President Joe Biden and former President Donald Trump participate in the CNN presidential debate on June 27, 2024, in Atlanta.

Justin Sullivan | Getty Images News | Getty Images

Inflation slowed further in June, bringing further relief to consumers’ wallets.

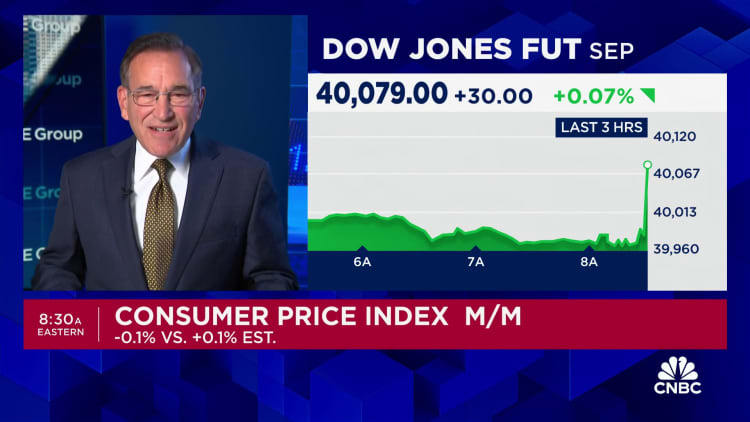

The consumer price index rose 3% in June 2024 from June 2023, down from an annual inflation rate of 3.3% in May, the Bureau of Labor Statistics reported Thursday.

Although inflation has not yet fully returned to policymakers’ long-term target of around 2%, it has fallen significantly from 9% two years ago, the highest level since 1981.

But why did inflation start to take off?

In the first US presidential debate last month, both candidates – President Joe Biden and former President Donald Trump – blamed each other for inflation-related grievances during the pandemic.

More information on personal finance:

Here’s the breakdown of inflation for June 2024 — in one chart

Why Housing Inflation Remains Stubbornly High

More Americans Are Struggling Despite Falling Inflation

“He caused inflation,” Trump said of Biden during the June 27 debate. “I gave him a country with no, virtually no inflation,” he added.

Biden countered that inflation was low during Trump’s term because the economy “was flat.”

“He decimated the economy, completely decimated the economy,” Biden said.

But the cause of inflation is not so simple, economists say.

In fact, Biden and Trump are not responsible for much of the inflation consumers have experienced in recent years, they said.

“Neither Trump nor Biden are to blame”

Global events beyond the control of either Trump or Biden have disrupted supply and demand dynamics in the U.S. economy, fueling higher prices, economists said.

There were other factors as well.

The Federal Reserve, which operates independently of the Oval Office, for example, was slow to act to contain runaway inflation. Some of Biden’s and Trump’s policies, such as pandemic relief packages, likely played a role, as did the infamous “gluttony.”

“I don’t think it’s a simple yes or no answer,” said David Wessel, director of the Hutchins Center on Fiscal and Monetary Policy at the Brookings Institution, a left-leaning think tank.

“Generally, presidents get more credit and blame for the economic situation than they deserve,” he said.

Biden’s perception of high inflation is partly due to image: He took office in early 2021, at a time when inflation was at a notable peak, economists say.

Similarly, the Covid-19 pandemic plunged the United States into a severe recession during Trump’s term, sending the consumer price index to near zero in the spring of 2020 as unemployment soared and consumers cut back on spending.

“In my view, neither Trump nor Biden are responsible for high inflation,” said Mark Zandi, chief economist at Moody’s Analytics. “The blame lies with the pandemic and Russia’s war in Ukraine.”

The main reasons for the soaring inflation

A terminal at Qingdao Port on June 20, 2022 in Qingdao, Shandong Province, China.

Wu Shaoyang/VCG via Getty Images

Inflation has multiple ramifications. When it reaches a high level, it is largely due to a mismatch between supply and demand.

The pandemic has disrupted normal dynamics, including disrupting global supply chains.

There were labor shortages: Illness sidelined workers. Daycares closed, making it difficult for parents to work. Others worried about getting sick on the job. Declining immigration also reduced the labor supply, economists said.

China, for example, has closed factories and cargo ships have been unable to unload their goods at ports, reducing the supply of goods.

In the meantime, consumers have changed their purchasing habits.

They bought more material goods like living room furniture and desks for their home offices as they spent more time indoors — a departure from pre-pandemic norms, when Americans tended to spend more money on services like dining out, traveling and going to movies and concerts.

Strong demand, which surged as the U.S. economy largely reopened, coupled with shortages of goods, fueled the price rise.

Other factors were also at play.

For example, automakers didn’t have enough of the semiconductor chips needed to build cars, while car rental companies sold their fleets because they didn’t think the recession would last long, making leasing more expensive when the economy rebounded quickly, Wessel said.

As Covid cases hit record highs heading into 2022, further disrupting supply chains, Russia’s war in Ukraine “supercharged” inflation by causing prices of commodities such as oil and food to rise around the world, Zandi said.

As a result, global inflation has reached a level “higher than that observed in several decades,” the International Monetary Fund wrote in October 2022.

“One only has to look at the persistently high inflation rates in most other advanced economies to see that much of this period of inflation was actually related to global trends…rather than to the specific policies of any one government (although they certainly played some role),” Stephen Brown, deputy chief North America economist at Capital Economics, written in an email.

Impact of big spending bills ‘only clear with hindsight’

U.S. President Joe Biden speaks during his speech on implementing the American Rescue Plan in Washington on March 15, 2021.

Eric Baradat | AFP | Getty Images

However, Biden and Trump are not entirely without fault: They green-lighted additional government spending during the pandemic, which contributed to inflation, for example, economists said.

For example, the American Rescue Plan—the $1.9 trillion stimulus package signed by Biden in March 2021—provided $1,400 stimulus checks, enhanced unemployment benefits, and a larger child tax credit for households, among other relief measures.

The policy has led to “some good things,” like a strong labor market and low unemployment, said Michael Strain, director of economic policy studies at the American Enterprise Institute, a right-leaning think tank.

But its magnitude was greater than the U.S. economy needed at the time, and helped raise prices by putting more money in consumers’ pockets, which fueled demand, he said.

“I think President Biden bears some responsibility for the inflation we’ve been experiencing over the last few years,” Strain said.

He said the American rescue plan Core inflation increased by about 2 percentage points. The consumer price index peaked at 9.1% in June 2022, its highest level since 1981. It has since declined to 3%.

The Federal Reserve, the US central bank, is targeting a long-term inflation rate of around 2%.

“I think without the American Rescue Plan, the United States would still have had inflation,” Strain added. “So I think it’s important not to overstate the situation.”

However, Zandi sees the inflationary impact of the ARP as “good” and “desirable,” returning the economy to the Fed’s long-run target inflation rate after a prolonged period of below-average inflation.

Trump also authorized two stimulus packages, in March and December 2020, worth about $3 trillion.

These so-called fiscal policy responses were insurance against a lackluster economic recovery, perhaps excessive after the United States’ lackluster response to the Great Recession that plunged the country into high unemployment for years, Wessel said.

The fact that the United States may have issued too much stimulus may be the fault of presidents, but “that only becomes clear in hindsight,” he said.

Biden and Trump have also adopted other policies that could contribute to higher prices, economists said.

For example, Trump imposed tariffs on steel, aluminum and several products imported from China, which Biden largely kept unchanged. Biden also introduced new import taxes on Chinese products such as electric vehicles and solar panels.

The Fed and “greedflation”

U.S. Federal Reserve Chairman Jerome Powell speaks during a news conference on interest rates, the economy, and monetary policy measures on June 15, 2022.

Olivier Douliery- | AFP | Getty Images

Fed officials also bear some responsibility for inflation, economists say.

The central bank uses interest rates to control inflation. Raising rates increases borrowing costs for businesses and consumers, which slows the economy and thus inflation.

The Fed raised rates to their highest level in about two decades, but it was initially slow to act, economists say. It first raised rates in March 2022, about a year after inflation began to spike.

Mr. Strain also said the Fed waited too long to taper its “quantitative easing,” a bond-buying program designed to stimulate economic activity.

“It was a mistake,” Mr. Zandi said of the Fed’s policy. “I don’t think anyone could have made the right choice under those circumstances, but in hindsight, it was a mistake.”

Some observers have also pointed to so-called “greedflation” — the idea that companies take advantage of high inflation to raise prices more than necessary, thereby increasing their profits — as a contributing factor.

This is unlikely to be a cause of inflation, although it may have contributed slightly, economists said.

“If that were the case – which I’m not sure it was – it would have been a very minor factor in the inflation that we’ve seen,” Strain said. He estimates that dynamic would have added much less than a percentage point to the inflation rate.

“Companies are always looking for an opportunity to raise prices when they can,” Wessel said. “I think they’ve benefited from the inflationary climate, but I don’t think they’re the cause of it.”