Apple (NASDAQ: AAPL) Apple unveiled its new AI features called “Apple Intelligence” a few weeks ago at its Worldwide Developers Conference. Highlights include text generation and synthesis in apps, advanced AI-powered photo editing capabilities, and a much smarter and more powerful Siri. It also integrates third-party services like ChatGPT for more advanced prompts.

What makes Apple Intelligence so compelling is how much of the AI processing it does on-device. Instead of taking your query, sending it to a server with all the relevant data, waiting for the server to process your query, and then downloading the results to your device, the entire process happens on your iPhone, Mac, or iPad. For more advanced queries that require a larger base model, Apple uses its own servers and a system called Private Cloud Compute, which protects user privacy.

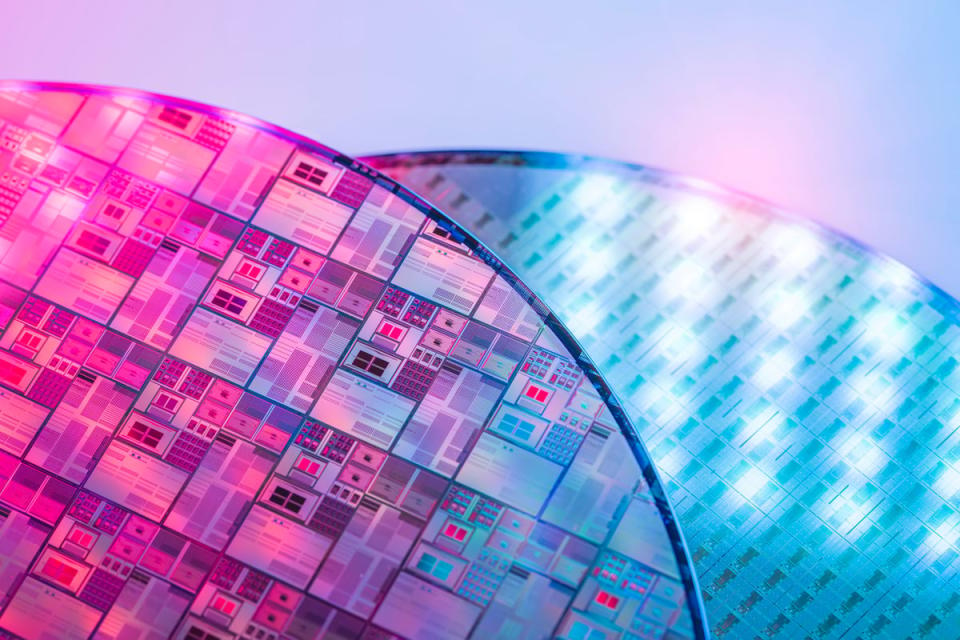

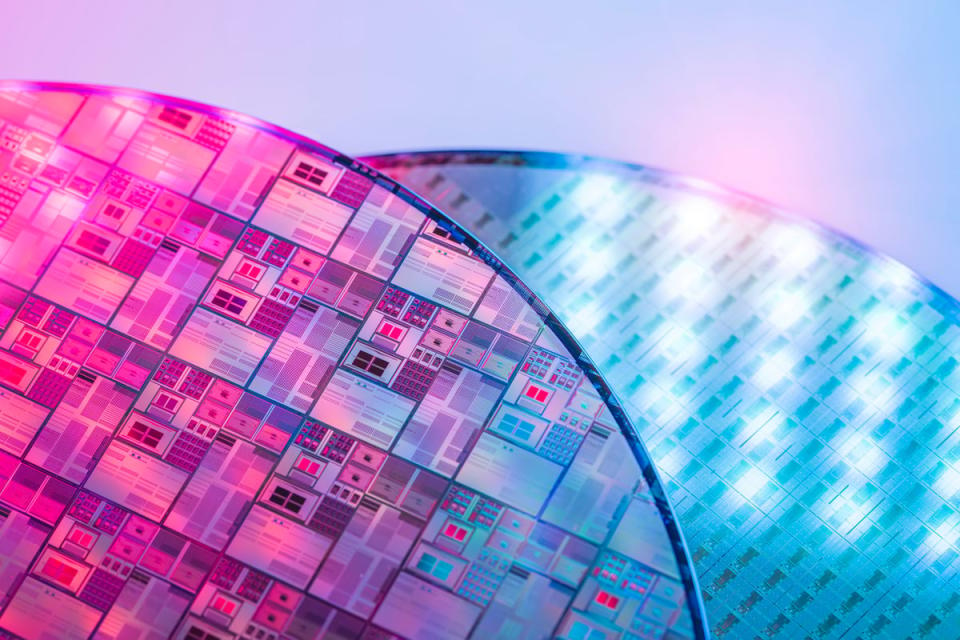

Both of these developments could be major wins for one of Apple’s largest suppliers. Since all of these new features run on Apple-designed silicon, the chip foundry Taiwan Semiconductor Manufacturing Co. (NYSE: TSM) Orders could increase thanks to Apple Intelligence. Additionally, as Apple leads the way in AI processing on devices, it could push other device makers to buy more advanced chips from TSMC as well.

Pushing the boundaries of artificial intelligence

With Apple Intelligence, Apple is ushering in the next phase of artificial intelligence known as edge AI (when data and algorithms are processed directly on the end device, in this case a smartphone, tablet or personal computer).

In order to handle AI queries on a device, however, the devices themselves need to be capable of doing so. That means even hardware that’s a few years old may not be able to handle AI queries as well as newer devices, or even handle them at all. Apple, for example, is limiting Apple Intelligence features to the iPhone 15 Pro, iPhone 15 Pro Max, and upcoming iPhone 16 devices. (Note that the limiting factor here is the amount of short-term memory, or RAM, on the device, not the processors themselves.)

As a result, Apple could see strong demand from users looking to upgrade their phones in the coming years as Apple Intelligence features roll out worldwide. And rising iPhone sales mean rising demand for TSMC’s chips.

But TSMC doesn’t just supply chips to Apple. It makes the majority of the world’s chips, accounting for more than 60% of the market. That size gives it a huge competitive advantage over smaller foundries because it can invest more money in R&D to develop more advanced processes to print more powerful and energy-efficient chips. That helps it retain existing customers, like Apple, that are looking for cutting-edge chips, and attract more customers. It also helps TSMC attract new customers, as innovations like cutting-edge artificial intelligence push companies to adopt new chip designs.

Apple’s cloud is just getting started

To support third-party extended language models (LLMs) and its own more advanced LLM, Apple created Private Cloud Compute (PCC). The system uses Apple servers that also deploy the tech giant’s own chip designs.

It’s worth noting that Apple isn’t using the platform to train AI models. It’s using PCC to process data and algorithms that would require more computing power than what’s available on consumer devices. The first implementation is to send prompts to ChatGPT.

Apple has significant potential to expand its data center capacity by partnering with more companies and developers looking to integrate their AI services into Apple’s platform. When the company announced its partnership with OpenAI’s ChatGPT, it said it was working to bring more partners to the platform later this year. If Apple incentivizes developers to use PCC, that could further increase Apple’s demand for TSMC’s services. It also gives Apple another way to generate revenue from developers.

Apple still has a long way to go in expanding its AI capabilities through third-party integrations. Just think of the phenomenal growth of the App Store over the past 15 years. Similar growth would be a boon for both Apple and TSMC.

Building a $1 Trillion Semiconductor Company

TSMC already has a market cap of around $900 billion. Even so, the stock appears undervalued at its current price, given the growth potential driven by continued demand for AI chips.

The stock trades at about 27 times earnings forecasts, which is a more than reasonable price. The company should be able to grow earnings quickly enough to justify that price, as demand for more advanced chips supports revenue growth and improves operating margins. Analysts expect earnings to rise more than 25% next year.

A major iPhone upgrade cycle in the coming years, growing demand for Apple’s new data centers, and the general push toward edge computing are all factors that are driving TSMC’s continued growth. Its competitive advantage in creating the most advanced, powerful, and energy-efficient chips will serve it well in the coming years. It’s only a matter of time before the company surpasses $1 trillion in market capitalization.

Should You Invest $1,000 in Semiconductor Manufacturing in Taiwan Right Now?

Before buying Taiwan Semiconductor Manufacturing stock, consider this:

THE Motley Fool, Securities Advisor The team of analysts has just identified what they believe to be the 10 best stocks Investors need to buy now…and Taiwan Semiconductor Manufacturing isn’t one of them. These 10 stocks could deliver monstrous returns in the years ahead.

Consider when Nvidia I made this list on April 15, 2005… if you had $1,000 invested at the time of our recommendation, you would have $751,670!*

Securities Advisor provides investors with an easy-to-follow blueprint for success, including portfolio building advice, regular analyst updates and two new stock picks each month. Securities Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See all 10 actions »

*Stock Advisor returns as of July 2, 2024

Adam Levy holds positions at Apple and Taiwan Semiconductor Manufacturing. The Motley Fool holds positions in and recommends Apple and Taiwan Semiconductor Manufacturing. The Motley Fool has a disclosure policy.

Apple’s new artificial intelligence (AI) features could propel the semiconductor company to a $1 trillion valuation was originally published by The Motley Fool