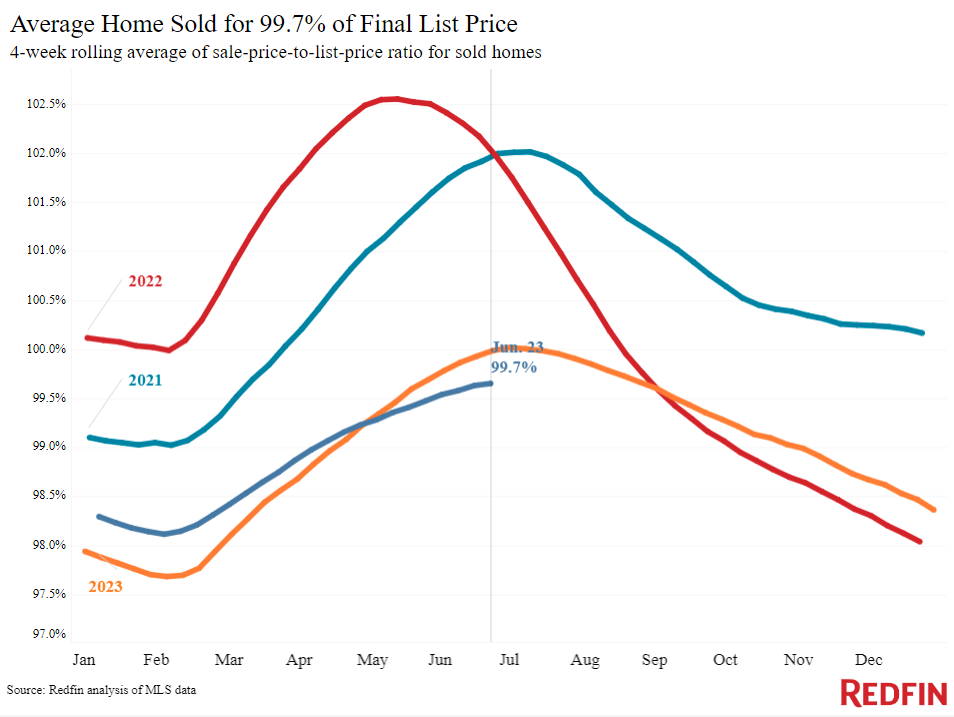

The typical American home sold in the four weeks ending June 23 sold for 0.3% less than its asking price. This is the first time a typical home has sold below list price at this time of year since the start of the pandemic in 2020, when the real estate market almost shut down. The typical house sold for exactly the list price a year ago, or about 2%. above its list price two years ago.

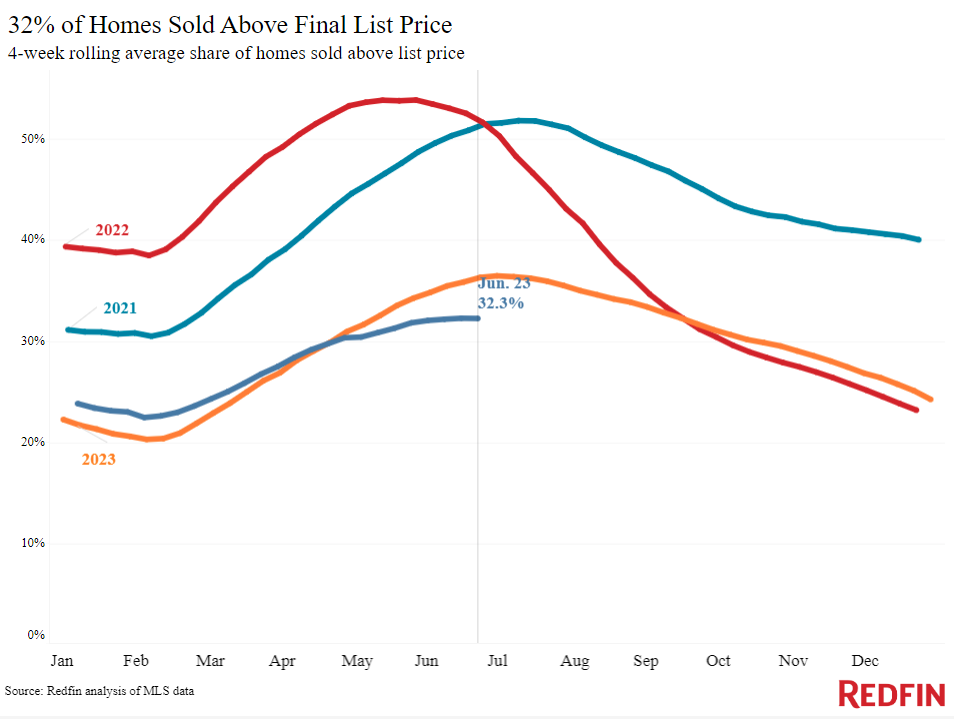

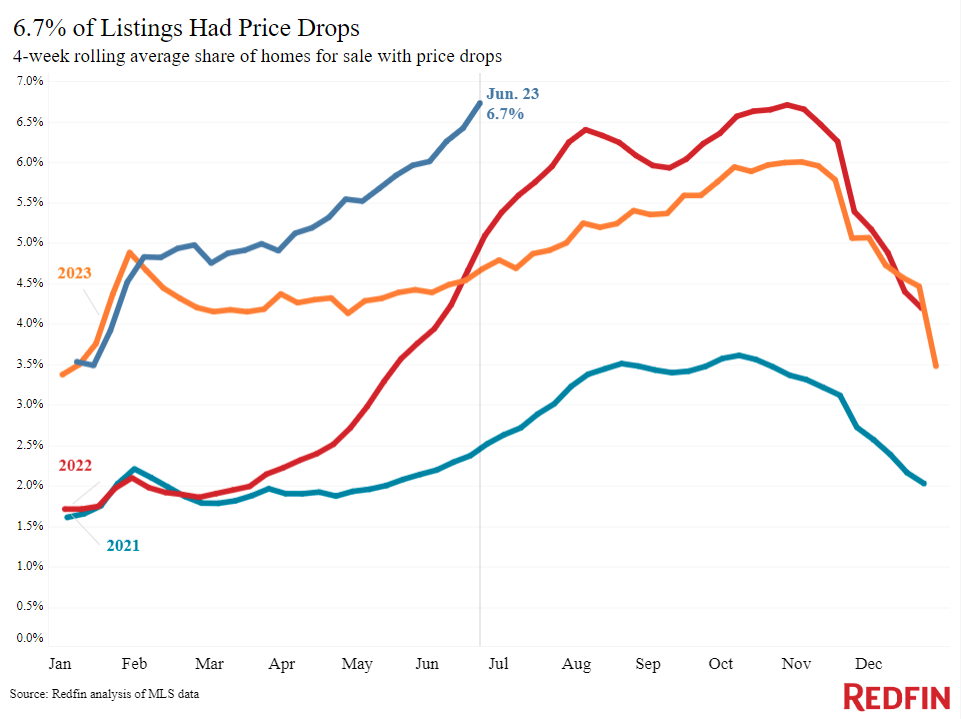

Additionally, just under two-thirds (32.3%) of U.S. homes sold for above asking price during this period. This is the lowest share of any late spring since 2020, when the real estate market came to a near halt with the start of the pandemic, and down from 36% a year earlier. Nearly 7% of home sellers lowered their asking price, on average, the highest level since November 2022 and up from 4.7% a year ago.

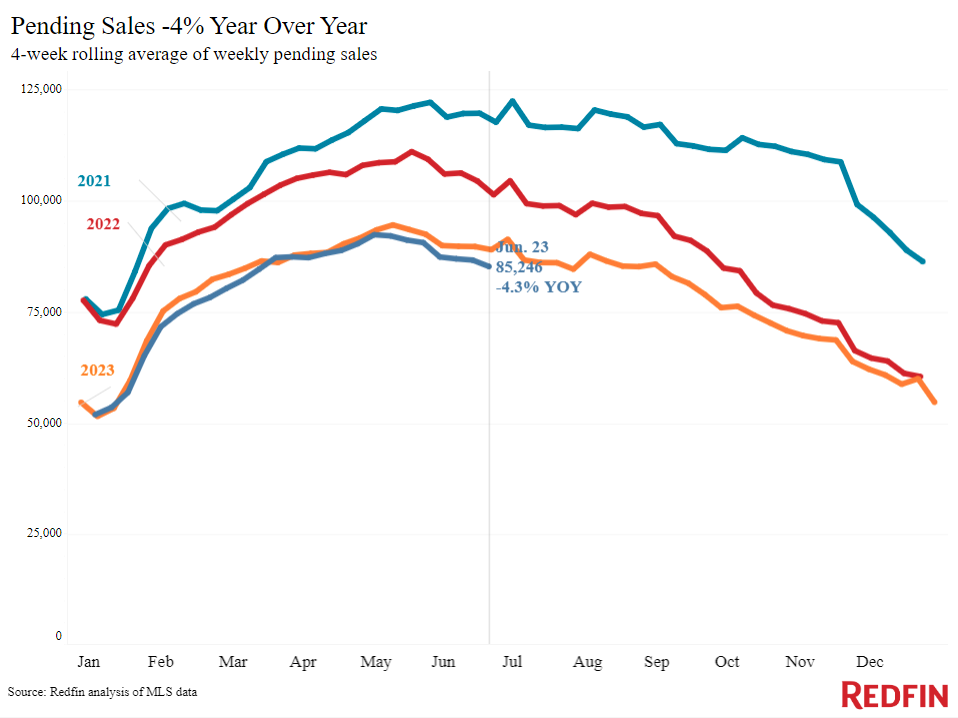

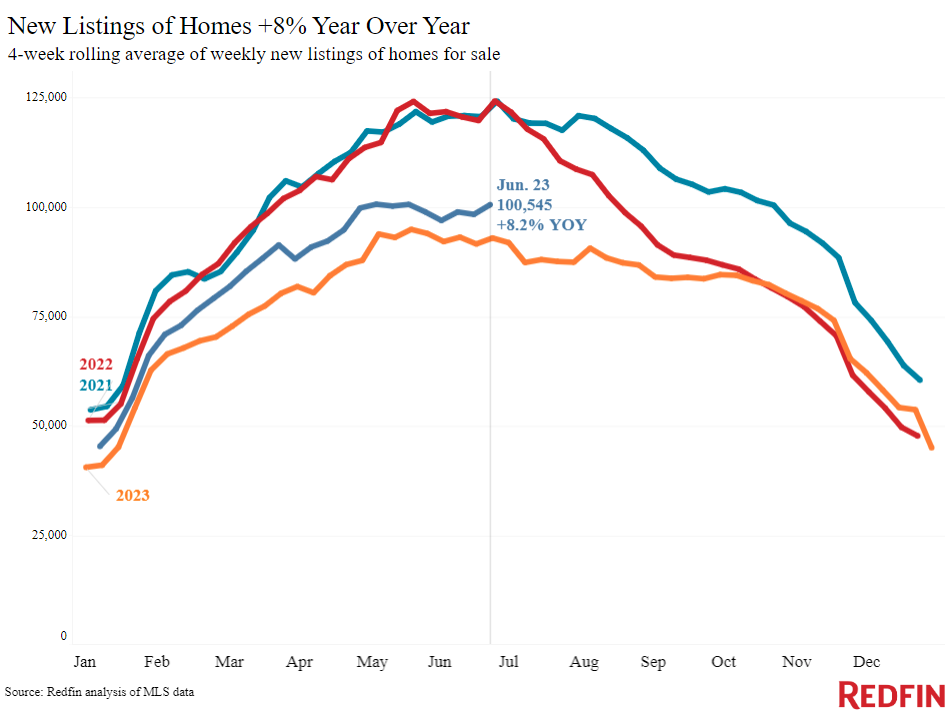

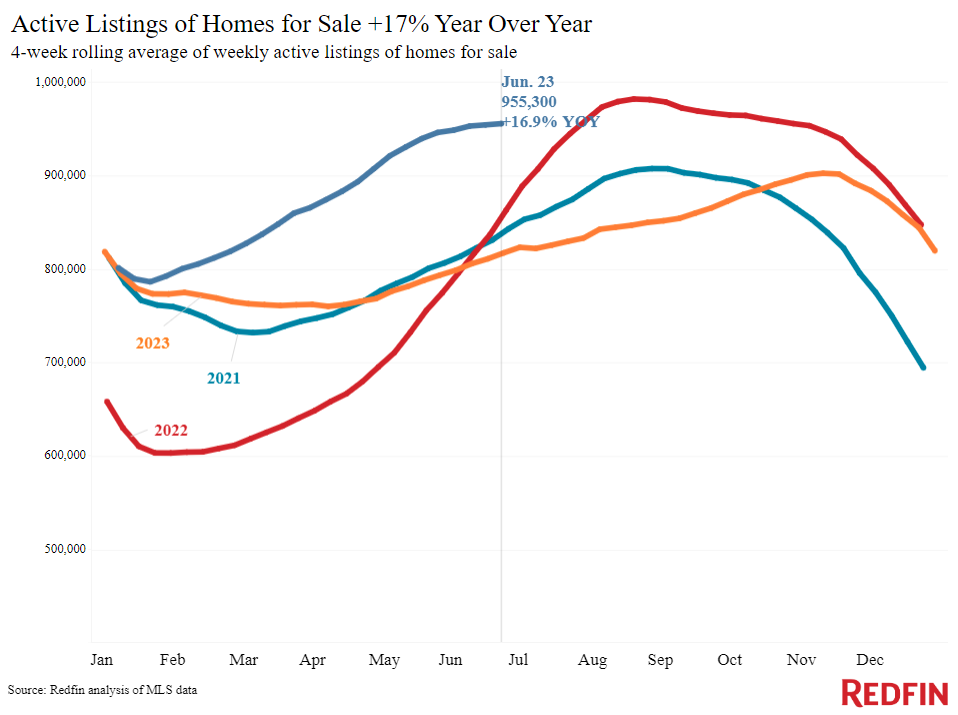

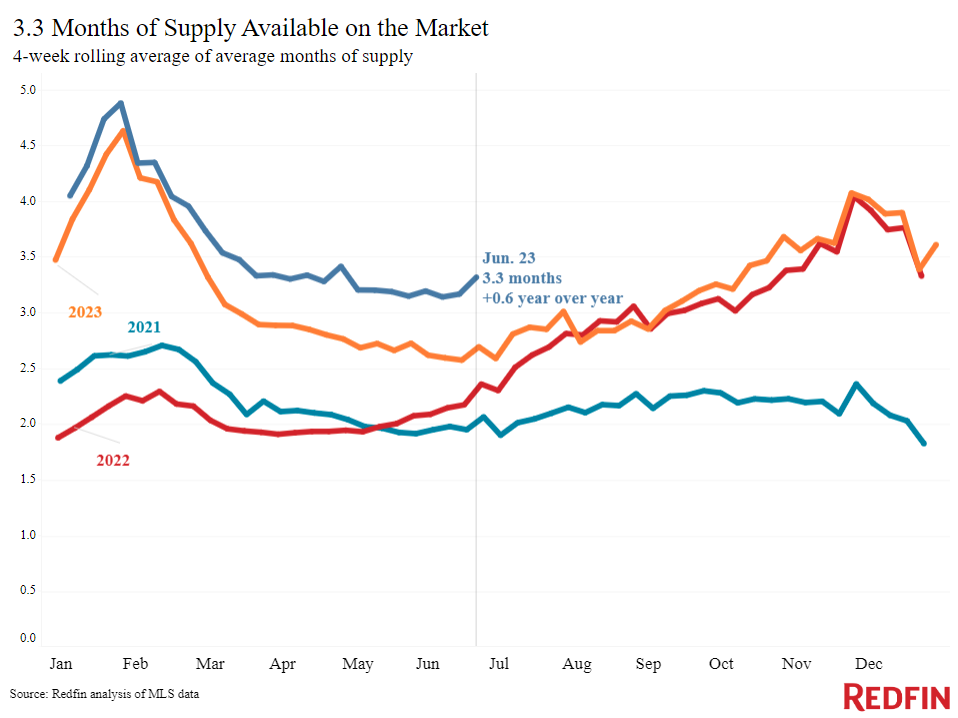

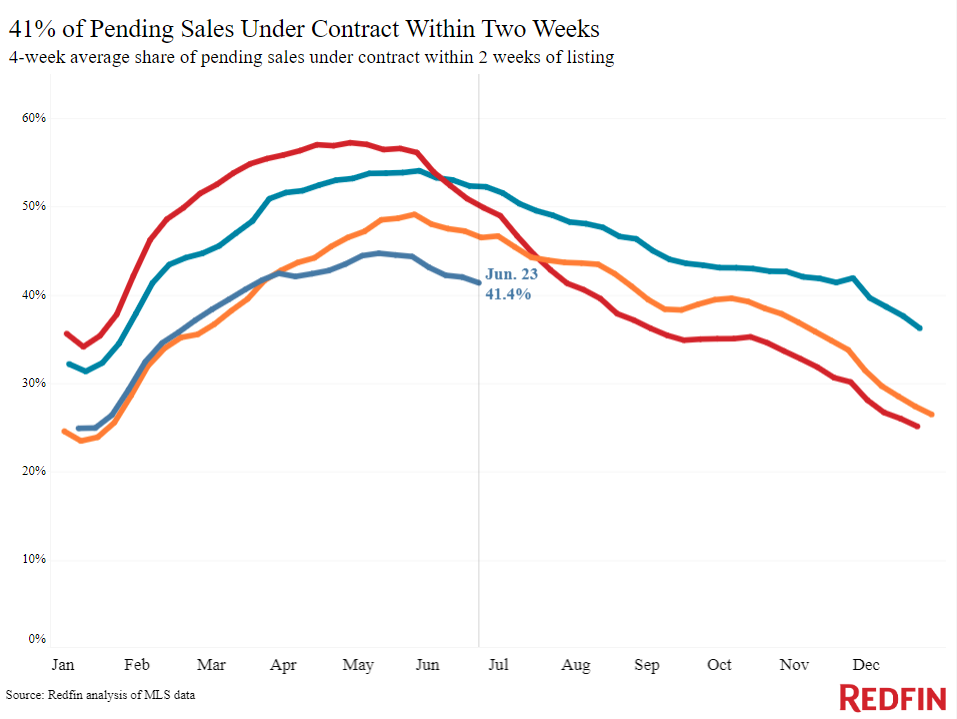

The likelihood of homes selling below asking price is increasing because there is more supply than demand, at least for some types of homes in some parts of the country. New listings are up 8.2% year over year nationally, while pending home sales are down 4.3%, the biggest decline in four months. Most inventory is increasingly obsolete;more than 60% of homes have been on sale for at least a month without being under contract.

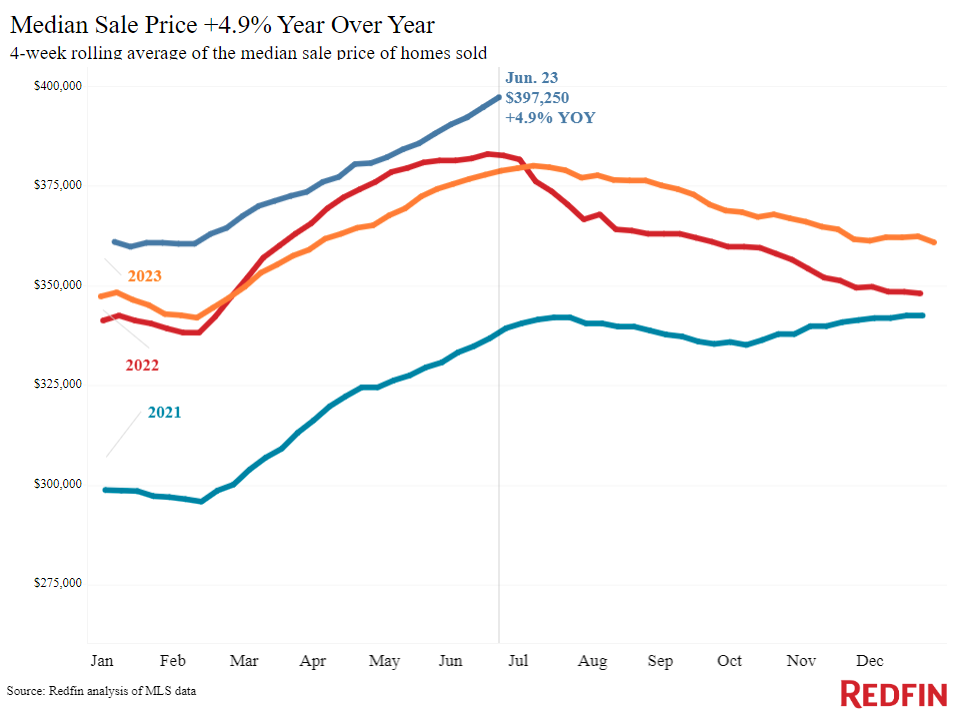

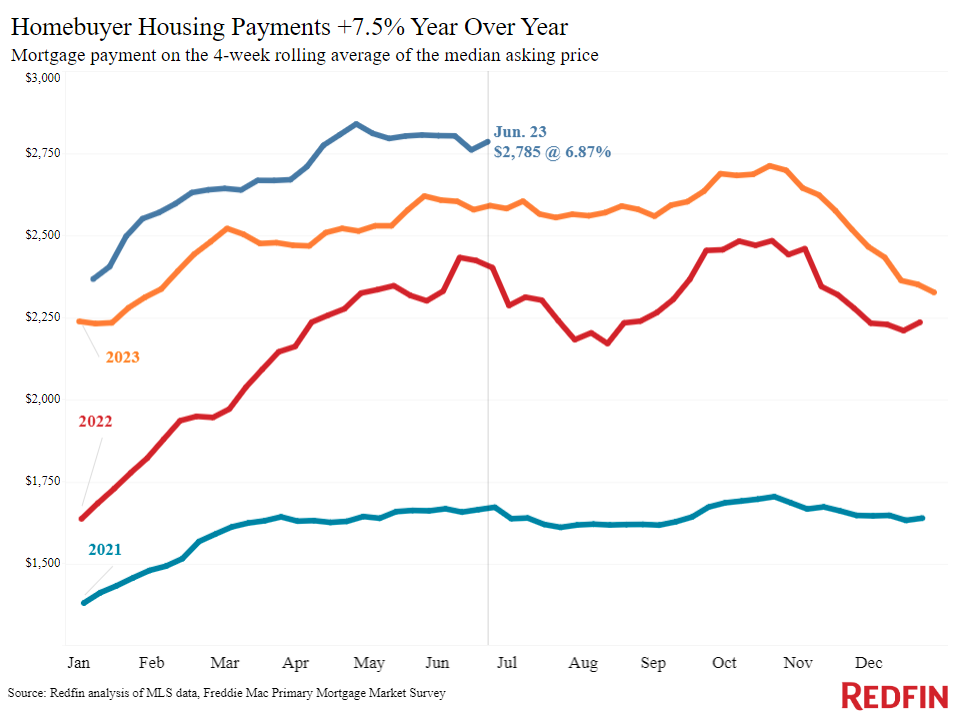

Buyers are hesitant due to exorbitant housing costs. The median price of homes sold increased 4.9% year-over-year to an all-time high of $397,250. Although mortgage rates have fallen from a six-month high in May, the weekly average is still almost 7%The typical monthly payment for a homebuyer is $2,785, about $50 below the record high.

A record heat is another reason why some buyers have taken a step back recently. “I’ve heard some customers say, ‘It’s so hot outside I don’t want to see anything,'” said Joe Hunt, director of Redfin in Phoenix. “But if mortgage rates were lower, I doubt the heat would keep buyers away.”

Buyers could soon benefit from a slight reprieve on costs. The increasing likelihood of homes selling below asking price, as well as the high number of sellers lowering their prices, could lead to a slowdown in sales price growth. Additionally, mortgage rates could fall further if inflation continues to cool.

Redfin agents say buyers and sellers need to be realistic about current market prices. Sellers should not overprice, and buyers should know that they may be able to negotiate, but only if a home has been on the market with little activity for at least a few weeks.

“Some buyers think they can get a deal because they hear the market is cool, and some sellers think every house will sell for top dollar, regardless of condition,” said Los Angeles Redfin Premier agent Marije Kruythoff. “Really, it all depends on the house and the location. The hottest properties in this area are either those that are move-in ready or those that need to be completely renovated. Middle-of-the-road homes, those that are quite nice but not updated, stay on the market the longest. Sellers of this type of home often benefit from cosmetic repairs before listing, which we offer through the Redfin concierge service. And buyers who encounter middle-of-the-road listings without much wow factor should consider trying to negotiate.

For Redfin economists’ views on the housing market, please visit “From our economists“page.

The main indicators

| Indicators of housing demand and purchasing activity | ||||

| Value (if any) | Recent change | Variation from year to year | Source | |

| Average daily fixed mortgage rate over 30 years | 7.06% (June 26) | Up from the 3-month low of 6.97% a week earlier, but down from the 5-month high of 7.52% 6 weeks earlier | Up 6.91% | Daily Mortgage News |

| Weekly average fixed mortgage rate over 30 years | 6.87% (week ending June 20) | Lowest level since week ending April 4 | Up 6.67% | Freddie Mac |

| Mortgage loan redemption requests (seasonally adjusted) | Increase of 1% from the previous week (as of the week ending June 21) | Down 13% | Mortgage Bankers Association | |

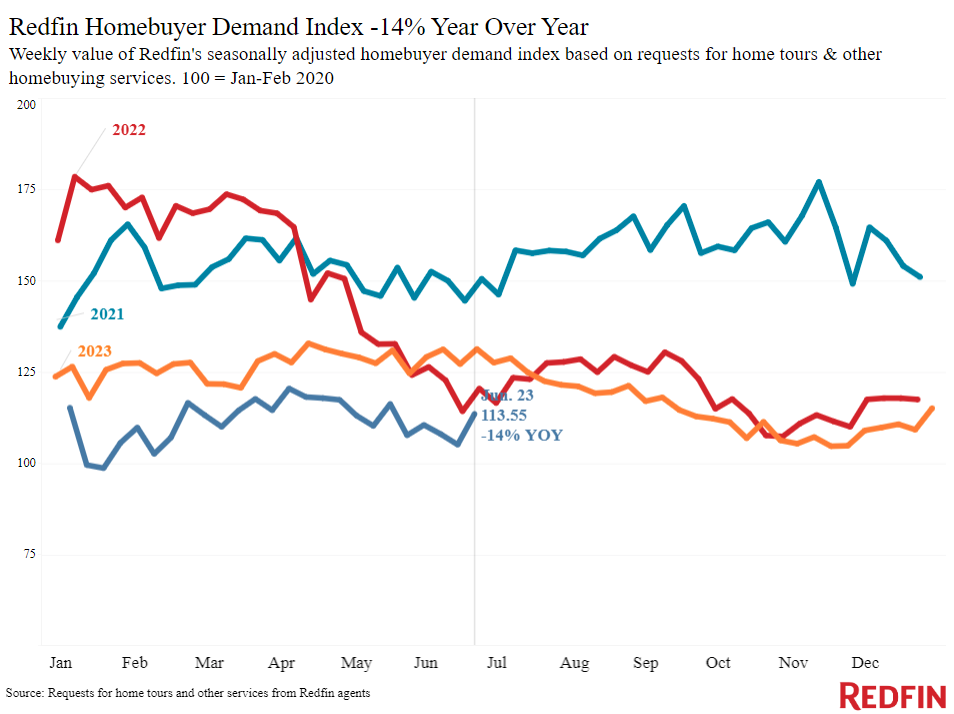

| Redfin Home Buyer Demand Index (seasonally adjusted) | Up 5% from the previous month (as of week ending June 23) | 14% drop | Redfin Homebuyer Demand Index, a measure of requests for showings and other home buying services from Redfin agents | |

| Traveling activity | Up 27% since the beginning of the year (as of June 23) | This time last year, it was also up 15% from the start of 2023. | Time displaya home touring technology company | |

| Google search “house for sale” | Unchanged from a month earlier (as of June 24) | Down 15% | Google trends | |

Key real estate market data

| US Highlights: Four weeks ending June 23, 2024

Redfin’s national metrics include data from more than 400 U.S. metro areas and are based on homes listed and/or sold during the period. Weekly real estate market data dates back to 2015. Subject to revision. |

|||

| Four weeks ending June 23, 2024 | Change from year to year | Remarks | |

| Median sales price | $397,250 | 4.9% | Record level; the biggest increase since March |

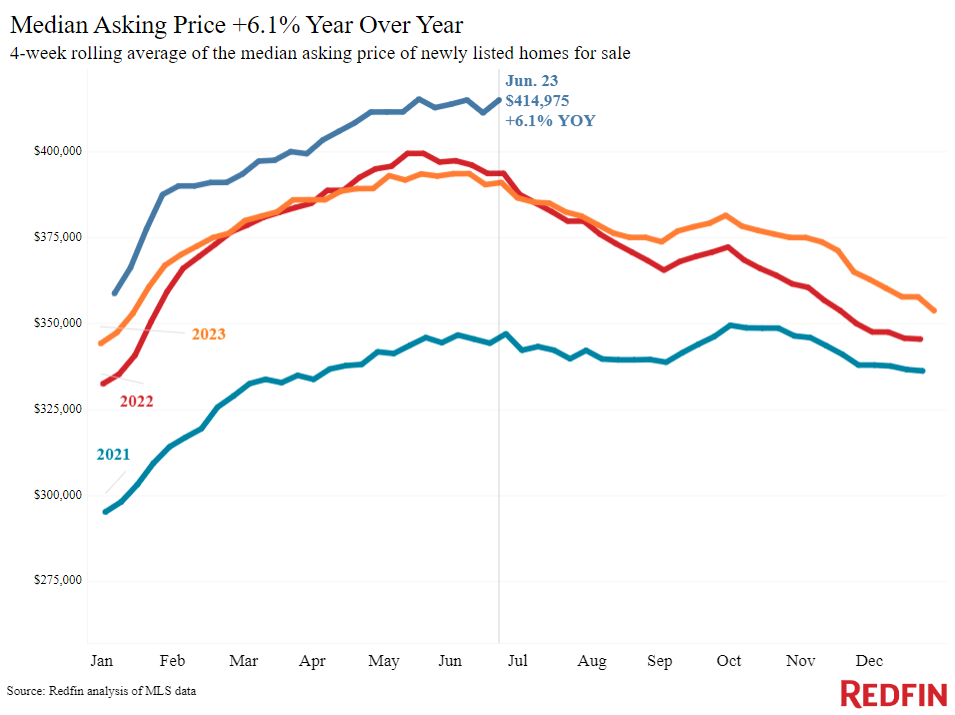

| Median asking price | $414,975 | 6.1% | Largest increase since October 2022 |

| Median monthly mortgage payment | $2,785 at a mortgage rate of 6.87% | 7.5% | $54 below all-time high set in 4 weeks ending April 28 |

| Pending sales | 85,246 | -4.3% | Biggest drop in 4 months |

| New announcements | 100,545 | 8.2% | Biggest increase in 2 months |

| Active ads | 953 300 | 16.9% | |

| Month of supply | 3.3 | +0.6pt. | 4 to 5 month supply is considered balanced, with a lower number indicating the seller’s market conditions. |

| Share of off-market housing in two weeks | 41.4% | Down 46% | |

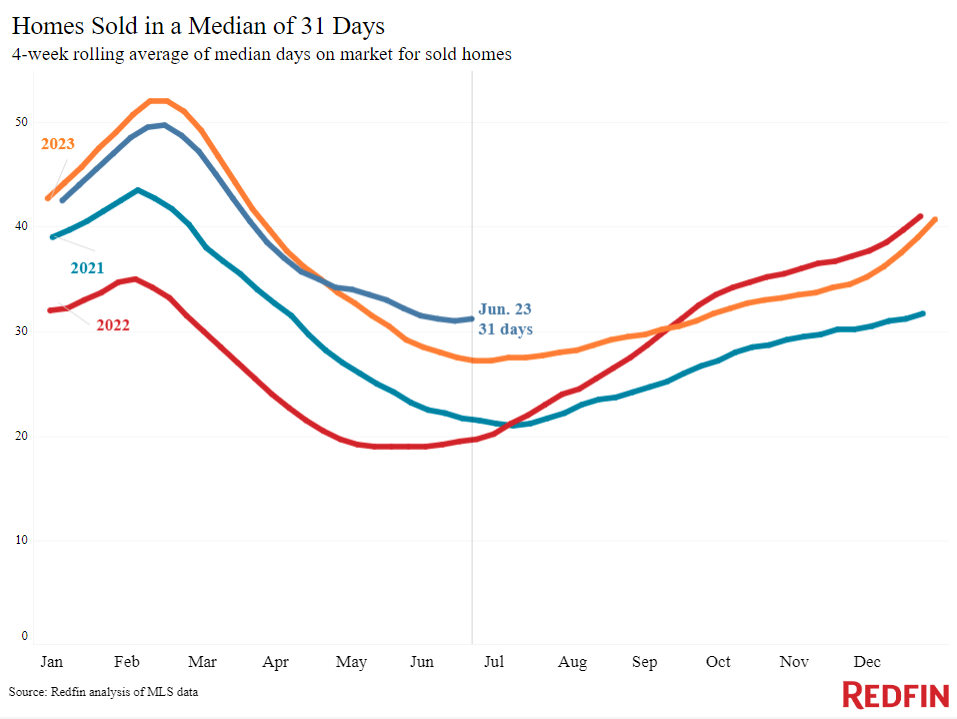

| Median Days on Market | 31 | +4 days | |

| Share of housing sold above list price | 32.3% | Down 36% | |

| Share of housing whose prices have fallen | 6.7% | +2 points. | Highest level since November 2022 |

| Average sales price/list price ratio | 99.7% | -0.3pt. | |

|

Metropolitan highlights: four weeks ending June 23, 2024 Redfin metro-level data includes the 50 most populous U.S. metros. Certain metros may be excluded from time to time to ensure data accuracy. |

|||

|---|---|---|---|

| Metropolises with the largest year-over-year increases | Metropolises with the biggest year-over-year declines | Remarks | |

| Median sales price | Anaheim, California (16%)

Nassau County, New York (14.4%) New Brunswick, NJ (13.8%) Newark, New Jersey (13.6%) West Palm Beach, Florida (12.7%) |

San Antonio (-2.5%)

Austin, Texas (-2.5%) Dallas (-0.9%) Fort Worth, Texas (-0.8%) |

Available in 4 metros |

| Pending sales | San Jose, California (14.7%)

Pittsburgh (5%) San Francisco (4.5%) Anaheim, California (3.4%) Columbus, Ohio (2.7%) |

Houston (-15.1%)

West Palm Beach, Florida (-14.9%) Atlanta (-12.2%) San Antonio (-11.4%) Miami (-11.2%) |

Increased in 11 metros |

| New announcements | San Jose, California (40.6%)

Miami (22.4%) San Diego (20.8%) Anaheim, California (19.3%) Phoenix (19.2%) |

Chicago (-7.6%)

Atlanta (-7.5%) Detroit (-2%) Minneapolis (-0.8%) Portland, Oregon (-0.4%) |

Refused in 5 metros |

Refer to our metrics definition page for explanations of all measures used in this report.