Adam Berry/Getty Images News

Google Investors Are Getting Fearful Again

Alphabet Inc. a.k.a Google (NASDAQ:GOOGL, NASDAQ: GOOG) investors have had a lot to digest recently as the stock has suffered a reckoning after peaking just below the $190 level early July 2024. As a result, GOOGL has declined more than 12% from this week’s lows, falling firmly into the correction zone.

In my previous bullish Google May 2024 article, I urged investors to stay invested. However, I downgraded the stock from Strong Buy to Buy to reflect its relatively less attractive valuation. However, I did not change my bullish thesis on the Mountain View-based company because I believe the market has not fully appreciated its potential growth prospects. My optimism was evident throughout the stock’s highs in July before the market shifted to small caps. As a result, the small caps represented in the iShares Russell 2000 ETF (RTY, IWM) outperformed their large-cap S&P 500 index (SP500, SPX, TO SPY) his peers over the past three weeks.

Did Microsoft Really Make Google Dance?

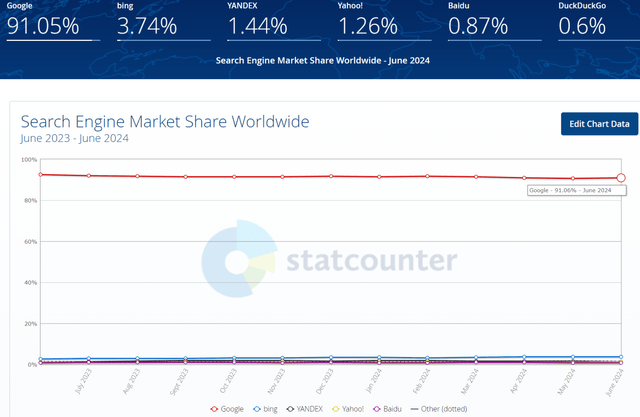

Search Engine Market Share % (statistics counter)

Despite the welcome rotation in the underlying market, I have not assessed any significant risks to the company’s sustainable competitive advantages in search. As we saw above, Google Search’s market share has remained incredibly stable and resilient over the past year, even as its closest competitors have improved their underlying generative AI models. Microsoft’s (MSFT) attempt to make “Google dance with the new Bing” has likely not worked out according to CEO Satya Nadella’s plans so far. As a result, Google CEO Sundar Pichai’s retort that his company prefers to “dance to its own tune” underscored the need to ignore unsubstantiated fears and hype. “Pichai cautioned against following external pressures or competitor actions, suggesting that doing so can lead to missteps.”

Deepwater Asset Management outlined its view on Google Search’s resilience in a July note. The firm cautioned investors against being overly concerned about the argument that traditional search could face imminent disruption from GenAI. Investors who feared for Google’s security and bought into the Microsoft Bing thesis likely underestimated the strength of traditional search. In Google’s case, Deepwater pointed to “the deeply ingrained habit of using search engines like Google, which serve approximately 4 billion people each day.” So unless Google has failed to effectively invest in AI and keep pace with the leaders, I think the threat of a near-term replacement is considered highly unlikely.

Google Q2: Solid profits but investors don’t like the increase in capital expenditures

Google’s Q2 earnings release highlighted its strong execution, posting revenue and EPS that were more than double expectations. Despite this, the market reacted negatively to higher-than-expected capital expenditures, which increased by over 90% year-over-year. As a result, I believe investors less convinced of the monetization potential of Google’s AI investments may have pulled back. Additionally, management stressed the importance of not “underinvesting,” assessing the threat of a potential fall relative to its leading hyperscaler peers.

Google’s AI summaries have made constructive progress among consumers aged 18-24, leading to “higher levels of engagement.” Additionally, the company highlighted Google Cloud’s $10 billion quarterly revenue, confirming its market share gains. With operating income of over $1 billion in the second quarter, I believe the cloud has made substantial progress to justify increased spending on AI. Additionally, cloud AI solutions “are used by over 2 million developers,” adding to management’s optimism.

Despite my positive comments, these investors likely reflected the increased risks of Google’s near-term investments in AI. While the company has made notable progress in AI (including its Gemini family of models), the monetization opportunities may be less clear in the near term. Management emphasized its optimism, believing that integrating AI into its search product should “provide meaningful benefits and open up new monetization opportunities.” It also sought to reinforce investor confidence that the company continues to “refine AI solutions.” As a result, the search leader is confident that “more tangible use cases will emerge, contributing to revenue growth and operational efficiencies.”

However, I viewed management’s optimism as a somewhat forward-looking commentary, but one that is not supported by solid clarity on the benefits resulting from its more aggressive AI spending. Additionally, management’s comments about its intention to “maintain or even increase quarterly capital expenditures throughout the year” may have spooked investors looking for more stability in AI investments. Additionally, management’s caution regarding potential margin issues in the third quarter likely corroborated investor concerns. While Google may continue to “reorganize” its cost base to improve operational efficiency, the market is justified in reflecting potential margin dilution headwinds.

OpenAI tests SearchGPT prototype, takes on Google Search

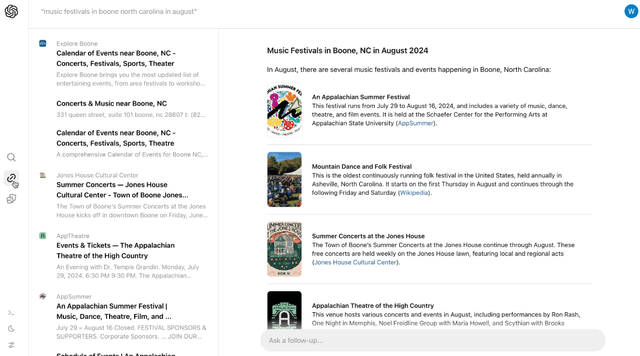

SearchGPT Interface (OpenAI blog)

OpenAI’s decision to launch the SearchGPT prototype is seen as another attempt to capitalize on Google Search’s highly successful and dominant market share. As a result, it has strengthened the case for partnering with major publishers in order to gain credibility and popularity with its new search product prototype. While the product is still in testing with a small group of testers, GOOGL investors have already reacted negatively to OpenAI’s new challenge.

I don’t want to underestimate OpenAI’s ability to potentially challenge Google’s dominance in search engines. As investors, we should always try to assess whether the competitor is credible. Given Microsoft’s backing and Apple’s (AAPL) decision to partner with the company led by Sam Altman, I believe OpenAI has substantial credibility, resources, and capabilities.

However, Google’s most advanced AI models have also made credible progress, even winning a silver medal at the International Mathematical Olympiad. Given the fundamental challenges that LLMs face in solving mathematical problems, Google’s progress is remarkable and warrants my confidence. Accordingly, I felt that management was aware of the existential threat that GenAI poses to its traditional search model. Therefore, Google must use its considerable resources (over $100 billion in cash and cash equivalents) to continue to invest proactively to keep pace with GenAI’s leaders.

GOOGL Stock: Not as Expensive as You Think

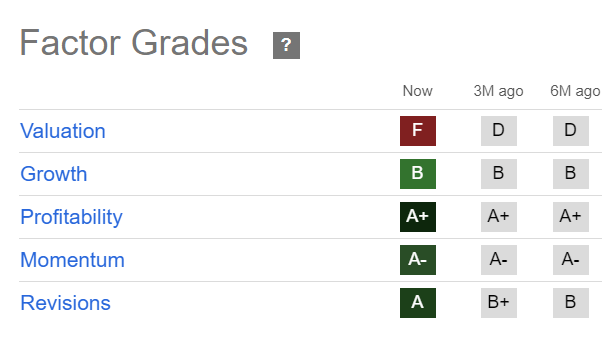

GOOGL Quantitative Notes (Looking for Alpha)

GOOGL is valued at a premium to its industry peers. However, investors should consider GOOGL’s ‘B’ Growth rating to better assess its growth-adjusted valuation metrics.

As a result, GOOGL’s forward PEG ratio of 1.25 is more than 10% lower than its industry peers, suggesting it is not as expensive as bearish investors claim.

Is GOOGL stock a buy, sell or hold?

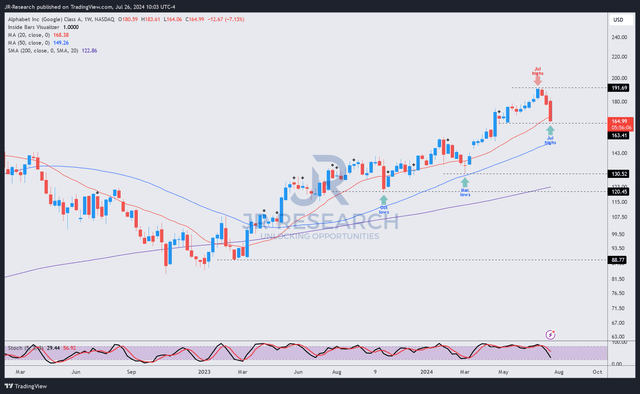

GOOGL Price Chart (Weekly, Mid-Term, Dividend-Adjusted) (TradingView)

The GOOGL stock price action supports my belief that the stock remains well supported by an uptrend. Despite this, the stock has fallen dramatically over the past three weeks, highlighting the panic that has engulfed it this week.

Despite this, GOOGL could bottom out at the $160 support level, although more cautious investors might want to wait for a validated bullish reversal first.

However, I am not overly concerned as the company’s market leadership has been tested since the launch of ChatGPT and has not been disrupted. Its fundamental strength in search has remained strong, bolstered by significant improvement in cloud revenue and profitability. Therefore, I believe the search leader’s ability to more robustly monetize its AI investments should not be underestimated. The company’s strong underlying fundamentals and healthy balance sheet reinforce its ability to keep pace with its major rivals, helping to solidify its market leadership.

Rating: Hold Buy.

Important Note: Investors are reminded to conduct their own due diligence and not rely on the information provided as financial advice. Consider this article as a supplement to your required research. Please always exercise your independence of mind. Please note that the rating is not intended to time any specific entry/exit at the time of writing unless otherwise stated.

Give me your news

Do you have constructive feedback to improve our thesis? Spotted a critical gap in our perspective? Saw something important that we didn’t see? Do you agree or disagree? Comment below in order to help everyone in the community learn better!