Restaurant investors are increasingly concerned about a challenging macroeconomic environment, marked by emerging risks affecting consumers. These include mixed consumer data and a growing weariness with rising restaurant prices, both in absolute terms and relative to food costs.

Under these conditions, Goldman Sachs analyst Christine Cho is adopting a “selectively constructive” stance as she launches her firm’s coverage of the restaurant sector. Its outlook balances a general belief in resilient business dynamics that support the sector as a whole, with targeted insights driving specific actions poised to strengthen.

“We have a selective and constructive view on restaurants, as we believe spending will continue to grow and increase its share of PCE (personal consumption expenditure) given the still stable spending outlook and more permanent behavioral changes after with covid (i.e. digital, convenience) acting as long-term tailwinds,” Cho noted.

The analyst goes on to lay out the generally favorable factors for the sector: “Traffic and unit growth will become an increasingly important part of the restaurant growth equation, leading to greater divergence among peers. That said, we are focused on identifying 1) concepts that can drive healthy traffic growth with a unique brand proposition/differentiated offerings, and/or 2) concepts that enable accelerated unit growth.

This position is followed by several specific recommendations for restaurant stocks. We used the TipRanks database to get a broader view of two names being considered by Goldman’s Cho; Let’s take a closer look and find out what makes these choices so compelling.

Starbucks (SEX)

We’ll start with the world’s largest coffee company, Starbucks. Founded in 1971, the company has not only reached the top of its own niche; it has also become one of the iconic brands in the world. The company’s journey has grown from a single store selling tea, spices, and ground and whole bean coffee in Seattle’s Pike Place Market to a global network with tens of thousands of stores in more than 80 markets, serving millions of customers every day. . Starbucks stores are both company-owned and franchise-operated.

Starbucks’ long-term success is reflected in the company’s gross revenues. In 2023, the coffee chain reported revenue of $35.98 billion, up 11.55% year-on-year.

In addition to generating solid earnings, Starbucks also has a reputation for generating reliable dividends. The company has been paying common stock splits since 2010 and has gradually increased the payout. The current dividend, 57 cents per share, was paid at the end of May, and its annualized rate of $2.28 gives a forward yield of 2.8%.

The most recent quarterly report, released on April 30 for fiscal 2Q24, put a serious obstacle in Starbucks’ path. The company reported a significant decline in walk-in customers, particularly in its core U.S. market, where walk-in traffic saw a 7% decline during the quarter. Revenue for the quarter was $8.56 billion, down 1.8% year-over-year and below forecasts of $600 million. Ultimately, Starbucks reported non-GAAP EPS of 68 cents, down 12 cents from estimates. Management attributed the shortfall to a “complex operating environment.” Shares of Starbucks fell 16% after the earnings report was released. Investors expected Starbucks’ business to slow, but the size of the decline came as a surprise and shares are still down more than 9%.

For analyst Cho, however, laying out Goldman’s view on Starbucks, the falling stock price represents a buying opportunity. She writes of the stock: “Following a significant reset of consensus expectations following fiscal 2024 results and some early signs of sequential improvement in April-May frequency data, we believe SBUX offers a attractive risk-reward opportunity… We recognize the still predominant market. skepticism as well as fundamental issues (throughput, younger customer engagement, etc.) that need to be resolved; However, we believe the worst is behind us and we expect to see the second derivative start to improve from FY3T24E.

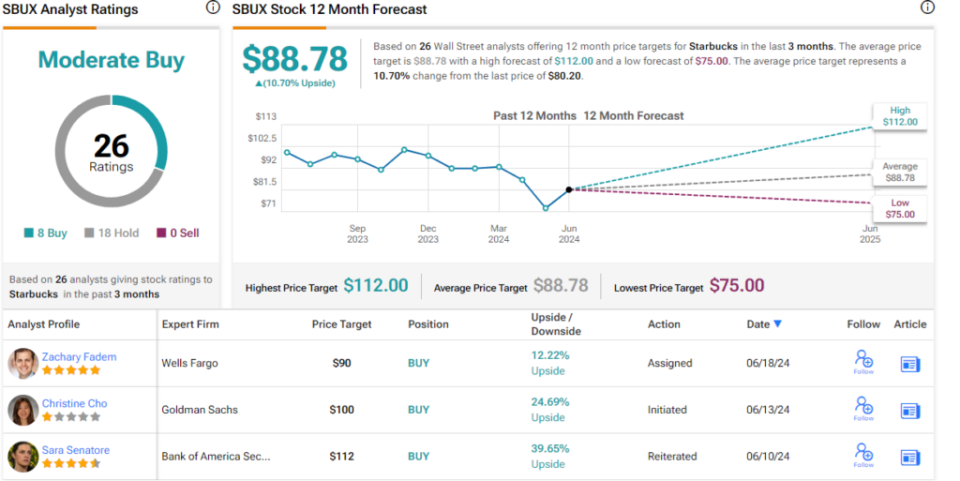

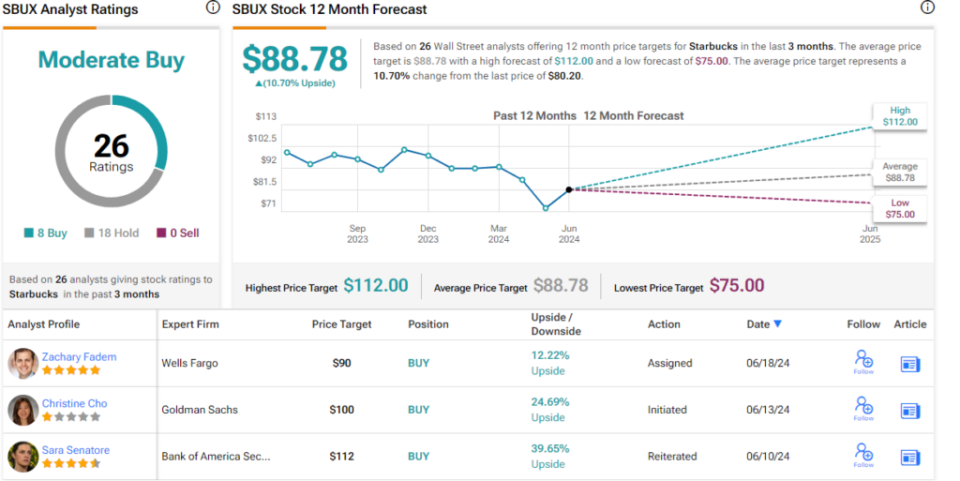

Cho quantifies his bullish outlook on SBUX with a Buy rating, and his $100 price target implies one-year upside potential of nearly 25%. (To see Cho’s track record, click here)

Now moving on to the rest of Wall Street, where the stock has a Moderate Buy rating, based on 7 Addition Buys and 18 Holds established over the past few weeks, and the average price target of $88.78 suggests upside from the stock by 11% over the next 12 months. (See Starbucks Stock Forecast)

Shake Shack (SHAKE)

Next on our list is Shake Shack, a New York-based burger chain with roots in Madison Square Garden. The company currently has more than 520 locations, including more than 335 in 33 states plus DC. Shake Shack’s international presence is particularly strong in Asia, where it has locations in Hong Kong, Shanghai, Singapore and Tokyo. The chain is also represented in London, Istanbul and Dubai.

These establishments offer Shake Shack versions of the American classic, the burger and the shake. The company prides itself on using the best ingredients for its beef and chicken patties, hand-spun shakes and homemade lemonade, and serving high-quality food in a hospitable environment at great value . Shake Shack built its brand on this foundation, as a burger chain with a difference, to create widespread appeal among customers.

The company’s financial performance reflects its reputation for quality. Shake Shack’s revenues have been increasing overall for several years. In its latest earnings release, Shake Shack reported 1Q24 revenue of $290.5 million. This figure is slightly lower than expected, missing by only $450,000, and represents an increase of more than 14% from the previous year. The company’s non-GAAP EPS, its bottom line, came in at $0.13 per share, 3 cents better than expected.

Checking again with Goldman’s Cho, we see that this company’s strong performance, loyal customer base, and strong potential have attracted its attention. Cho wrote of Shake Shack: “SHAK appears to be at an inflection point. We expect EPS to more than double over the next two years, driven by SSSG of ~3%, unit growth in the mid-teens and a steadily improving corporate dining profit margin to reach levels of 21-22% (with long-term potential closer to mid-year). -20% levels). We appreciate management’s clear presentation of its strategic priorities which include 1) delivering a consistent customer experience, 2) growing revenue and brand awareness with plans to double advertising spend this year, 3) a continued margin recovery, 4) improve returns on new stores. with a 10% reduction in the cost of new construction, and 5) develop and reward teams.

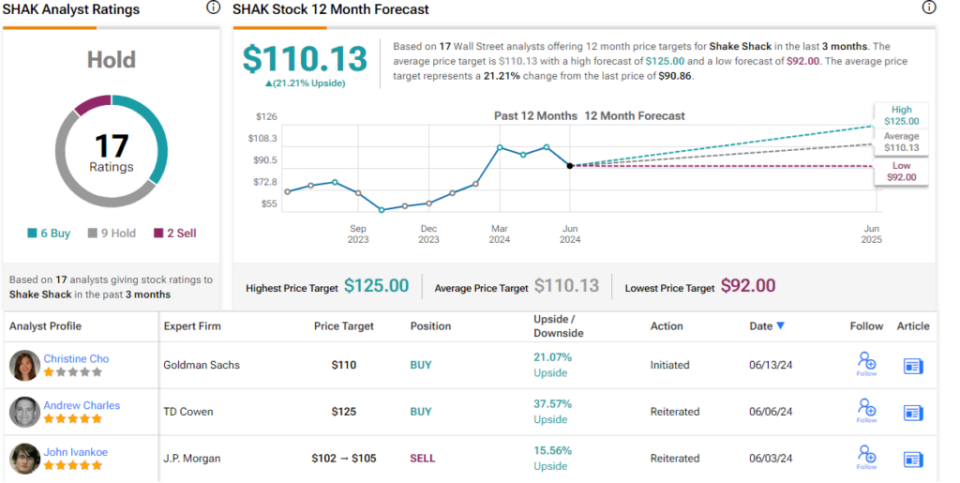

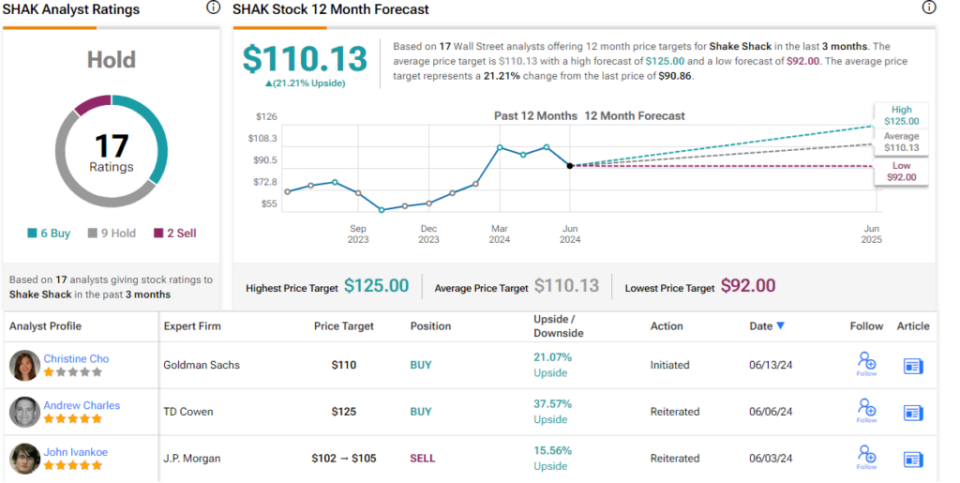

These comments support Cho’s Buy rating, and his $110 price target suggests a 21% upside over a one-year horizon.

This is a more optimistic view than the Wall Street consensus on SHAK. Overall, the stock has a Hold rating by analyst consensus, based on 17 recent reviews including 6 Buys, 9 Holds, and 2 Sells. However, somewhat of a contradiction, the average price target of $110.13 is in line with Goldman’s bullish view. (See SHAK Stock Forecast)

To find good ideas for trading stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the analysts featured. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.