On July 9, Anne-Sophie Chassagnou will judge whether the sky is clear enough for Europe to launch its first new rocket in almost 30 years.

Aged only 26, the chief meteorologist of the first flight of Ariane 6 has considerable influence on the continent’s space ambitions. Last year, minutes before the rocket was due to launch, France’s CNES meteorologist canceled the first launch attempt of the 1.6 billion euro European mission to explore Jupiter’s icy moons.

“My body was shaking when I had to press the red button,” she said from Europe’s spaceport in French Guiana, between Brazil and Suriname, but if conditions aren’t right for Ariane 6, she won’t hesitate to do it again. “I don’t want to, but if I have to, I will,” she said.

This time, the stakes go well beyond a simple deep space mission. The first flight of the Ariane 6 rocket will test Europe’s ability to regain credibility in the commercial launch market, formerly dominated by Ariane 5 and now by SpaceX, Elon Musk’s group.

Europe is also counting on Ariane 6 to regain its independence in space, an increasingly contested area where the world’s superpowers compete for economic and strategic supremacy. For a year, Europe has had to rely on SpaceX to launch some of its most sensitive satellites.

It’s an uncomfortable position. In the 1970s, the United States attempted to prevent certain European satellites from competing commercially in exchange for launch services. “The Ariane program was triggered by the lack of commercial access to space,” said Eric Dalbiès, president of ArianeGroup, the French joint venture that makes Europe’s Ariane heavy rockets. “This has reignited the need for Europe to have sovereign access. »

Europe has been left without launch capacity again since Ariane 5 was retired last July. Technological challenges, pandemic lockdowns and labor shortages led to a costly four-year delay for Ariane 6. Cooperation with Russia ended after the invasion of Ukraine, and problems with Italy’s new Vega-C medium-sized launcher have left that rocket grounded since 2022.

Josef Aschbacher, director of the European Space Agency, called the situation a “crisis” for Europe. The EU’s new space security and defense strategy has made restoring autonomous access to space a priority.

At the Guiana Space Centre, located near the coastal town of Kourou, teams from ESA, CNES and ArianeGroup have been working hard to achieve this goal.

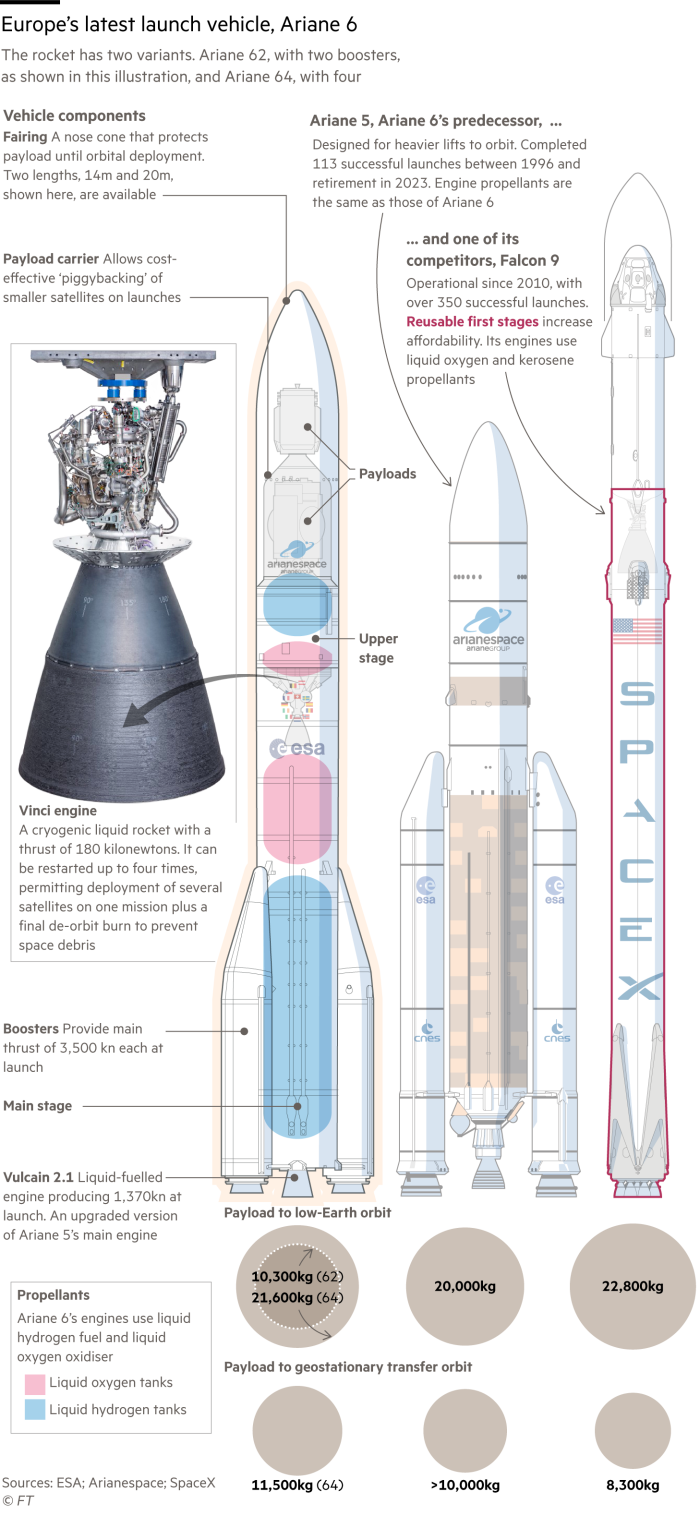

In April, the rocket core was transferred to the launch pad and two boosters carrying 140 tons of solid propellant were attached. On June 20, Ariane 6 was refueled and defueled during the final rehearsal. Sixteen satellites and experiments were loaded onto the rocket.

Nearly 50% of rockets fail on their first flight, Aschbacher said, but Kourou officials hope that repeated testing and rehearsals have mitigated the risks. The goal is to “get everything right the first time,” said Lucia Linares, ESA’s chief strategy officer.

Even if the first flight fails, Europe’s strategic needs will keep the program alive. It is less certain that the rocket can be competitive in a market that has changed radically since Europe chose in 2014 to build a conventional launcher.

SpaceX’s reusable Falcon 9 has seen its price drop, making it the clear leader in reliable, low-cost launches. This week, the EU’s weather satellite operator opted to launch its next Starship on SpaceX, rather than wait for Ariane 6. SpaceX expects Starship, the world’s most powerful rocket, which completed its fourth test flight this month, to also be reusable, unlike Ariane 6.

Europe’s decision not to invest in a reusable rocket is widely seen as a mistake. Germany was reluctant to fund a new rocket program, according to former ESA director Jan Wörner. “The German idea was to continue with Ariane 5 but with a new upper stage. That was the cheapest solution,” he said.

But France, which has long dominated the European launcher industry, wanted to retain rocket-making jobs and skills with a new programme.

A compromise was found. ArianeGroup, resulting from the merger of the Franco-German rocket activities Airbus and Safran, has committed to designing a disposable launcher which would cost at least 50% less to operate than Ariane 5, which would fly in five years and which would require no grant, Wörner said. The program has not kept its promises on all these points.

Last fall, ESA member states agreed to inject an additional 1 billion euros, on top of an estimated development cost of 4 billion euros, to enable Ariane 6 to compete with SpaceX.

Some experts defend the European decision to reject reuse in favor of a disposable launcher with a highly flexible upper stage that can take satellites to different orbits during a single mission. A reusable rocket would have required a large and sustained demand that was not available, they say.

“It was the right decision,” Linares said. “It’s true that if you reuse the first stage … normally you reduce the cost. But it depends on how many times you can do the launch.”

Yet even for a conventional rocket, demand matters, and Ariane 6 is entering a more difficult commercial market than its predecessor.

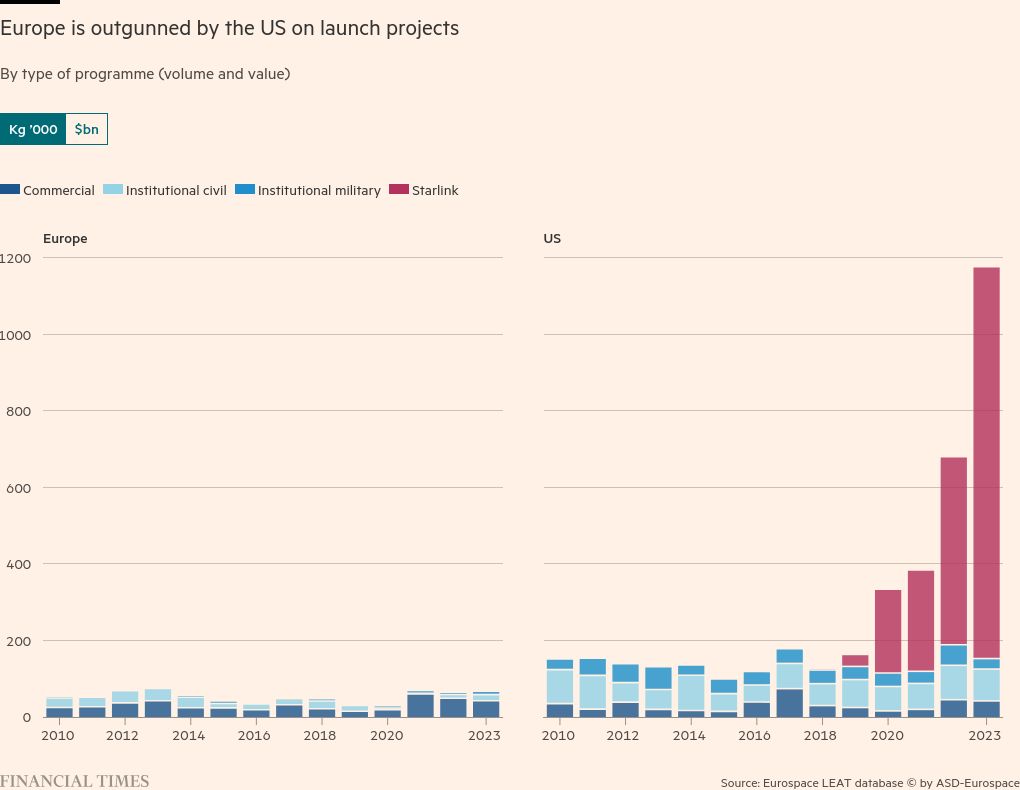

Over the next decade, the United States will launch about three times as many satellites as Europe for governments, universities and other institutions, and nearly 10 times as many commercial spacecraft, according to analysts at Novaspace. The Pentagon, NASA and Musk’s Starlink satellite broadband service will likely turn to SpaceX before Ariane.

Meanwhile, many launcher startups around the world are eyeing the booming market for low-Earth orbit satellite services.

“Previously, Ariane launched two non-institutional satellites for every institutional satellite. Today, new launchers are meeting this demand,” explains Pierre Lionnet, research director of the professional association ASD-Eurospace.

Novaspace estimates that around 2,800 satellites will be launched each year until 2033. Much of this business volume will be covered by national launchers, but Linares believes that enough satellites will still be open to competition – and Ariane’s flexibility will be an advantage.

Ariane 6 already has 30 launches booked, including 18 for Amazon’s upcoming Kuiper broadband satellite constellation. Customers want a diversity of launch providers beyond SpaceX, Linares said.

But even those behind the European program admit that the system that gave birth to Ariane 6 – which awards supply contracts based on nationality rather than competitiveness – will have to change. This year, ESA launched a competition for the development of small commercial launchers, from which it will purchase services.

The decision was an “electric shock” to the economic and political complacency that had hampered Ariane 6, one insider said.

However, the high price of a heavy rocket means Europe cannot avoid collaboration and compromise, which could further hamper its competitiveness.

“I am not convinced that in Europe we will be able to offer launch services at prices as low as those of SpaceX,” said Carine Leveau, head of space transport systems at CNES. “But we can be more competitive than today and more than we will be with Ariane 6.”

But for now, the priority is to ensure Europe’s access to space. “It is very important that this maiden flight is a success,” she added. “That will reassure everyone.”

Illustration by Ian Bott