Stock splits have always been bad news for Nvidia shareholders.

Nvidia (NVDA -6.68%) recently conducted a 10-for-1 stock split to reset its stock price, which had surged 725% over the previous 18 months. The driving force behind this performance was growing interest in artificial intelligence. However, the odds are now stacked against Nvidia. History says the stock is headed for a sharp decline.

Nvidia announced its stock split on May 22, and its stock price has since risen 33%. But since 2010, companies have seen their stock prices rise just 18.3% on average in the 12 months following a stock split announcement, according to Bank of America. This implies a decline of around 15% for Nvidia over the next 11 months.

Even more worrying, Nvidia has consistently lost momentum following previous stock splits. Here’s what happened the last five times.

Nvidia has generally performed poorly following stock splits

Nvidia has completed six stock splits as a public company. The last five splits are listed in the chart below, along with the stock price appreciation (or depreciation) over the next six months, one year, and two years. Generally speaking, Nvidia has performed poorly following stock splits.

|

Share split date |

Review over 6 months |

1 year review |

Looking back over 2 years |

|---|---|---|---|

|

June 2000 |

(50%) |

28% |

(52%) |

|

September 2001 |

44% |

(72%) |

(49%) |

|

April 2006 |

63% |

1% |

(6%) |

|

September 2007 |

(45%) |

(70%) |

(53%) |

|

July 2021 |

30% |

(4%) |

145% |

|

Average |

8% |

(23%) |

(3%) |

Data source: YCharts.

As noted above, Nvidia generated an average return of 8% in the six months following previous stock splits. But stocks fell an average of 23% in the first year, and they were still down an average of 3% after two years. Past performance never guarantees future results, but we can apply this information to the current situation to make an educated guess.

Specifically, Nvidia shares are up 4% since the company executed its 10-for-1 stock split on June 7. This implies an increase of 4% until December 2024. But it implies a decrease of 27% by June 2025 and a decrease of 7% until June 2026. However, it is difficult to make comparisons with the current situation. current, as the last five stock splits have occurred near stock market crashes.

Most notably, the dotcom bubble became a bear market between March 2000 and October 2002, during which S&P500 decreased by 49%. And the subprime mortgage crisis turned into a bear market between October 2007 and March 2009, during which the S&P 500 fell 57%.

The fifth stock split also occurred near a bear market. The S&P 500 fell 25% between January 2022 and October 2022. But Nvidia shareholders were likely saved from heavy losses thanks to the November 2022 launch of ChatGPT, the generative AI application that sparked unprecedented demand for Nvidia graphics processing units (GPUs).

Wall Street analysts see Nvidia as a long-term leader in artificial intelligence

Nvidia specializes in accelerated computing, a discipline that uses special hardware and software to accelerate complex data center workloads such as analytics and artificial intelligence. Nvidia has over 90% market share in data center GPUs and up to 95% market share in artificial intelligence chips.

One of the reasons for this success is the superior quality of the material. Nvidia systems regularly set records on MLPerf benchmarks, which provide unbiased evaluations of AI hardware and software in training and inference use cases. Analysts at Forrester Search recently wrote: “Nvidia is setting the pace for AI infrastructure worldwide. Without Nvidia GPUs, modern AI would not be possible. »

Another reason for this success is the extensive software. Nvidia’s CUDA programming language allows developers to easily train AI models and create GPU-accelerated applications. The CUDA platform includes hundreds of software libraries and frameworks that streamline development. No other chipmaker offers a comparable ecosystem of support software.

Finally, Nvidia also provides data center hardware beyond GPUs, including central processing units (CPUs) and networking equipment optimized for AI. The former is growing into a multi-billion dollar product line, and the latter is already a $12 billion business. Additionally, Nvidia complements its hardware portfolio with subscription software and cloud services that further help developers build and run AI applications.

In short, Nvidia offers a full-stack accelerated computing platform, which gives the company an almost insurmountable competitive advantage. Consider the following comment from Wall Street analysts.

- Harlan Sur to JPMorgan Chase expects Nvidia to stay one to two steps ahead of its competitors with its full-stack strategy, large CUDA developer ecosystem, and rapid product innovation.

- Jim Kelleher of Argus recently wrote: “Nvidia’s expertise, market leadership and continued investments in new technologies put it generations ahead of its competitors and provide a lasting competitive advantage.” »

- CFRA’s Angelo Zino recently wrote: “On the software side, (Nvidia’s) competitive moat appears stronger than ever given its ability to control the entire stack.” »

- Brian Colello and The morning star “Nvidia not only has a lead in hardware, but also benefits from high customer switching costs around CUDA, making it unlikely that another GPU vendor will become a leader in AI training.”

Nvidia Stock Is Worth Buying, Despite Its Downtrend Following Stock Splits

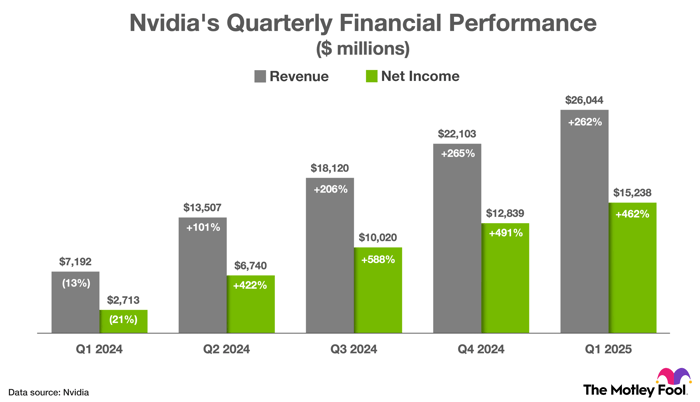

Nvidia has reported stunning financial results over the past few quarters. The chart below provides details on non-GAAP revenue and net income growth.

Nvidia has grown its revenue and non-GAAP net income at a triple-digit pace over the past four quarters. Note: The first quarter of fiscal 2025 ended April 28, 2024.

Looking ahead, Wall Street analysts estimate that Nvidia’s earnings per share will grow 32% annually over the next three to five years. This estimate places its current valuation of 74 times earnings between reasonable and expensive.

Personally, I think growth investors should have a position in Nvidia. Anyone without such a position should consider buying a few stocks today, provided they are comfortable with the risks. Nvidia has a history of poor results following stock splits, and shares could fall if the company fails to meet Wall Street’s high earnings expectations.

JPMorgan Chase is an advertising partner of The Ascent, a Motley Fool company. Bank of America is an advertising partner of The Ascent, a Motley Fool company. Trevor Jennewine holds positions at Nvidia. The Motley Fool holds positions and recommends Bank of America, JPMorgan Chase and Nvidia. The Motley Fool has a disclosure policy.