Taiwan Semiconductor Manufacturing (TSM), the world’s largest maker of AI chips, briefly hit a $1 trillion market cap last week, surpassing Tesla (TSLA) in terms of market cap. It’s worth noting that the stock has gained 20% since I pointed out in April that TSM’s impending growth was being overlooked. I remain bullish on TSM, given the multiple tailwinds of insatiable demand for AI, various growth catalysts, its monopoly position in advanced microprocessors, and its capacity expansion.

Several catalysts are driving growth at TSM

TSM remains the leading producer and supplier to AI stalwarts like Nvidia (NVDA), Advanced Micro Devices (AMD), Apple (AAPL), and Qualcomm (QCOM). It’s worth noting that TSM is also the primary manufacturer of NVDA’s latest line of advanced Blackwell chips.

The strong demand for manufacturing chips from these AI giants has recently driven TSM’s stock price higher. TSM will continue to benefit from the strong demand for AI as many industries continue to integrate AI into their business infrastructures.

In addition, the cyclical recovery in demand for personal computers and strong momentum in artificial intelligence chips are expected to drive sales growth. Smartphone sales increased globally in the first quarter, leading to an increase in orders for mobile chips.

As a result, sales of Apple’s iPhone mobile chips as well as high-end Android phones were higher than expected, with TSM securing significant orders from a number of its top customers, including AMD, Apple, Broadcom (AVGO), and others.

TSM has indicated that it will likely increase the price of the chips it supplies to Nvidia. Given ongoing supply and demand constraints, the price increase could be significant. Better pricing will boost TSM’s margins in the coming quarters.

NVDA management is open to TSM price increases and has not made any comments against them. Therefore, other AI players will likely accept the price increase in the coming months.

Given the strong demand, TSM will likely increase its capital expenditures to $37 billion, a 15% increase from the $32 billion planned for 2024. TSM will use the additional spending to expand its capacity and develop more advanced processes with higher computing power, such as 2-nanometer technology chips. Its 2nm technology is highly anticipated and is expected to lead the industry with its advanced capabilities.

With increased investment, TSM will secure its leadership in the AI chipmaking market. Competition is intensifying with rivals like Samsung Electronics (GB:SMSN) and Intel (INTC) vying for a larger share of the semiconductor foundry market. However, TSM’s scale and leading technology give it a clear advantage over the industry overall with a market share of over 60%, compared to a much lower market share for its nearest competitor, Samsung, at 11%, according to Statesman.

It is important to note that TSM is making geographic diversification its key strategy. The company is expanding into other international territories to reduce geopolitical risk. For example, TSM launched its first chip factory in Kumamoto, Japan to ease concerns from the US and China. The manufacturing plant is expected to start production by the end of 2024, while a second Japanese factory is also expected to begin construction towards the end of 2024.

Earlier this year, TSM received a further boost to its manufacturing operations. The company was approved for $11.6 billion in direct federal funding through the U.S. government’s CHIPS Act, as well as $6.6 billion in grants to expand its manufacturing facility in Phoenix, Arizona.

Considering the above factors, TSM is expected to benefit from strong demand for AI as the outlook for semiconductors remains bright.

Revenue and Profit Forecast for the Second Quarter

On July 6, TSM announced that its May sales increased 30% year-on-year in local currency, although they were down 2.7% year-on-year from April. For the June quarter, sales are expected to grow 32.9% year-on-year (down 9.5% year-on-year). Overall, first-half sales are expected to increase 28% year-on-year, beating analysts’ expectations.

On the EPS front, TSM is expected to report Q2 EPS of $1.50. It is worth noting that TSM has a strong track record of beating market expectations over the past 11 quarters.

Ahead of TSM’s second-quarter earnings release tomorrow, many Wall Street analysts have already raised their price targets on TSM. Additionally, TSM stock has received a very positive signal from hedge fund managers, who added 5.8 million shares in the past quarter.

TSM trades at an attractive valuation

In terms of valuation, TSM looks cheap. Currently, it trades at an attractive forward price-to-earnings ratio of 26.7x compared to the much higher multiples of its peer group. Semiconductor company Advanced Micro Devices trades at a higher forward price-to-earnings multiple (52x), while AI whiz Nvidia trades at a forward price-to-earnings ratio of 47x.

Wall Street analysts expect TSM’s EPS to reach $8.20 in fiscal 2025 (end of December). If TSM maintains the same forward P/E ratio by then, its stock price will be around $219, or about 28% higher than the current price. Therefore, it makes sense to consider buying TSM shares at current levels, given the strong growth potential in the AI sector.

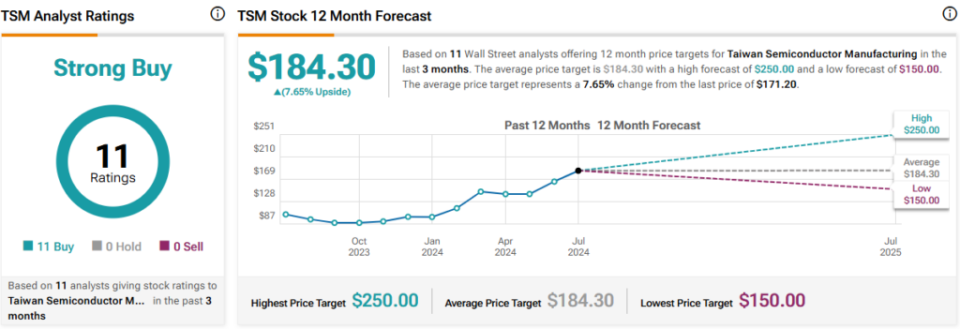

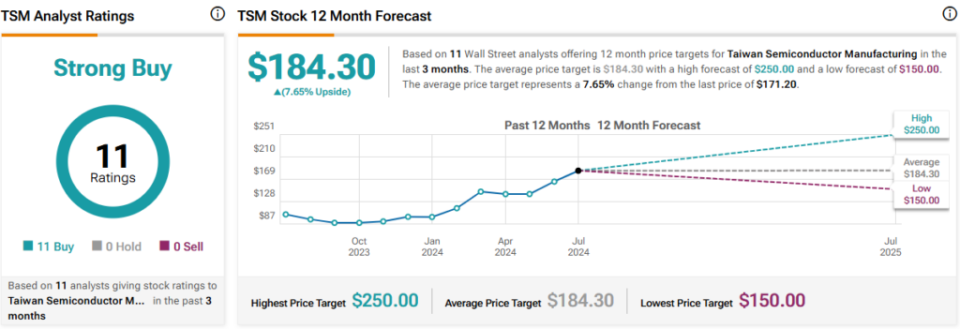

Is TSM a Buy, Sell or Hold, According to Analysts?

The Wall Street community is clearly bullish on Taiwan Semiconductor Manufacturing stock. Overall, the stock has a Strong Buy consensus rating based on 11 unanimous Buys. However, TSM’s average price target of $184.30 implies an upside potential of 7.65%.

Conclusion: Consider TSM for Long-Term AI Potential

The growing demand for all things AI has led to a significant demand for AI chips. TSM’s dominance in AI chip manufacturing remains unchallenged, making it a key contributor as well as a direct beneficiary of the AI boom.

With its large capacity expansion plans and geographic diversification, its highly anticipated 2nm technology and higher pricing, TSM is on a growth trajectory for the next few years. Therefore, I would buy the stock at current levels.

Disclosure