MCCAIG

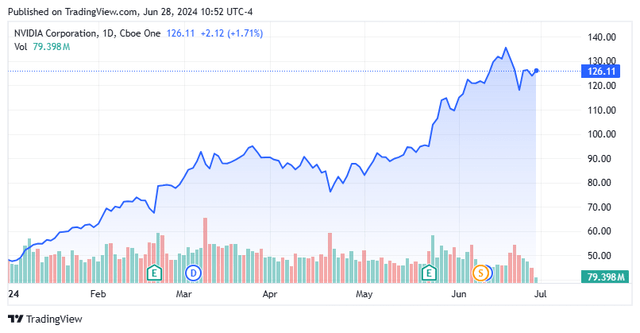

The Nasdaq (COMP.IND) and S&P 500 (SP500) have had good years so far. So far, both major indexes are up around 15% in 2024. As I noted in an article article earlier this week, the gathering was extremely heavy, with heavy AI weight Nvidia Corporation (NVDA) representing about a third of the market’s overall gains to date.

Looking for Alpha

Interestingly, none of the expected six to seven 25-basis point cuts in the federal funds rate have yet materialized. That was the consensus expectation of investors by the end of 2023, based on futures at the time. Moreover, excluding contributions from the seven largest tech stocks by market cap, S&P 500 earnings growth has been negative on an annual basis over the past two quarters. Overall, U.S. corporate earnings in the first quarter also fell -2.7% quarter-over-quarter.

The huge rally in prices after the last stock market trough that ended in late October also occurred against the backdrop of a clear economic slowdown. In fact, one could even say that much of the economy is already in recession. And that is the main topic of this article today.

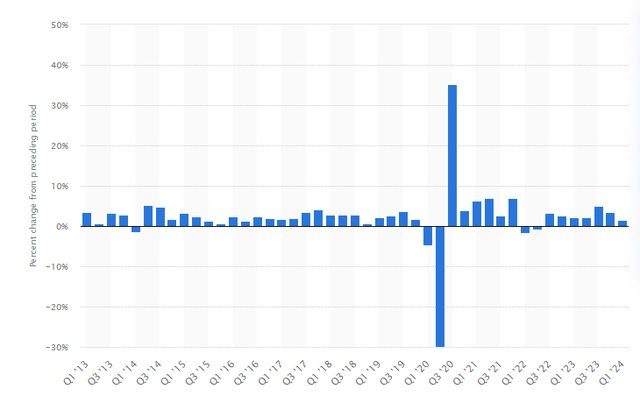

US GDP growth by quarter (Statesman)

GDP growth reached an impressive 4.9% in the third quarter of 2023, but slowed to 3.4% in the fourth quarter, and our latest estimate for GDP growth in the first quarter of 2024 is 1.4%. .

The most worrying aspect of the current economic situation is that the majority of consumers are clearly in distress. Consumer spending increased by only 1.5% in the first quarter. If we compare the real inflation rate, we could easily say that spending declined during the quarter.

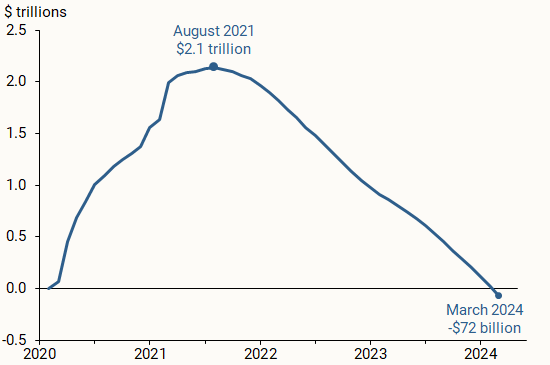

Zero hedge

It’s easy to see why the consumer is under increasing stress. The average American household has lost purchasing power to inflation since the beginning of 2021, and as I pointed out in a previous article, article in June, government statistics underestimate the true inflation rate. Additionally, consumers have spent all of the massive excess savings afforded by the massive Covid relief packages.

Personal Savings Surplus in the United States (Economic Analysis Bureau)

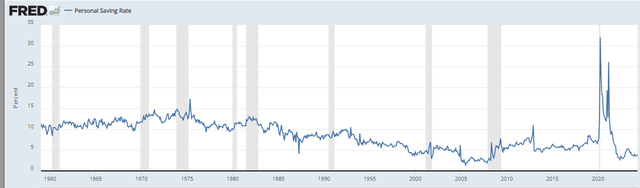

Now that those savings have been spent and the personal savings rate has fallen to half its pre-pandemic level, consumers are often turning to credit cards to help make ends meet. There has also been a overvoltage of Americans work at least two jobs.

Personal Savings Rate in the United States (Federal Reserve Bank of St. Louis)

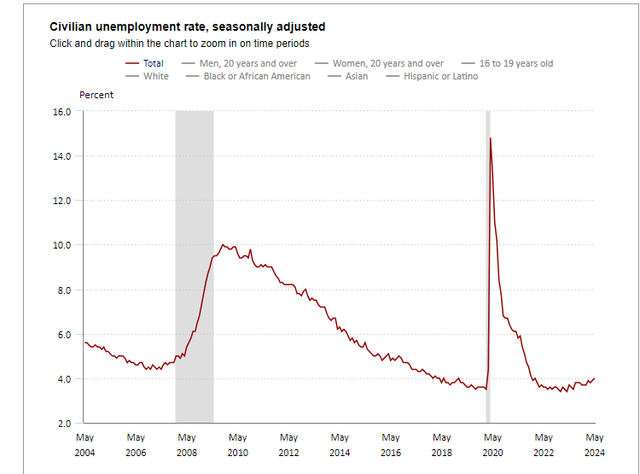

With credit card debt at an all-time high Tops and with the erosion of purchasing power, it is not surprising that consumer delinquency rates are increasing. Additionally, the unemployment rate has increased from a low of 3.5 percent to the current four percent.

United States Bureau of Labor Statistics

Weakening consumer sentiment has been a theme in disappointing results/forecasts from household names like Starbucks (SBUX), Target (TGT), McDonald’s (MCD) And Home deposit (HD) during the first quarter earnings season.

Yesterday, the stock Walgreens Boot Alliance (WBA) suffered its worst daily loss in about 30 years after the company warned growing pressure from consumers and its plans to close a significant number of stores. The actions of Nike (NIKE) are getting hammered Friday morning after the company provided tepid forecast, largely due to weak consumer demand. The famous H&M and Levi’s also warned this week of poor consumption indicators. Given that the American consumer accounts for nearly 70% of American economic activity, it is difficult to be optimistic about the overall economy given the increasingly difficult situation in which most American households find themselves.

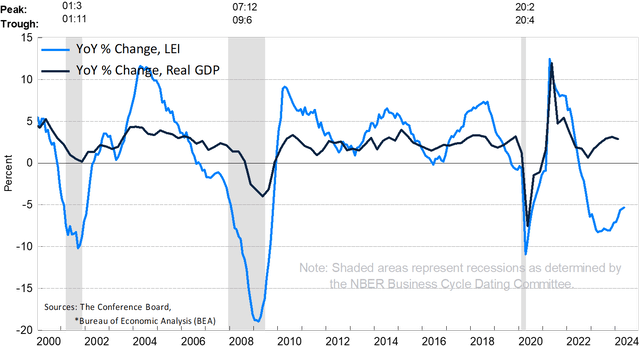

Monthly Leading Economic Indicators (Conference Board)

Manufacturing, however, could be in even worse shape. The Dallas Fed’s services index is now negative territory for 25 consecutive months. Poor manufacturing indicators are also a major reason why leading economic indicators have declined in 26 of the last 27 months. Historically, this indicates that a recession is on the horizon.

U.S. Existing Home Sales (2014-2024) (FXEmpire)

Finally, we have real estate. Average 30-year mortgage rates have more than doubled since the Federal Reserve began tightening monetary policy in March 2022. This has been a major headwind for the real estate sector, as existing home sales in 2023 hit their lowest annual level since 1995. With tens of millions of homeowners having “golden handcuffs” Given current low mortgage rates, it is unlikely that mortgage activity will pick up in the coming quarters.

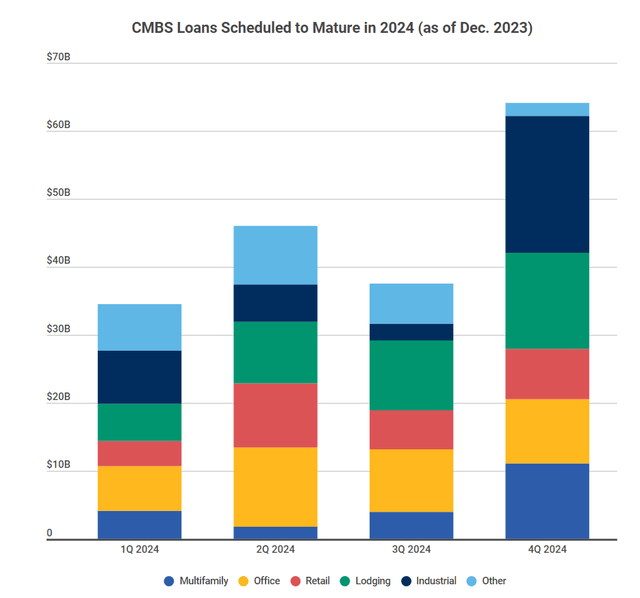

CMBS debt due 2024 (Stairs)

However, it is the commercial side of real estate that is really going downhill. As I noted in this recent articleOffice property values and many other types of real estate are plummeting, leading to higher delinquency and default rates. We are in the early stages of this reset, and it will pose a bigger headwind for the banking system in the months ahead, particularly for regional and community banks.

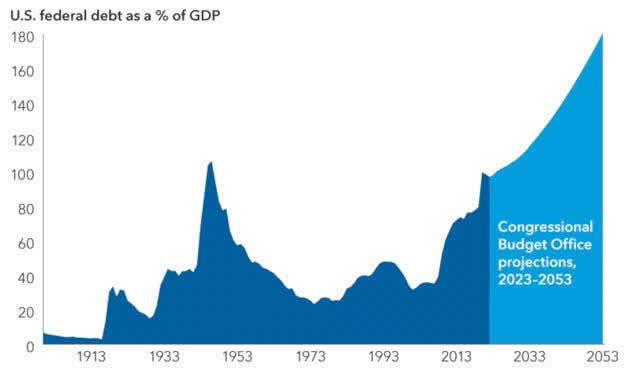

CBO/Capital Economics

The massive increase in AI spending has been a key driver of economic growth for some time now. The federal government is also engaged in massive deficit spending (6.7% of GDP in fiscal year 2024 according to the latest CBO projection). Clearly, given that the United States already has the highest debt-to-GDP ratio in its history, this situation is not sustainable in the long term. And right now, it is hard to find many other potential drivers of economic growth.

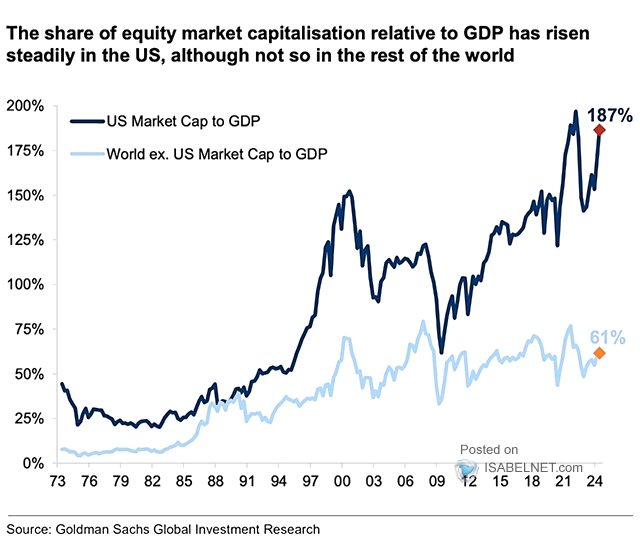

Goldman Sachs Global Investment Research

This leaves us with a global market selling at nearly 22 times forward S&P 500 earnings while the risk-free yield on the 10-year Treasury is 4.3%. As can be seen above, the U.S. market cap-to-GDP ratio has never been higher, even during the late stages of the dot-com boom a quarter-century ago. Just before the crash back then, the global market was selling at five times book value and 2.2 times revenue. Today, we are at five times book value and 2.9 times revenue.

In short, it has been obvious to many investors for some time that the overall market is clearly and substantially overvalued by many key metrics. In many ways, it is more inflated than it was before the dot-com crash of the early 2000s. All it takes is an event like the one that happened on a CNN debate stage Thursday night to make that clear to a much wider audience in the blink of an eye. And that is when the stock sales happen.

And as the famous quote from economist Herb Stein says: “If something can’t last forever, it will end.“And when the”“irrational exuberance” The stock market is finally coming to an end, but I don’t think it will end well for investors who aren’t positioned accordingly.