It’s been a terrible year for Snowflake (NYSE: SNOW) shareholders. Although the data cloud provider started 2024 on a positive note, the stock is now down 48% from the 52-week high reached in mid-February, due to issues ranging from employee turnover to increasing competition, through quarterly results that did not meet expectations. .

However, this sharp pullback may have created an opportunity for savvy investors, especially given Snowflake’s current valuation.

Snowflake’s growth likely to accelerate

When Snowflake reported results for its first quarter of fiscal 2025 (ended April 30) in May, it reported that product revenue increased 34% year over year to $790 million. dollars. This was significantly higher than its forecast range of $745 million to $750 million. Additionally, the company raised its full-year product revenue guidance to $3.30 billion, up from $3.25 billion previously.

The revised figure suggests a 24% increase in revenue compared to fiscal 2024. However, there is a good chance that Snowflake will further increase its revenue guidance as the year progresses, given the impressive growth of its remaining performance obligation (RPO) in the last quarter. RPO refers to the “amount of contracted future revenue that has not yet been recognized.”

This metric includes Snowflake’s deferred revenue – funds the company has received in advance for services that will be provided at a later date – and non-cancelable contracts that will be “billed and recognized as revenue in future periods.” The fact that this metric grew at a much faster rate than Snowflake’s revenue suggests that the company’s revenue growth is likely to accelerate.

More importantly, Snowflake is forecasting incredible expansion of its total addressable market driven by the emergence of artificial intelligence (AI). During its 2024 Investor Day presentation, Snowflake management claimed that its total addressable market could grow from $152 billion in 2023 to $342 billion in 2028. And the company is offering a suite of products to capitalize on the AI-driven opportunity in the data cloud market.

Many of these products are expected to be made available to customers during the current fiscal year. These include Cortex AI, Document AI and Snowflake Copilot. Cortex AI, for example, will allow Snowflake customers to build generative AI applications such as chatbots using large language models (LLM), using their proprietary data.

Meanwhile, Snowflake Copilot was designed to help enterprise customers write structured query language (SQL) code and improve productivity. And Document AI is a proprietary LLM that customers can use to extract data from different types of documents. As Snowflake introduces these products widely, it may be able to increase spending among its existing customers while attracting new ones.

It’s worth noting that Snowflake ended its fiscal first quarter with 9,822 customers, an increase of 21% from the year-ago period. However, the number of customers contributing more than $1 million in product revenue annually to Snowflake increased 30% from the previous year, to 485. The company may be able to to maintain this trend of increased customer spending through new growth drivers such as AI, as well as its focus on new product launches.

However, Snowflake’s detractors might argue that its growth comes at the expense of its margins. After all, the company’s non-GAAP gross margin declined slightly in the previous quarter, to 76.9%. The company also reduced its full-year margin forecast to 75% from the previous estimate of 76%.

Unsurprisingly, analysts expect Snowflake’s adjusted earnings to fall to $0.62 per share in fiscal 2025, from $0.98 per share last year. While this is a significant decline, they are expected to rebound over the next fiscal year to $0.99 per share. Management attributed the impact on profitability to “increased GPU costs related to our AI initiatives.”

But at the same time, these investments should open up a solid long-term growth opportunity for Snowflake and should ideally allow the company to generate more revenue from its existing customers as they purchase its cloud-related offerings. AI. Any short-term difficulties could eventually pave the way for better long-term net performance, which is why investors should focus on the big picture.

Valuation makes the stock an attractive bet right now

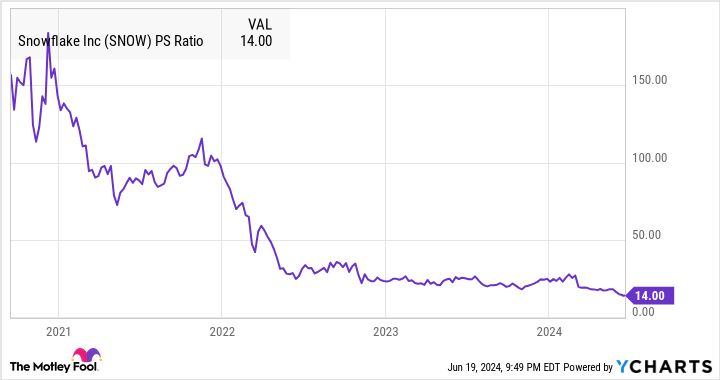

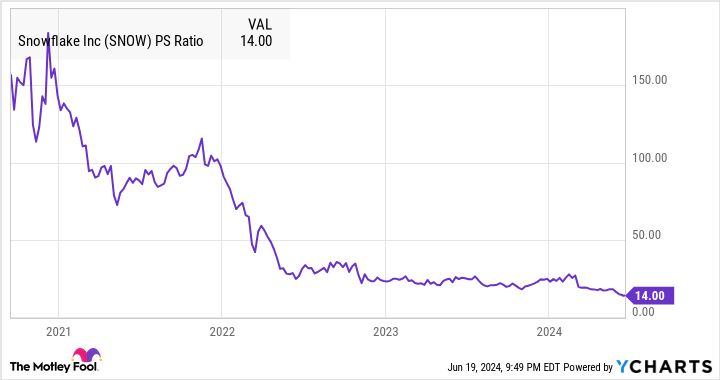

Investors can buy Snowflake shares at a relatively attractive price-to-sales ratio of 14, which is well below its multiple of 25 at the end of 2023. Of course, Snowflake’s sales multiple remains higher than the US technology sector average of 8. However, Snowflake is now cheaper by this metric than it has ever been.

Given Snowflake’s strong revenue pipeline and better-than-expected revenue growth, savvy investors may want to consider buying the stock now. After all, 71% of the 48 analysts who cover Snowflake rate it a Buy, and their median 12-month price target for the stock is $200, or 60% above the current price.

If Snowflake’s revenue growth continues to exceed expectations, the stock could soar again.

Should you invest $1,000 in Snowflake right now?

Before buying Snowflake stock, consider this:

THE Motley Fool Stock Advisor The team of analysts has just identified what they believe to be the 10 best stocks for investors to buy now…and Snowflake was not one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia made this list on April 15, 2005…if you had invested $1,000 at the time of our recommendation, you would have $723,729!*

Equity Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 values »

*Stock Advisor returns June 24, 2024

Harsh Chauhan has no position in any of the securities mentioned. The Motley Fool posts and recommends Snowflake. The Motley Fool has a disclosure policy.

1 A Beautiful Artificial Intelligence (AI) Growth Stock Down 48% to Buy Hand Over Fist Before It Starts to Surge was originally published by The Motley Fool