JHVEPhoto

Supermicro: down 45% in bear market

Super Micro Computer, Inc. (NASDAQ: SMCI) investors are heading into the highly anticipated earnings release of the AI server systems provider next month. Amid the current market rotation from AI stocks to small caps, AI infrastructure Stocks like SMCI have also been battered. In my previous update from May 2024, I highlighted The bullish opportunity of the SMCI. I discussed the company’s speed to market and the growing opportunities in AI server systems. Supermicro Releases Fourth Quarter Results will be closely monitored for signs of sustained growth momentum.

As a result, the stock has fallen more than 45% from its March 2024 highs to last week’s lows. As a result, there is no question that SMCI has plunged deep into a bear market, although bullish investors will likely argue that the profit-taking should not have surprised anyone. Does that make sense?

SMCI: still performing better than the market

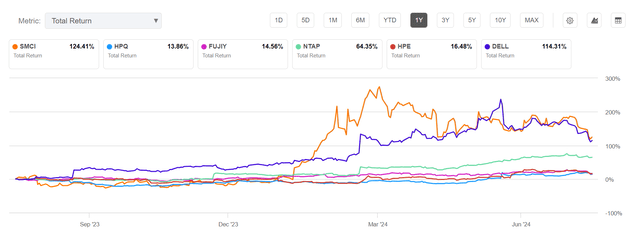

SMCI 1-year total return vs. peers % (Looking for Alpha)

Despite the setbacks, SMCI’s total return of over 120% over the past year proves that this is nothing more than a welcome pullback. Additionally, shares of SMCI and rival Dell (DELL) have traded much more closely in recent months as their valuation bifurcation has also narrowed. As a result, the market may have priced in higher execution risks in the second half and into fiscal 2025 as Dell ramps up its AI efforts to more aggressively compete with Supermicro’s leadership in AI systems.

Supermicro’s Rapid Go-to-Market Strategy

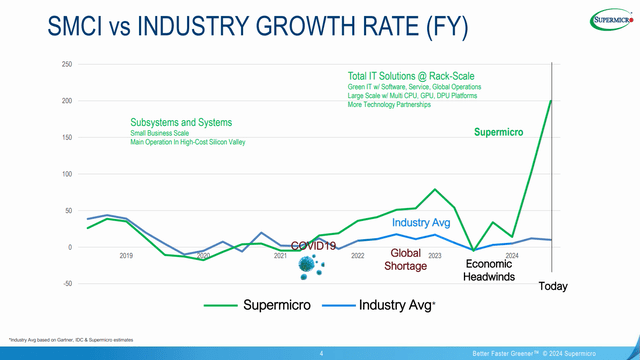

Supermicros Growth Compared to Industry Peers (Supermicro Files)

The company has been recognized for its ability to keep pace with AI chip leader Nvidia (NVDA)’s product launches. As a result, it has helped SMCI quickly gain market share and achieve widespread adoption. Supermicro “continues its first-to-market strategy by rapidly adopting and integrating the latest technologies.” Notably, its ability to integrate Nvidia’s latest and future Blackwell offerings should give SMCI an edge over its closest peers. The company’s ability to offer customizable, AI-optimized solutions to leading cloud service providers should reassure investors that it can capitalize on the AI gold rush.

Despite my optimism, there are legitimate concerns about Supermicro’s ability to maintain its breakout growth as Dell accelerates market adoption of its AI server systems. Dell is known for the power of its enterprise servers, which could give Nvidia a more robust penetration into the enterprise base to encourage them to adopt AI factories (massive AI clusters). Dell’s AI server backlog jumped to “$3.8 billion from $2.9 billion in the prior quarter,” underscoring its competitive and commercial acceptance. Additionally, I believe Nvidia is likely eager to diversify its reliance on SMCI as NVDA explores new growth opportunities in the enterprise base.

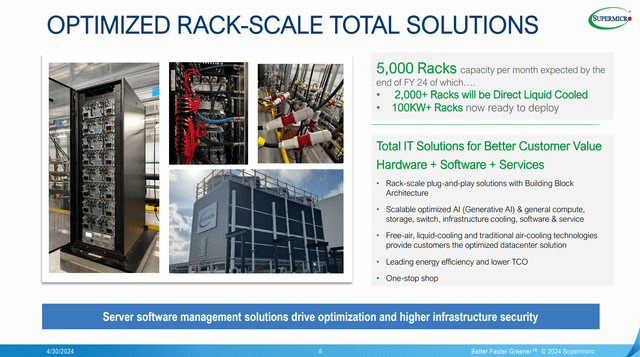

Additionally, SMCI’s transition to direct liquid cooling is also raising concerns as the company ramps up its DLC capacity. Supermicro’s Q3 earnings commentary noted that it was “readying over 1,000 liquid cooling racks” for the June quarter. Additionally, the company recently added “3 new manufacturing facilities” to enhance its transition to DLC servers. As a result, it aims to “more than double current capacity of 1,000 liquid-cooled AI superclusters shipped per month,” which could bring it closer to its fiscal 2024 outlook.

SMCI Well Positioned for Liquid-Cooled AI Servers

SMCI Rack Capacity Outlook (Supermicro Files)

These efforts demonstrate the company’s commitment to meeting its near-term rack capacity guidance. Supermicro’s fiscal 2024 outlook indicates a trajectory toward 2,000 DLC rack capacity per month. As a result, I think investors are likely evaluating whether the leading AI server systems vendor is on track to meet its guidance.

Wall Street analysts are split on SMCI, suggesting that the market could be uncertain as the company and its peers move to Blackwell architecture and DLC racks. While the concerns are justified, I believe the market’s confidence in Supermicro’s execution has not diminished.

Google’s (GOOGL) (GOOG) commitment to continue investing heavily in AI capital expenditures demonstrates the need for hyperscalers to invest heavily in AI. Additionally, Meta Platform’s (META) recent launch of its Llama 3.1 LLM underscores the AI arms race championed by technology and cloud leaders. As a result, I believe the secular growth momentum driving the AI gold rush is still in a multi-year cycle, benefiting Supermicro’s market leadership.

SMCI could face a slowdown in its growth

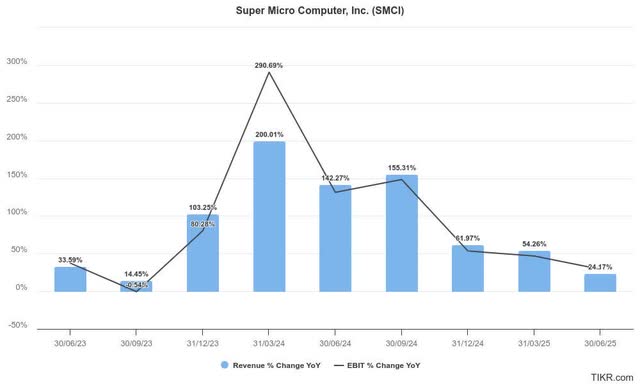

Supermicro Quarterly Estimates (REALLY)

According to Wall Street estimates, SMCI’s exceptional growth momentum is not expected to continue “indefinitely.” In addition, the company’s medium-term revenue outlook of more than $25 billion has not changed, corroborating the potential for a phase of growth normalization.

As noted above, the AI server leader is expected to see its revenue growth trend downward in FY25. This is also expected to impact its operating leverage gains, suggesting that margin expansion could peak in the next fiscal year.

Additionally, the market was likely disappointed that management did not deliver strong preliminary results, which added to buy sentiment. As a result, the market likely priced in higher execution risks into Supermicro’s future growth outlook, although the near 45% drop may also have been overstated.

SMCI stock: not expensive if we take into account growth

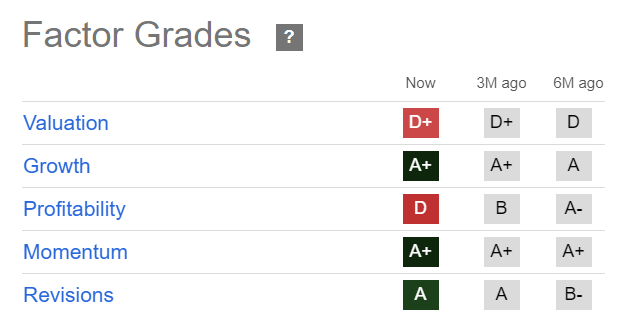

Quantum Qualities SMCI (Looking for Alpha)

Despite my reservations, SMCI still has an “A+” growth rating, which underscores Wall Street’s optimism about its tech peers. Care should be taken to assess SMCI’s valuation in the context of an appropriate growth-adjusted metric.

As a result, SMCI’s forward-adjusted PEG ratio of 0.6 is more than 65% below its tech sector median. As a result, bullish investors could argue that the recent blow is likely attributed to a broad-based devaluation of AI winners as the market turned.

In other words, the recent sharp pullback in the SMCI could also offer high-conviction investors another solid entry point if the resilience of buying is assessed at current levels.

Is SMCI stock a buy, sell or hold?

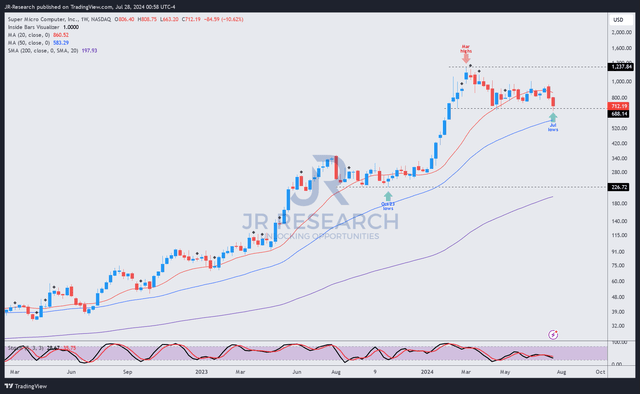

SMCI Price Chart (Weekly, Medium Term) (TradingView)

The SMCI’s price action has remained incredibly robust. Its bullish bias is supported by its “A+” momentum rating, highlighting remarkable dip buying support.

I believe SMCI has a potential opportunity to bottom above the $670 level, which it retested last week. The stock has been in a consolidation zone since late February 2024, suggesting an extended accumulation phase. Notably, the stock also faced a consolidation zone between August and October 2023 before the rocket exploded over the next six months.

While I don’t expect such massive gains in the near term, I didn’t feel it necessary to be overly cautious about Supermicro’s bullish thesis. AI’s multi-year growth cycle supports the company’s strong fundamentals as AI adoption broadens and deepens.

The transition to DLC servers could introduce some near-term uncertainty. However, the company’s strong execution history should provide confidence to long-term investors willing to tolerate short-term volatility as an opportunity to add exposure to significant drawdowns.

Rating: Hold Buy.

Important Note: Investors are reminded to conduct their own due diligence and not rely on the information provided as financial advice. Consider this article as a supplement to your required research. Please always exercise your independence of mind. Please note that the rating is not intended to time any specific entry/exit at the time of writing unless otherwise stated.

Give me your news

Do you have constructive feedback to improve our thesis? Spotted a critical gap in our perspective? Saw something important that we didn’t see? Do you agree or disagree? Comment below in order to help everyone in the community learn better!