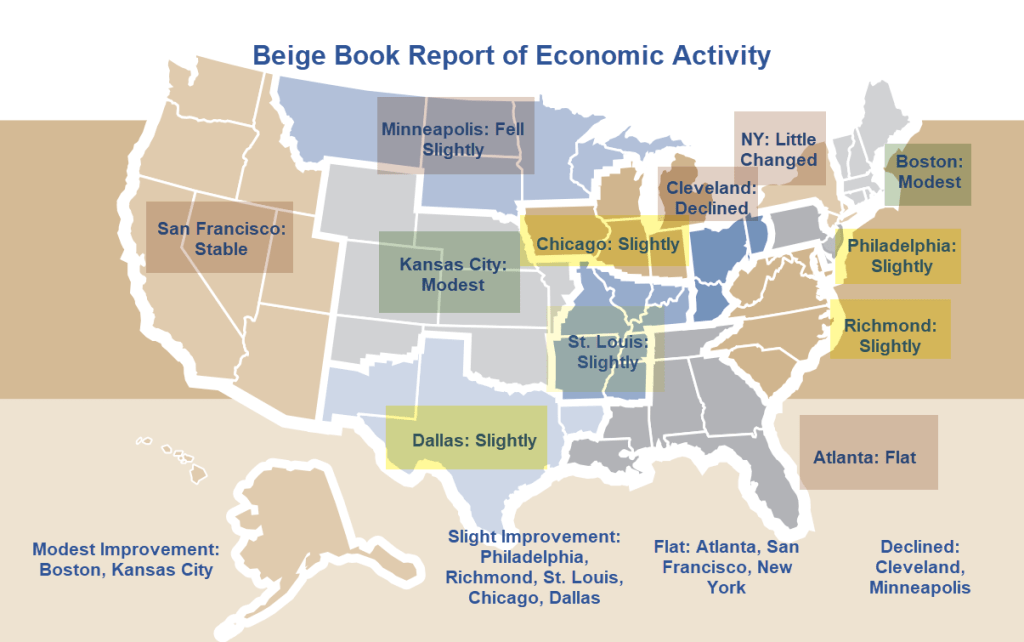

Let’s listen to the Fed’s Beige Book summary of economic activity in the twelve Federal Reserve districts.

Summary below from the Beige Book, summary of comments on current economic conditions.

Key points of the overall activity of the Beige Book

- Seven districts reported some level of increase in activity, five noted stable or decreasing activity, three more than in the previous reporting period.

- Wages continued to grow at a modest to moderate pace in most districts, while prices generally increased modestly.

- Household spending little changed this period according to most district banks. Auto sales varied across districts during this cycle, but some districts noted that sales were lower in part due to a cyberattack on dealerships and high interest rates.

- Most districts saw weak demand for consumer and business loans. Reports on residential and commercial real estate markets have been mixed, but most banks have reported little or no change in recent weeks. Travel and tourism have grown steadily and have been in line with seasonal expectations.

- Districts also reported widely varying trends in manufacturing activity, ranging from rapid slowdown to moderate growth..

Boston: Economic activity grew modestly overallPrices have edged up and wage growth has been slow amid stable employment. Residential real estate activity has increased on improving supply, but commercial activity has been flat on growing concerns about office leasing activity. The outlook remains cautiously optimistic, but contacts continue to report elevated uncertainty.

new York: Overall, regional economic activity has changed little. Labor market conditions continued to moderate, with demand for labor softening and the supply of workers increasing significantly. Consumer spending increased modestly and remained strong. Although inventories increased, home sales activity remained limited. Sales prices continued to increase at a moderate pace.

Philadelphia cream: Business activity continued to grow slightly In the current Beige Book period, non-manufacturing activity has driven employment growth at a moderate pace; however, wage inflation has remained modest. Firms have reported modest increases in costs paid and prices received and have noted increased competition in consumer-facing sectors. Expectations for future growth have remained slightly positive overall, rising for most firms but falling for manufacturers.

Cleveland:Business activity in the district has declined slightly in recent weeks and contacts expect stable activity in the coming months. Consumer spending continued to decline slightly and demand for manufactured goods weakened. Employment levels remained stable.Overall, contacts indicated that growth in wages and input costs remained moderate and selling prices increased modestly.

Richmond: The regional economy grew slightly over this period, down from the modest pace of growth seen in the last cycle. Consumer spending on food goods and services remained broadly stable or increased slightly.; however, leisure travel spending increased moderately, particularly in coastal areas of our region. Employment increased slightly and wage growth continued to outpace price growth, putting downward pressure on margins for some companies. Price growth remained moderate.

Atlanta: Economic activity remained relatively stable. Labor markets have stabilized; wage growth has slowed. Growth in non-labor input costs has slowed, in net terms. Consumer demand remained stableBusiness and group travel improved. Home sales were flat to slightly down. Transportation activity was mixed. Loan demand remained stableEnergy activity was mixed. Agricultural conditions improved.

Chicago: Economic activity increased slightlyEmployment increased slightly, business and consumer spending increased slightly, nonbusiness contacts were little changed in activity, and manufacturing, construction, and housing activity declined slightly. Prices increased slightly, wages increased moderately, and financial conditions eased slightly. The outlook for farm incomes for 2024 declined slightly.

Saint Louis: Economic activity in the Eighth District continued to increase slightly Since our last report, inflationary pressures have increased slightly, with price growth slower than in previous reports. Consumer spending reports are mixedCrop conditions in the district remain stable with heavy rainfall mitigating excessive heat.

Minneapolis: The district’s economic activity has declined slightly. Employment has increased but demand for labor has decreased. Wage pressures remained moderate and prices increased slightly. Consumer spending remained stable, but some segments remained healthyManufacturing fell and the outlook is negative. Commercial and residential construction improved slightly and home sales were mixed. Agricultural conditions fell due to weakening farm incomes.

Kansas City: The economy of the tenth district has been growing at a moderate pace. Hiring activity slowed as many companies cut job openings, but employment levels remained stableContinued strength in labor markets supported modest wage growth. Consumer spending grew at a solid pace, driven by discretionary spending with particularly strong growth in travel-related consumptionPrices have increased at a modest pace, with cost pass-through remaining difficult.

Dallas: Economic activity increased slightly during the period under reviewdriven by growth in activity in the non-financial services, finance and energy sectors. Housing demand and retail sales have declined partly due to high prices and borrowing costswhile manufacturing output remained stable. Employment increased and wage growth moderated, although pressures eased. The outlook is generally less pessimistic.

San Francisco: Economic activity and employment levels remained stableWages and prices increased slightly, while retail sales decreased slightly. Activity was mixed in the services, manufacturing and commercial real estate sectors, but continued to slow in residential real estateThe situation in the agricultural sector has deteriorated somewhat. The situation in the financial sector has hardly changed.

Progression

- Modest to light or flat (2)

- Slightly flat or down (5)

- Stable to decline (3)

- Already in decline (2)

This looks like a real recession because it is a real recession. I think within two or three months, the majority of Americans will be in decline.

Recession, when?

I thought the recession started in May or June and I haven’t seen much to change my mind, but maybe I’m a few months ahead of schedule.

For discussion please see Weak Data Indicates Recession Has Already Begun, Now Let’s Discuss When It Will Happen