Photography by Ton

BRK Action: Buy Rating Reiterated

The last time I wrote about Berkshire Hathaway Inc. (New York Stock Exchange: BRK.B), my goal was to answer a question from my readers (see screenshot below). The gist of the question and my answer are cited below:

With BRK prices at near record levels, should we start selling as the P/B ratio is now well above the so-called Buffett price?

My answer is no. The key considerations in my answer are twofold. First, the commonly reported price-to-value ratio is skewed. And second, BRK is no longer an insurance company (at least not only) and the price-to-value ratio no longer accurately reflects its valuation.

Looking for Alpha

So my last article focused on the stock’s valuation, particularly the limitations of the Buffett price. Since my last article, the company has released its quarterly results. That’s why in this article I want to to provide an updated assessment of the stock from a different perspective, more focused on its fundamental operations (notably insurance revenues) and also the impact of share buybacks.

My conclusion is that the company maintains its Buy rating. In addition to its high earnings potential, I believe shareholders will also benefit enormously from what I call the triple compound effect – the combined effect of EPS growth, share repurchases, and share buybacks from its holdings.

BRK Action: EPS Growth

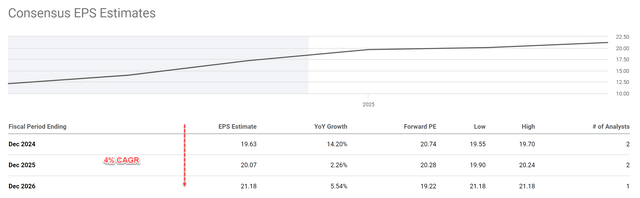

Consensus EPS estimates present a weak projection for earnings growth over the next few years, as shown in the chart below. Analysts expect its EPS to grow at a compound annual growth rate (“CAGR”) of 4% over the next three fiscal years. This translates to EPS of $19.63 for fiscal 2024, rising to $20.07 for fiscal 2025 and $21.18 for fiscal 2026.

Looking for Alpha

I think the projections are a bit too conservative. For example, according to its most recent quarterly report, operating income (i.e. excluding capital gains and losses on the investment portfolio) was $5.20 billion, up a whopping 40% from the prior year. The insurance segment’s results were particularly strong, with underwriting income of $2.6 billion, compared to just over $900 million in the comparable period of 2023. It’s worth noting that last year’s results were hampered by an above-average level of catastrophes.

Looking ahead, I expect the momentum to continue. This year’s strong improvement, in my view, reflects management’s rigorous underwriting standards, which will continue to drive results as industry-wide catastrophe levels return to more normalized levels. In addition, investment income increased nearly 32%, largely driven by higher bond reinvestment rates, another factor that should persist over the next 1-2 years.

But even assuming a lackluster 4% earnings growth, shareholders can still expect a respectable total return due to other compositional forces at work, as detailed below.

BRK action: capitalization via buybacks

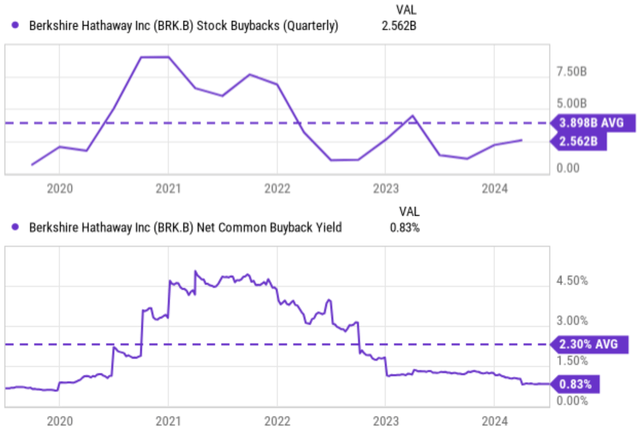

The next growth driver at work is share repurchases. BRK has been a consistent and significant buyer of its stock in recent years. Specifically, the chart below shows its share repurchases in dollars (top panel) and its net common share repurchase yield (bottom panel) over the past five years.

BRK’s share repurchases prior to 2020 were quite modest. Repurchases then increased significantly in 2021 and 2022, peaking at nearly $8 billion per quarter. Repurchase activity then declined in 2023, but has been very substantial. In the most recent quarter, the company spent over $2.5 billion on repurchases and the five-year average is about $3.9 billion, which translates into an average net common share repurchase yield of 2.3%. Also, many investors have been put off by BRK’s lack of dividends. But a 2.3% repurchase yield is higher than the cash dividend yield provided by many dividend stocks and is also better in my view once the tax implications are factored in.

Next, I will explore the combined impacts of earnings growth and share buybacks.

Looking for Alpha

BRK Actions: The Power of Double Capitalization

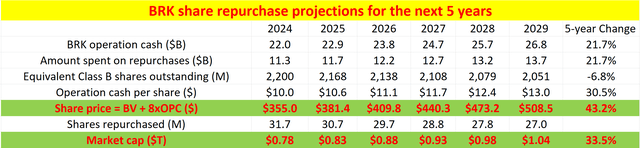

The table below illustrates the combined impacts of EPS growth and share repurchases on shareholder returns. In this projection, I have made the following assumptions:

- I assumed BRK’s operating income would grow at a CAGR of 4%, based on the consensus EPS estimate mentioned above (and again, a conservative assumption in my view).

- I then assumed that BRK would spend the same fraction of its future operating income on share repurchases. The fraction used in the table was 51%, based on the amount spent on share repurchases and its operating income in recent quarters.

- The most important assumption in my view is the price at which future repurchases were made. I modeled these prices as its repurchase value plus 8 times its operating profit following the method detailed in my previous analysis.

Under these assumptions, operating income would grow about 22% over five years (4% compounded over five years). But earnings per share would grow more than 30%, as share repurchases would reduce the stock base by about 7%. With the growth of its stock portfolio, total shareholder returns should exceed 43%. And over time, BRK would reach a market capitalization of $1 trillion.

Author

BRK Action: Other Risks and Final Thoughts

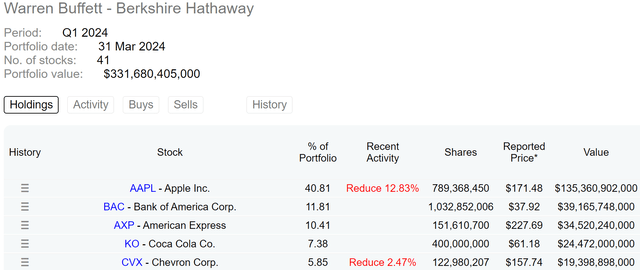

But BRK still has to contend with a third growth force: the growth and redemption of shares held in its equity portfolio. As of this writing, about 40% of BRK’s current market capitalization ($877 billion) is in its equity portfolio (which has a market value of over $331 billion, see the next chart below). Many of these holdings are expected to grow at double-digit rates of earnings, and many are also buying back their shares in a big way.

DataRoma

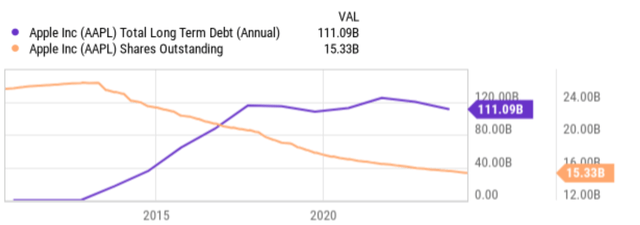

Consider Apple Inc. (AAPL). The company has been rapidly reducing its share base in recent years (see chart below) and recently announced a $110 billion share buyback program. Buffett already highlighted the power of this third force of composition in his 2021 shareholder letter (quoted below with emphasis added), so I won’t elaborate further.

Apple, our second largest stock in terms of year-end market value, is a different kind of holding. Here, Our participation is only 5.55%, compared to 5.39% a year earlier. This increase seems minimal. But consider that each 0.1% Apple’s 2021 profits were $100 million. We spent No Berkshire funds allow us to gain growth. Apple’s acquisitions did the trickIt is important to understand that only dividends Apple’s profits are reported in Berkshire’s GAAP earnings reports – and last year, Apple paid us $785 million of that. Yet our “share” of Apple’s profits was $5.6 million. billion. Much of the company’s retained profits were used to buy back Apple stock, an act we applaud.

Looking for Alpha

In terms of downside risks, BRK and its insurance peers face common risks. Catastrophic events (such as natural disasters) are ultimately unpredictable and can result in significant financial losses. These events are becoming more frequent and severe due to climate change, making it difficult for insurers to accurately assess risk. As a recent example, the past year has been challenging for insurers due to extreme weather events and it is impossible to know if and when such weather conditions will recur. Beyond these common risks, BRK also faces unique challenges. The first is the much-discussed transition risk. With Warren Buffett potentially departing, it is uncertain whether future management will be able to maintain BRK’s historical performance. BRK’s conglomerate structure further compounds transition risk. The conglomerate structure, while providing diversification and downside protection, introduces significant complexity. Managing such a wide range of businesses can be challenging, especially during a time of transition.

Overall, my verdict is that over the long term, the triple compounding effect will be the dominant fundamental force. In short, shareholders will benefit from EPS growth fueled by BRK’s strong underlying business, consistent share buybacks, and its massive and well-managed equity portfolio. All three factors contribute to the compounding effect. Since the compounding effect works multiplicatively (rather than additively), the net result is far more powerful than each factor alone. This is a real-world example of 1+1+1 being much better than 3.