solid colors/E+ via Getty Images

Co-written by Treading Softly.

When you were young, do you remember your career dreams? Many of us had unrealistic dreams, like becoming some kind of superhero or having a career in a field we cared about. In the end, I didn’t follow through, but I thought it would be fun and exciting, like a police officer, firefighter or doctor.

I have a daughter who is convinced that she will be a princess when she grows up. She has already decided which of the young princes of England she wants to marry to join the ranks of the royal family. It gives her great pleasure to think that in the future I will have to call her “your majesty”.

When it comes to the market, many of us have goals we want to achieve for our retirement. Unfortunately, many of our Goals aren’t really effective in helping us achieve a goal. If your goal is to save $1,000,000 for retirement, you’re left with the question, “So what?” You have $1,000,000; what are you going to do with it? Unfortunately, many people rush toward the idea of having $1,000,000 and have no idea what to do with it, other than fear of running out of money before they run out of steam. I’m a big believer in a retirement dream that uses the market as a tool to fund your retirement, not as an ultimate goal in itself.

My dream in retirement is to visit my family, enjoy my hobbies and at the end of the day sit and relax in front of the fireplace with a glass of tea. I will remember with my wife the wonderful things we were able to accomplish that day.

Today I want to look at two funds to help you fund your retirement.

Let’s dive in!

Choice #1: OXLC – Yield 19.3%

Shareholders of Oxford Lane Capital Company (OXLC) will receive a distribution increase starting with this month’s payouts. The monthly distribution of $0.09/share represents a 12.5% increase over the previous month. What may surprise investors the most is that OXLC’s yield was already over 17%. How is it possible that an investment with such high yields can increase its distribution?

The answer is that CLOs (Collateralized Loan Obligations) are currently in the “sweet spot” where asset values are recovering and default rates remain very low.

What is a CLO?

A CLO is an actively managed investment portfolio that invests in bank loans. A CLO manager creates a CLO by acquiring loans and then raises debt capital by selling “tranches” of the CLO. The word “tranche” confuses many people, but ultimately, a “tranche” is just one level of the capital structure. In companies, we would divide the capital structure into senior secured debt, first lien debt, second lien debt, preferred equity, and common equity. The corporate structure has different levels of capital with different seniority.

In a CLO, you also have tiers that are ranked in order of seniority, called tranches, and are labeled with letters that clearly indicate their respective seniority. You know that the AA tranche is senior to the A tranche, which is senior to the BBB tranche. Companies should use the same system because it would save investors from trying to figure out whether the senior loan is senior or on par with a senior bond. When you read the details, you find all too often that a “senior” bond is subordinate to certain loans.

CLOs offer two major advantages:

- The ability to choose your own risk/reward ratio. The higher your tranche, the lower your return and risk. The lower your tranche, the higher your return and risk. Within a CLO, there is a tier for everyone.

- A very stable structure. CLOs are super structured in everything they do. Everything is determined from the beginning. For every payment collected by the CLO, there is no question about where that money is going. Even when a CLO has a high level of defaults and is unable to pay in full, there is no reason to go to bankruptcy court. The manner in which the tranches will be paid and the conditions under which the senior tranches will be prepaid are already predetermined.

Institutions value the predictability and defensiveness of senior tranches. That is why they are willing to accept a low yield of SOFR + 150 bps while the underlying loans held by the CLO have coupons higher than SOFR + 500 bps. They are willing to sacrifice the high yield, for the certainty of return.

OXLC The equity tranche is targeted. This is called “common equity,” a level that carries no collateral. As borrowers repay their loans, the interest owed to the debt tranches is paid first, and then the equity keeps the profit.

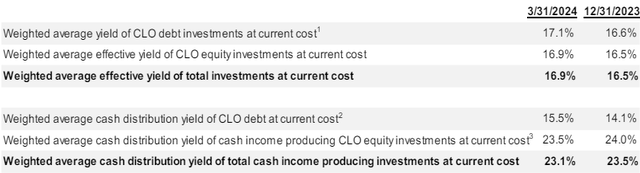

Thanks to low default rates, the return on CLO equity positions has been enormous. OXLC provides us with two returns: the “effective yield,” which is a GAAP calculation that includes assumptions about future defaults, and a “cash distribution yield,” which is the actual cash received. Source.

Presentation of the OXLC of March 2024

Note that these returns are calculated based on OXLC’s cost base, not fair market value. Therefore, OXLC is currently receiving a significant amount of cash flow relative to its net asset value (NAV).

While OXLC is swimming in cash, its NAV has recovered. OXLC reported in May that its NAV was $5.02 to $5.12. This is the highest NAV OXLC has seen since June 2022. CLO share prices are finally starting to recover and likely have significant room to rise.

While prices have been low over the past two years, what did OXLC do? They bought the dip. OXLC increased its assets to approximately $1.7 billion, up from $1.2 billion as of June 2022. It did this with a minimum debt/preferred issuance of $483.4 million to $487.2 million. In other words, OXLC grew its portfolio while significantly deleveraging. Even with OXLC’s recent debt issuance, its leverage will be lower than it was two years ago.

Things are looking good for OXLC right now. Leverage is down, cash flow is high, defaults are low, and net asset value is up. Just as CLO investors can choose their own risk/reward, OXLC investors can choose their own risk/reward. Equity has a peak yield, but if defaults increase significantly, common stock is the cushion that will absorb the impact. Term preferred notes or bonds offer a lower yield, but are also a very good option for risk-averse investors. As noted above, OXLC’s leverage, which includes the preferred notes, is very low.

Choice #2: HQH — 12.5% Yield

ABRDN Healthcare Investors (HQH) is a closed-end investment fund (CEF) formerly known as “Tekla Healthcare Investors”. Aberdeen acquired Tekla and retained the same fund managers in the same Boston office.

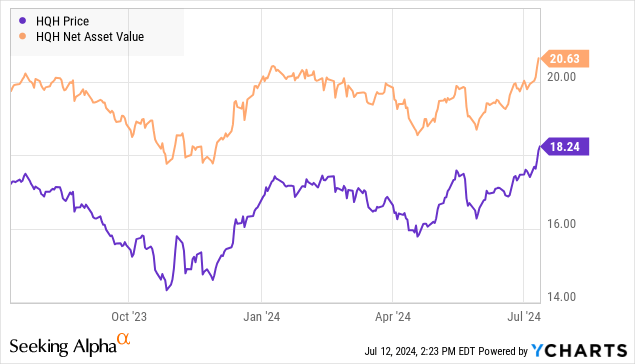

A major change that Aberdeen has brought with HQis an increase in its distribution policy. HQH has a variable distribution policy, where the amount it pays out is based on a percentage of net asset value (NAV). HQH has announced that for at least the next year, distributions will be 3% of NAV each quarter (12% annualized)

Note that the distribution calculation is based on NAV, not share price. So a 12% yield on NAV is a yield of over 13% based on market price! While HQH’s share price has risen significantly since its October 2023 low, this increase has been offset by a recovery in NAV.

The current price represents a discount of about 12% to NAV. One of Aberdeen’s goals with this change is of course to reduce the discount. However, if that is not the case, it is beneficial for shareholders to receive higher distributions when a fund is trading at a significant discount to NAV. The reason is that $1 of NAV translates into only $0.88 of share price. $1 of distributions is $1 in our pockets.

Because HQH’s distribution policy is variable, the actual size of the distribution will be directly affected by changes in net asset value. If the fund does not grow by 3% in a quarter, the net asset value will be lower after the distribution, reducing the future distribution. If the fund can grow by more than 3% per quarter, the net asset value will increase despite the distribution, and future distributions will be higher.

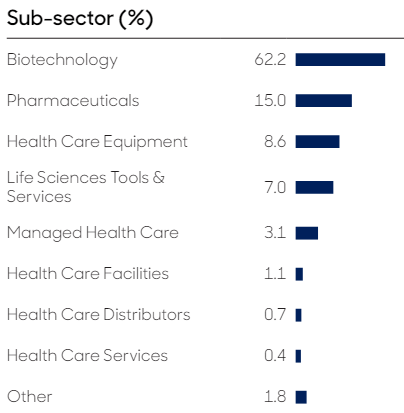

Is a 12% or higher yield reasonable for HQH’s portfolio? We think it’s entirely possible. HQH focuses on biotech and pharmaceuticals. Both sectors became popular during the COVID pandemic, but prices have declined as investors have pulled back.

HQH Fact Sheet

The fundamentals of these sectors remain strong as medical innovation continues to advance and consumer demand for essential and elective medicines only continues to grow.

There are many reasons to believe that given current low valuations, we could see HQH’s portfolio post double-digit gains. In the meantime, we’re getting $0.88 of market value converted to $1.00 of cash in our pockets.

Conclusion

OXLC and HQH give us broad exposure to two very different sectors of the market. One provides exposure to CLOs, allowing you to benefit from income by taking advantage of floating interest rates. When rates are high, they provide even higher income. When rates fall, they provide a lower level of income, but still superior to many other options available in the market.

HQH gives you a strong exposure to the pharmaceutical sector and healthcare as a whole. The amount of money that individuals spend on healthcare continues to increase. As our population ages, our healthcare spending increases. It is often said that in retirement, you trade a large portion of your wealth to try to maintain some of your health, especially if you have traded your health to try to gain as much wealth as possible. I can use HQH as a fund to be able to fund my retirement alongside OXLC. It gives me a leg up to be able to meet my expenses head on.

What is your retirement dream? Set your goals to help you achieve that dream, whether it’s being able to travel and see the world, or buying a piece of land in a quiet corner of America and enjoying the peace and quiet without traffic noise or annoying neighbors. Your goal will be as unique as you are, tailored to achieving your unique dreams. You can then use something like our income method to help you achieve your goals and make your dreams come true. With choices like these, you’re making money, even while you sleep!

That’s the beauty of my income method. That’s the beauty of income-based investing.