Microsoft may have taken the first step in the AI revolution, but are Nvidia and Apple catching up?

Currently, there are only three companies in the world with a market capitalization above $3 trillion: Nvidia (NVDA -6.68%), Microsoft (MSFT -0.47%)And Apple (AAPL 0.31%).

With Apple hitting a $3 trillion valuation in 2022, Microsoft and Nvidia are new members to the club – and each is fighting every day for the title of the world’s most valuable company.

Let’s explore these three members of the “Magnificent Seven” and assess which one might be best for artificial intelligence (AI) investors.

1. The case of Nvidia

Nvidia started 2024 with a market cap of around $1.2 trillion. Today, roughly halfway through the year, the company’s market cap stands at $3.2 trillion.

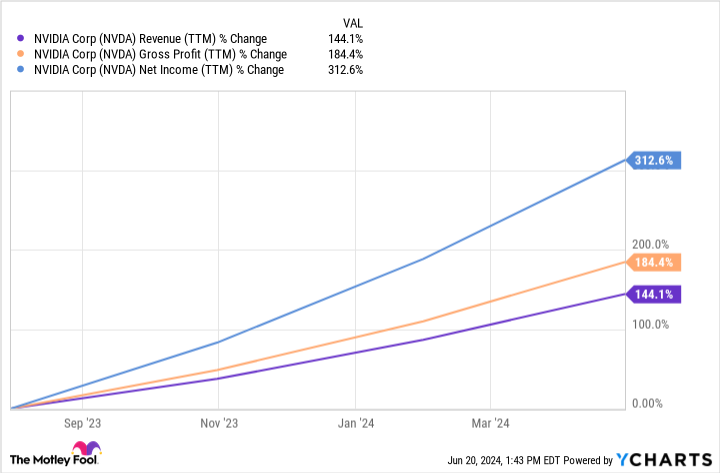

NVDA Earnings Data (TTM) by YCharts

The chart illustrates the annual growth rate of Nvidia’s revenue, gross profit and net profit on a trailing 12-month basis. What’s encouraging about Nvidia’s business is that the company is growing both in terms of revenue and bottom line.

However, what’s even more incredible is that the company’s profitability is accelerating much faster than revenue. This implies that not only are Nvidia’s products in high demand, but the company is also able to have strong pricing power, leading to an expanding profitability profile.

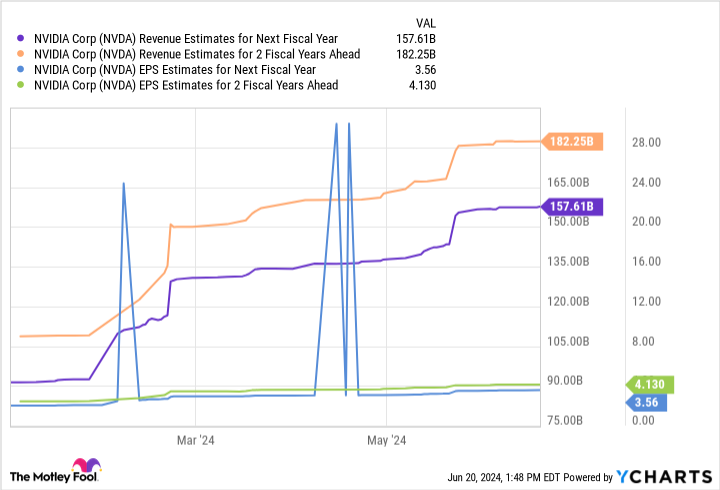

The best part about this dynamic is that analysts don’t expect a slowdown anytime soon. As the chart shows, consensus estimates for Nvidia’s revenue and earnings per share (EPS) are expected to continue growing over the next couple of years, fueled by the AI craze.

NVDA revenue estimates for next fiscal year data by YCharts

While Nvidia’s price-to-earnings (P/E) multiple of 74 isn’t exactly cheap, it is much more reasonable than what it was this time last year (above 200).

2. The case of Microsoft

Microsoft has come a long way since the development of the Windows operating system and the revolution in modern computing. Over the past few years, much of Microsoft’s growth has come from its Azure cloud computing platform. However, about 18 months ago, the company turned heads after revealing that Microsoft would invest $10 billion in OpenAI, the developer of ChatGPT.

Throughout 2023, Microsoft has been rapidly integrating ChatGPT functionality into its ecosystem, including LinkedIn, Azure, Microsoft Office, and more.

From my perspective, this pioneering position has given Microsoft a competitive advantage over peers such as Amazon, Alphabet, and Apple. While each of its mega-cap peers has invested in competing generative AI platforms, I believe Microsoft has unprecedented growth potential, due to the breadth of its ecosystem and diverse assets.

The only word of caution I have for investors considering Microsoft stock is valuation.

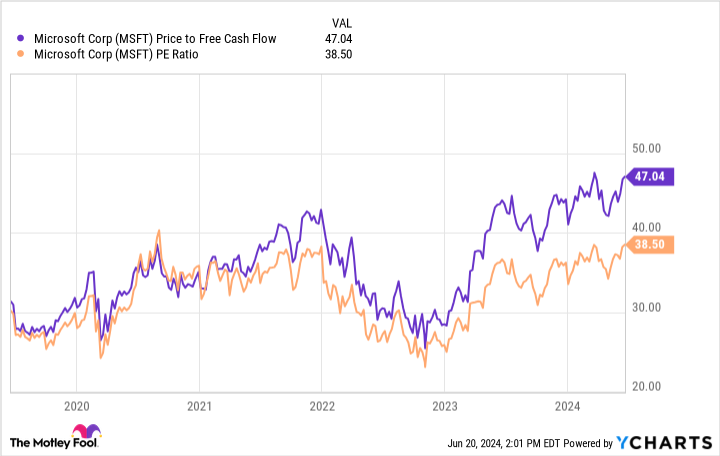

MSFT Price to Free Cash Flow Data by YCharts

According to this analysis, Microsoft’s P/E ratio and price to free cash flow (P/FCF) are noticeably elevated compared to historical levels. Additionally, investors can see that both of these metrics have increased significantly since early 2023, around the time of Microsoft’s $10 billion investment in OpenAI.

To me, this indicates that some of the benefits presented by AI may already be baked into Microsoft stock.

Image source: Getty Images.

3. The case of Apple

As I mentioned, Apple was the first company to reach a valuation of $3 trillion. But unlike Microsoft or Nvidia, I would say that innovation and new market opportunities are not the main reasons.

Apple has long been a mainstay of Warren Buffett’s portfolio, and it’s easy to see why. The company has a rich history of rewarding shareholders in the form of dividends and share repurchases. Apple is able to fund these initiatives thanks to the company’s ever-increasing cash flow. The combination of strong brand equity, customer loyalty, a strong balance sheet and generous shareholder returns made Apple an obvious long-term investment.

That said, I admit I’ve been a little harsh on the iPhone maker when it comes to the tech industry’s newest obsession: AI. Earlier this month, Apple finally revealed its AI roadmap after playing around for too long (in my opinion).

The company’s next phase of growth relies on Apple Intelligence. The company is partnering with OpenAI to combine ChatGPT’s software capabilities with Apple’s hardware portfolio. These apps are expected to bring a whole new level of productivity and consumer experience to iPhone, iPad, Mac and Siri.

Given that the company has an installed base of more than 2 billion active devices, Apple Intelligence represents a colossal opportunity as Apple seeks to position itself in the AI landscape.

So which AI stock should you choose?

Although Nvidia, Microsoft, and Apple all have a valuation of $3 trillion, it’s hard to pick one as the big winner.

I see Nvidia as the driving force behind the AI revolution. The company’s chips, data center services and software applications provide Nvidia with end-to-end reach in the AI ecosystem.

Although Microsoft stock is a bit expensive, I think the premium is worth it. The company took the first step towards chess in the AI revolution, and so far it seems to be paying off in integrating AI across its various platforms. However, it will be important for the company to foster and maintain its relationship with OpenAI now that Apple has entered the equation.

To me, Apple has the most to prove among this cohort. While the prospects for Apple Intelligence are intriguing, it may take some time for the company to begin achieving meaningful monetization of AI. Only time will tell whether Apple was simply late to the AI party, or whether its peers are too far ahead and represent more attractive investment opportunities.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Adam Spatacco holds positions at Alphabet, Amazon, Apple, Microsoft and Nvidia. The Motley Fool holds positions and recommends Alphabet, Amazon, Apple, Microsoft and Nvidia. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.