With the historic car manufacturer Volkswagen (OTC:VWAGY) is investing up to $5 billion in electric vehicle maker Rivian Automotive (NASDAQ:RIVN), the question seems obvious regarding the final beneficiaries. However, the surprise winner of the operation could well be the technology giant Honeywell (NASDAQ: HON). The surprising event in the auto sector is a decided pivot towards the middle-income consumer. In the same vein, Honeywell is offering technologies related to public charging. So I am bullish on HON stock.

Analysis of the relevance of HON actions

A closer look at the investment doesn’t seem to support Honeywell. After all, Rivian is the one receiving the influx of funds. For Volkswagen, the company can support its long-term vision of getting into the electric vehicle space. While the upside for HON stock isn’t direct, it would probably be a mistake to ignore it.

An initial investment of $1 billion will get the project off the ground. Volkswagen plans to invest another $1 billion in 2025 and 2026. An additional $2 billion could be injected in 2026 to support a technology joint venture to develop an electrical architecture and software solutions. So where does HON stock fit into this narrative?

It all comes down to economic incentives. As TipRanks writer Paul Hoffman has noted, the electric vehicle industry has seen stagnant growth due to consumer concerns. Those concerns stem primarily from inflation and high borrowing costs. Yes, Rivian’s current product portfolio includes expensive vehicles, with the cheapest model selling for $71,900. That’s assuming Rivian is targeting the high-income demographic.

Even if that’s the case, this approach doesn’t work. Over the past year, Rivian’s stock is down more than 19%. Since its IPO, it’s down about 86%. So Rivian needs to try something else, and that’s what it’s doing.

In 2026, the company will launch its R2 model, which will start at $45,000. A year later, it will launch the R3, which, according to industry publications, could start at $37,000. Clearly, Rivian believes that its future depends on middle-income consumers. Volkswagen’s investment will help achieve this goal.

However, analysts seem to forget that each category has its pros and cons when targeting different segments of the income spectrum. On paper, marketing electric vehicles to the wealthy seems like a good idea. However, this approach suffers from one obstacle: there aren’t that many wealthy people.

At the other end, middle-income buyers are more numerous. Guess what? One of their problems is that they will need public charging stations, and that’s where Honeywell comes in.

Honeywell’s electric vehicle charging solutions could generate handsome profits

As an industrial and applied sciences company, Honeywell has many strengths. True, EV charging is not a deal-breaker for HON stock. However, betting on pure electric infrastructure ideas can be problematic for many investors. That’s because, to my knowledge, these are all small-cap companies, meaning high risk and high reward.

With Honeywell, you’re betting on a major player whose business division could see significant growth. Specifically, if more companies follow the example of the Volkswagen-Rivian deal, building electric vehicles primarily for middle-income households, demand for public charging networks could increase. That would be good news for Honeywell’s Building Controls division, where it can market electric vehicle charging stations to commercial property managers.

A study carried out by Boston Consulting Group revealed that among the three key attributes that hesitant EV buyers needed to see before taking the plunge into electric mobility, one of them was charging solutions in less than 20 minutes.

This is important for two reasons. First, it implies that potential buyers may not have access to a home charging station or will use their electric vehicle a lot for work or errands. Second, the focus on a specific time period implies that these people have little time to waste on unnecessary frustration.

Translation? Middle-income buyers need public charging solutions, and lots of them. That should be a net positive for HON stock.

A deep dive into Honeywell’s valuation

Currently, HON stock is trading at a trailing-year sales multiple of 3.84x. That’s not exactly undervalued. While it’s hard to properly categorize Honeywell, it is ultimately an industrial conglomerate. And the overall conglomerate sector has an average revenue multiple of 1.64x.

It is worth noting, however, that analysts estimate that for fiscal 2024, the company will post revenue of $38.7 billion. If so, this revenue would increase by 5.6%. Moreover, the following year, revenue could reach $41.08 billion. This represents a 6.1% increase over the projected sales for 2024. Therefore, HON stock is trading at 3.39 times its projected revenue for 2025.

While that’s not a huge discount, it’s also worth considering that a focus on EV charging solutions could boost Honeywell’s overall business. With that in mind, the highest sales estimates — $39.05 billion in 2024 and $41.65 billion in 2025 — could be on the table.

Is Honeywell Stock a Buy, According to Analysts?

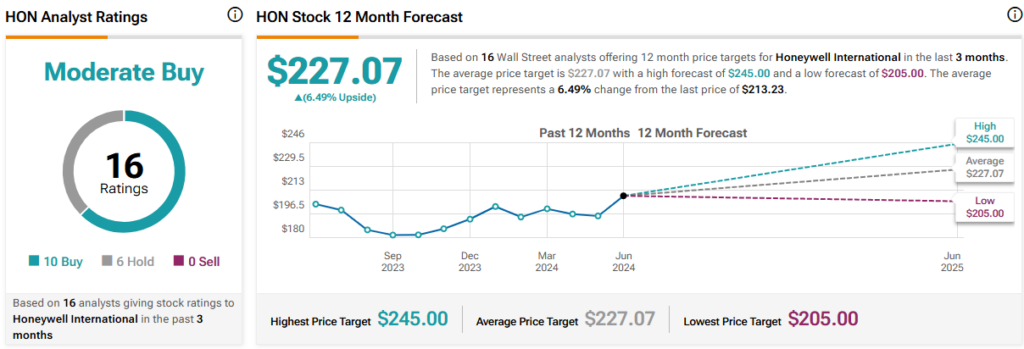

On Wall Street, HON stock has a Moderate Buy consensus rating based on 10 Buy reviews, 5 Hold reviews, and 0 Sell reviews. The average price target for HON stock is $227.07, implying a 6.5% upside potential.

Takeaway: EV charging routes point to HON stocks

At first glance, Honeywell may not seem to have much to do with Volkswagen’s surprise investment in Rivian Automotive. However, one of the deal’s key messages is a shift toward the middle-income consumer. If true, that dynamic translates into a need for more public EV charging solutions. That could benefit Honeywell’s Building Controls division, making HON stock a potentially compelling pick.

Disclosure