultimately rebounded after all five stock splits and produced phenomenal long-term returns. The chart below shows the magnitude of these returns as of June 12, 2024.

The chart shows Nvidia’s annual return between 2000 and 2024, as well as the total return after each stock split as of June 12, 2024.

Going forward, whether Nvidia is a good or bad investment depends on two things: (1) how quickly the semiconductor company can grow its earnings per share and (2) how much investors are willing to pay for these benefits.

Nvidia has a sustainable competitive advantage

Nvidia’s graphics processing units (GPUs) hold a near-monopoly in accelerated computing, a discipline that uses specialized hardware and software to accelerate complex data center workloads like artificial intelligence (AI) and data analysis.

Nvidia products consistently set performance records in AI training and inference based on MLPerf testing, standardized tests that provide unbiased assessments of AI systems. Additionally, the company has over 90% market share in data center GPUs and over 80% in AI chips.

Nvidia dismisses these advantages and cites growing competition as cause for alarm. Specifically, they cite semiconductor companies like AMD and cloud providers like Amazon, MicrosoftAnd Alphabet, all of which are building chips to supplant Nvidia GPUs. But this bearish argument ignores the formidable economic gap that Nvidia has in its full-stack strategy.

CEO Jensen Huang recently told analysts, “We’re literally building the entire data center.” He means that Nvidia is not just a chipmaker, but rather a full-stack computing company. Nvidia supplements its GPUs with central processing units (CPUs) and networking hardware designed specifically for artificial intelligence. The company also offers subscription software and cloud services that support AI workflows across many end markets, from manufacturing and logistics to customer service and healthcare.

The heart of Nvidia’s full-stack computing platform is CUDA, a parallel programming language that allows GPUs (originally designed for graphics processing) to function as data center accelerators. The CUDA ecosystem is made up of hundreds of software frameworks and libraries that streamline the development of complex applications. This gives Nvidia a huge advantage, as no other chipmaker has a comparable ecosystem of supporting software.

To quote The morning star According to analyst Brian Colello, “CUDA is owned by Nvidia and only runs on its GPUs, and we believe this hardware and software integration has created high client switching costs in AI, contributing to the wide gap from Nvidia.”

Nvidia stock looks a little expensive at its current valuation

Looking ahead, Wall Street expects Nvidia to grow its earnings per share by 31.7% annually over the next three to five years. If that number is divided by its current price-to-earnings multiple of 75.8, the quotient is a price-to-earnings-to-growth (PEG) ratio of 2.4. This multiple represents a reduction from the three-year average of 3.2, but it is still relatively expensive on an absolute basis.

That said, consensus earnings forecasts leave room for upside. Spending on AI hardware, software and services is expected to grow 36.6% annually through 2030, according to Grand View Research. Nvidia could certainly keep up with this pace, and perhaps surpass it. To that end, its current valuation might look quite reasonable, even cheap, in hindsight.

Ultimately, investors have a somewhat difficult decision to make here, but I think Joseph Moore, Morgan Stanley has the right idea. “(We) believe the context warrants exposure to AI, even amid extreme enthusiasm – and Nvidia remains the clearest way to get that exposure,” he wrote in a recent note addressed to its customers.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Trevor Jennevine holds positions at Amazon and Nvidia. The Motley Fool holds positions and recommends Advanced Micro Devices, Alphabet, Amazon, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.