Romolo Tavani/iStock via Getty Images

Co-written with Hidden Opportunities.

“Among many, one” is the traditional motto of the United States, appearing on the Great Seal of the nation. It is Latin for “out of many, one,” symbolizing the unity of the various states and peoples of the America, uniting as one nation. Since the nation’s founding in 1776, America has been considered a land of opportunity.

“In 232 years of existence, no other country has ever been more conducive to the development of human potential. If you look at what was happening here in 1776 and what is happening here today, this country has done an incredible job of deploying resources and human ingenuity. The idea that people can unleash their potential… It’s a miracle.”

Despite some severe interruptions, our country’s economic progress was mind-blowing. Our unwavering conclusion: never bet against America.” – Warren Buffett.

America is built on the pillars of capitalism, and Mr. Buffett views the entire system as a golden goose. In a capitalist system, the market is driven by consumer demand and competition, which often leads to higher quality products and services at lower prices. Mr. Buffett continues to emphasize that we are only just beginning to discover what capitalism can do. Let’s now review two choices that are the foundation of the American economy, but are structurally designed to make you money.

Choice #1: EPD – 7.1% yield

The midstream sector plays a critical role in the energy supply chain by ensuring the safe and cost-effective transportation and storage of essential energy products. The midstream sector has a huge economic impact not only on individuals and businesses, but also on the entire nation and has a profound impact on global trade and commerce.

LP Enterprise Product Partners (EPD) is the largest U.S. midstream company by market capitalization. It is one of the best-managed MLPs in the sector, with 25 consecutive years of distribution growth and $53.2 billion returned to unitholders through distributions and unit redemptions since 1998.

The midstream energy sector is in a phase of consolidation, with a significant increase in transactions in recent quarters. While some companies are looking to reduce costs, others are seeking more scalable access to attractive oil and gas producing regions, such as the largest U.S. shale oil field, the Permian Basin, and export facilities on the Gulf Coast.

Note: DEP is a master limited partnership that issues a K-1 form to investors.

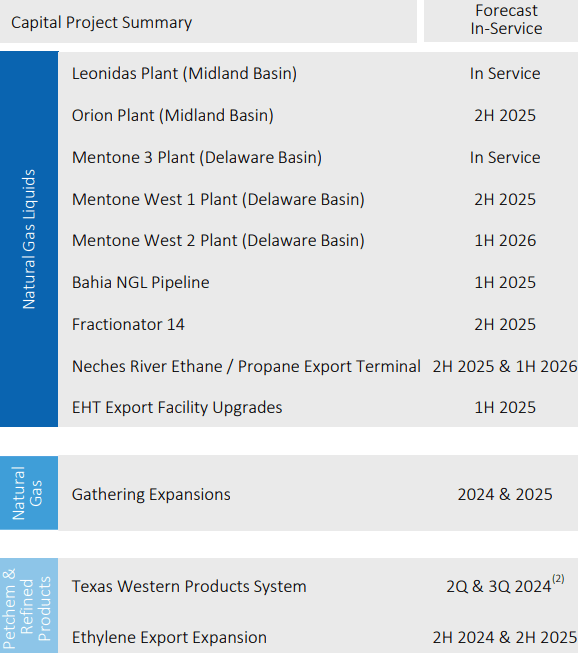

During the first quarter, EPD reported distributable cash flow of $1.9 billion (flat year-over-year), representing 1.7x distribution coverage. The partnership retained $786 million of this free cash flow. During the quarter, EPD repurchased approximately $40 million of its common units in the open market, utilizing a total of 48% of its $2 billion unit repurchase program. EPD made capital investments of $1.1 billion, including $875 million for growth capital projects and $180 million for sustaining capital expenditures. The partnership has several projects coming online in the next 12 to 18 months, providing excellent tailwinds for continued free cash flow and distribution growth. Source.

May 2024 Investor Presentation

EPD expects annual capital expenditure growth of between $3.25 billion and $3.75 billion for fiscal 2024. The Company maintains a strong A3-rated balance sheet with excellent liquidity of approximately $4.5 billion (including unrestricted cash and available borrowing capacity under its revolving credit facilities), positioning it well to accretively acquire suitable targets when the opportunity arises.

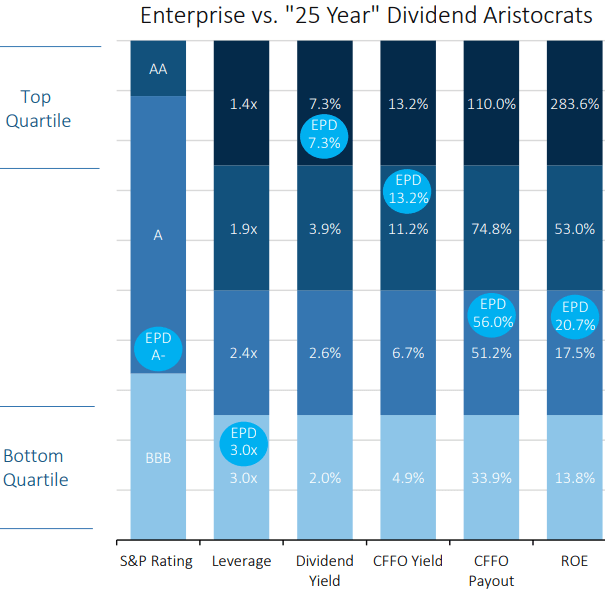

EPD isn’t just another Dividend Aristocrat, it’s the cream of the crop. Among the companies in the Aristocrats club, EPD ranks among the companies with the highest yield, lowest debt levels, and top-quartile CFFO and ROE payments.

May 2024 Investor Presentation

With multi-year fee-based contracts with creditworthy companies, high asset utilization and excess free cash flow after distributions, we expect EPD to be a strong participant in the growing energy export sector while being a serious contender in the M&A race to maintain and improve its competitive positioning.

Choice #2: CCD – Yield 10.3%

The NYSE and NASDAQ together represent a market capitalization of $40 trillion with 6,100 listed companies, nearly six times the size of its nearest competitor, the Shanghai Stock Exchange, and more than twice the number of listed companies of the Tokyo Stock Exchange. The U.S. markets are highly sought after for innovation and growth of world-class companies.

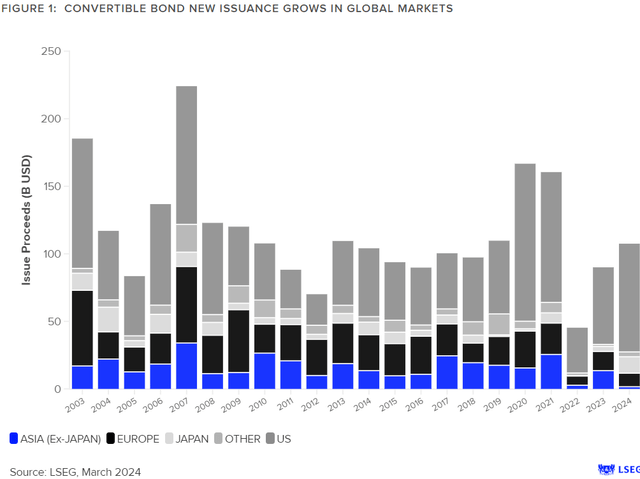

Amid rising interest rates in 2023, convertible bond issuance has soared, and the trend continues in 2024. Global convertible debt issuance in 2023 exceeded $90 billion, and the US market led the asset class, with issuance worth $57 billion. In the first quarter of 2024, $25.2 billion of new convertible bonds were issued globally, with the US leading the group with $20.8 billion, Japan raising $2.9 billion, Europe launching $1.1 billion, and Asia ex-Japan launching $400 million.

LSEG

These new convertible issues offer attractive terms, including higher coupons and lower conversion premiums. Leading issuers come from a wide range of sectors, including artificial intelligence companies like MicroStrategy and Super Micro Computer, ride-hailing competitor Lyft, fintech superstar SoFi Technologies, and clean energy producers NextEra Energy (NEE) and Kosmos Energy. UK-based financial data provider LSEG estimates that between $100 billion and $110 billion of global convertible issuance will occur this year, creating a huge opportunity in this asset class inaccessible via CEFs.

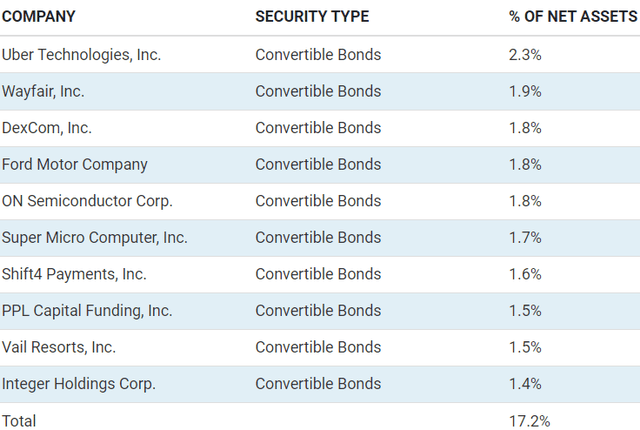

Calamos Dynamic Income and Conversion Fund (CCD) is highly diversified across 602 securities, primarily convertible bonds, some corporate bonds and preferred stocks. Approximately 57% of the fund’s assets are deployed in securities issued by companies in the information technology, healthcare and consumer discretionary sectors. It is worth noting that 95% of the CEF’s exposure is to securities issued by US companies. Source.

Calamos Website

There is a lot of discussion about this CCDCCD’s distributions for the first half of fiscal 2024 are 80% ROC (Return of Capital) and 20% short-term capital gains. Let’s dive a little deeper. Since its inception in March 2015, CCD has distributed a total of $18.17/share, of which approximately 48% was ROC ($8.725). The CEF’s IPO price was $24.50/share.

“The best measure of whether a fund has earned its distributions is the change in its net asset value net of distributions. Regardless of how distributions are characterized, if a fund’s net asset value increases, the fund has earned its distribution. If it does not, the fund has not earned its distribution – the economic concept of return of capital.” – The Return of Capital Demystified, Eaton Vance.

If CCD had a destructive ROC, its current NAV would be much lower than 15.97 (24.50–8.725). However, given that the most recent reported NAV was close to $19, we see that CCD is earning its distributions.

The CCD yields $0.195 per month, representing an annualized return of 10.3%. While the CEF trades at a 19% premium to net asset value, it is important to note that convertibles are illiquid instruments that are generally inaccessible to retail investors. As a result, the valuation of illiquid securities is generally conservative and subjective and may involve some degree of estimation and judgment.

Convertible bonds are a popular security class in current market conditions and are likely to see further acceleration in issuance if the U.S. economy falls into a recession. As a basket of instruments that can generate positive returns in good times and protect investors when markets are struggling, CCDs present an attractive investment opportunity to harvest high yields while the economy figures out its next steps.

Conclusion

Every business, and indeed every country, experiences good times and bad times. It’s a cycle, and strong, well-managed institutions weather the storm and thrive in the long run. America is a nation built on the ideals of resilience, innovation, and an unwavering belief in progress that continue to navigate and thrive through the ups and downs of history. Millions of people around the world seek to relocate to the United States to harness the power of the American Dream, to do business with American organizations, or to invest in the American economy. In particular, the United States is a prime destination for foreign direct investment. As Mr. Buffett says, it’s never wise to bet against the American economy, the engine of wealth and prosperity.

With EPD, you have access to a well-managed company that operates the world’s largest network of pipelines, storage, and energy processing infrastructure, pursuing a business that solidifies America’s position as a leading energy exporter. With CCD, you have access to a highly sought-after way to raise capital in an environment of high borrowing costs and generally lower valuations in an economic downturn. Together, they enrich my passive income stream, but they are just two of more than 45 dividend-paying stocks in our investment group’s model portfolio.

Our investment group taps into this enormous wealth generator with a diversified approach that delivers consistent paychecks in the form of large, growing dividends. We call this approach the Income Method, our secret to a stress-free retirement.