The glory days of the world leader in artificial intelligence (AI) may already be behind us.

The first half of 2024 is behind us and the bulls still have control of Wall Street. Mature, stock-focused investors, Dow Jones Industrial Averagereference S&P 500and fueled by growth actions Nasdaq Composite Index all propelled towards new records.

While there are many catalysts behind Wall Street’s gains, much of the credit goes to what is arguably the hottest trend since the advent of the Internet in the mid-1990s. I’m talking about the rise of artificial intelligence (AI).

Image source: Getty Images.

The broad scope of AI involves using software and systems to handle tasks that humans would normally undertake or supervise. What makes this revolutionary technology so appealing is the ability of AI software and systems to learn without Human intervention. The ability to become more proficient at assigned tasks or perhaps evolve to learn new tasks/jobs makes artificial intelligence useful in most sectors and industries.

As you can imagine, estimates of how much AI can change the growth curve of businesses vary widely. But according to a report published last year by PwC analysts, AI is expected to add $15.7 trillion (Yeswith a “t”) to the global economy by the turn of the decade.

With dollar figures this high, it’s easy to see why AI stocks have been the best thing since sliced bread appeared in 2024. But among the vast sea of stocks that have benefited from the AI revolution, Nvidia (NVDA 4.57%) reigns supreme.

The key question is: How much longer can Nvidia remain on its pedestal?

If history is any guide, Nvidia’s glory days may already be behind us.

Nvidia’s operational ramp-up has been nothing short of textbook

For over a year, Nvidia has been expanding its operations to a level never before seen for an industry-leading company. After reporting revenue of $27 billion for fiscal year 2023 (ending January 2023), Nvidia is expected to report revenue of over $120 billion for fiscal year 2025 (ending January 2025).

Its innovative AI-driven graphics processing units (GPUs) have made this meteoric growth in sales and profits possible. In particular, Nvidia’s H100 GPU has quickly become the standard in AI-accelerated data centers. TechInsights analysts recently reported that Nvidia’s chips accounted for 98% of the 3.85 million AI GPUs shipped last year.

Despite its first-mover advantages, this AI leader isn’t sitting idly by. While competitors aim to catch up with the H100 GPU, Nvidia plans to launch its next-generation Blackwell chip later this year. CEO Jensen Huang also recently teased the company’s “Rubin” AI GPU architecture, which is expected to be released in 2026. It looks like Nvidia has no trouble maintaining its compute advantages.

Additionally, enterprise demand for AI chips has completely outpaced available supply. This has been music to management’s ears, as it has allowed the company to significantly increase the price of its H100 chip. The ongoing shortage of AI GPUs has pushed Nvidia’s adjusted gross margin to over 78% in the fiscal first quarter (ended April 28).

But when things seem too good to be true on Wall Street, that’s usually when investors should worry.

Image source: Getty Images.

Nvidia Shares Could Drop Up to 56% by Year-End

This isn’t the first time Nvidia has been the primary beneficiary of a major technology innovation or trend. In 2018, the company’s stock saw a surge thanks to the surge in cryptocurrency prices.

While not all digital currencies use a proof-of-work (PoW) mechanism to validate transactions on the blockchain, some of the most prominent cryptocurrencies do, such as BitcoinValidation with PoW is done through cryptocurrency mining.

Cryptocurrency miners use very powerful GPUs that solve complex equations and verify payments. The first miner to validate a group of transactions, called a block, receives a block reward (tokens of the mined digital currency). Nvidia GPUs have become the gold standard for cryptocurrency miners.

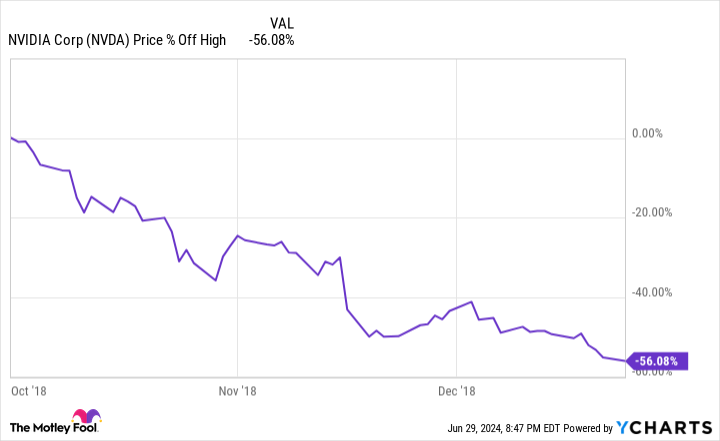

But shortly after the cryptocurrency bubble burst, Nvidia quickly gave up a significant portion of its earlier gains. Less than three months after reaching its innovation peak in October 2018, Nvidia shares were down 56%!

NVDA data by YCharts.

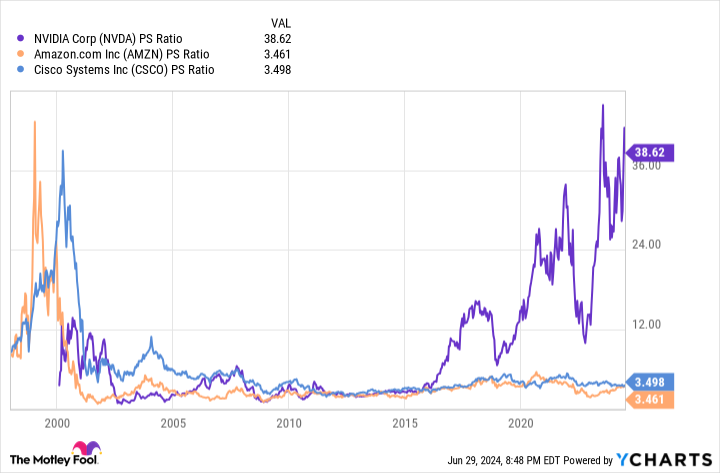

We have also witnessed rapid declines in other industry-leading companies when speculative bubbles burst. AmazonAfter peaking in December 1999, before the dot-com bubble burst, the stock’s value fell by two-thirds over the next six months. Cisco Systems fell 37% just months after reaching its dot-com peak.

I mention Amazon and Cisco Systems because these two industry leaders were the most expensive in terms of 12-month trailing sales (TTM) valuation before the dot-com bubble burst. On June 20, 2024, when Nvidia hit its all-time high, its TTM price-to-sales ratio was virtually identical to Amazon and Cisco.

The fact is that while Nvidia peaked on June 20 at over $140 per share, the decline from that pedestal is unlikely to be gradual. History has shown that once bubbles burst, industry leaders are quickly pushed out. That’s why I predict the company could lose as much as 56% of its peak in the second half of 2024.

NVDA PS ratio data by YCharts. PS = price to sales.

But that’s only part of the story.

In addition to all the innovations or cutting-edge technologies that experience a bubble burst early in their existence, Nvidia will have to face its first real influx of competitors. Well-known behemoths of the semiconductor industry Advanced microsystems And Intel have respective AI accelerator chips that they will deploy or ramp up production in the second half of this year.

Here’s the interesting problem Nvidia faces: Even though its H100 and Blackwell chips retain clearly identifiable computing advantages, the company still risks losing market share. Nvidia is at the mercy of its suppliers, which means it won’t be able to meet demand from all of its customers. That opens the door for AMD and Intel to fill the void.

As I’ve already pointed out, Nvidia’s four major customers are also developing their own AI GPUs. While these chips aren’t likely to outperform Nvidia’s AI GPU architecture, their very presence signals a desire by the world’s most influential companies to reduce their reliance on the current AI leader.

Additionally, the mere presence of these new AI GPUs taking up valuable space in AI-accelerated data centers means that Nvidia’s pricing power will diminish over time.

History shows that falling from grace when speculative bubbles burst is not pleasant to watch, and Nvidia’s steep decline may have already begun.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams holds positions in Amazon and Intel. The Motley Fool holds positions in and recommends Advanced Micro Devices, Amazon, Bitcoin, Cisco Systems, and Nvidia. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel and short August 2024 $35 calls on Intel. The Motley Fool has a disclosure policy.