Georges Clerc

Amazon is expected to report its June quarter results on August 1, after the market closes. Ahead of the upcoming report, I believe the company’s core retail business is well positioned for continued growth: the company’s strategic focus on improving delivery Amazon today said its sales in North America, Europe, and Asia will increase by $1.5 billion compared to its largest market, the United States. As for Amazon’s cloud business, I believe AWS maintained its strong growth trajectory from the March quarter into the second quarter, fueled by new product releases and positive market sentiment toward cloud computing. I expect AWS to report $26 billion in revenue in the second quarter. As a result, my projections are for total group revenue of $151 billion, compared to the consensus of $149 billion.

To put things in context, since the beginning of the year, Amazon shares have significantly outperformed the broader market: Since the beginning of the year, AMZN shares are up about 21%, compared to a gain of about 15% for the S&P 500.

Looking for Alpha

Since my last article, Amazon shares are up about 2%, while the S&P 500 is up about 9%. In my last article on Amazon, I discussed Amazon’s outlook for Q1 performance and concluded with a “Buy” rating. Today, I revisit my thesis on Amazon stock in light of the company’s upcoming earnings report.

AWS business is running at full speed

Amazon’s web services business likely continued to show strong sales momentum in the second quarter, building on trends seen in the first quarter, with a growth trajectory supported by a string of product launches and favorable market sentiment toward the cloud. AWS has generated multi-billion-dollar revenue in AI/ML, with the AI segment alone expected to generate “tens of billions” in sales in the coming years, according to recent reports. AWS’s AI platform, Bedrock, has emerged as one of the fastest-growing services, underscoring the platform’s critical role in the company’s strategy. Additionally, AWS’s market share dominance in cloud computing provides a significant advantage as enterprises increasingly leverage AI for their data hosted in AWS. This has led to material growth in AI/ML workloads, with many AWS customers eager to leverage the models available through AWS Bedrock for their ease of use, cost-effectiveness, and security benefits.

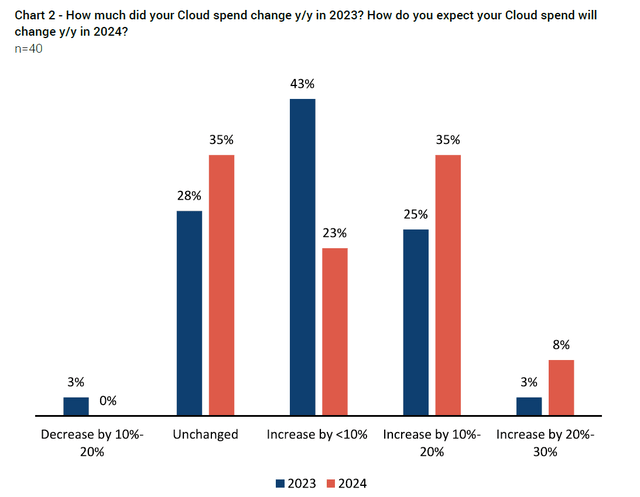

According to a Jefferies survey of 40 CIOs, cloud spending intentions are accelerating, with 43% of respondents saying they expect to see a more than 10% increase in 2024, compared to 28% who anticipate a similar increase in 2023. Additionally, the survey results suggest a significant and continued shift of workloads to the cloud, with 58% of CIOs expecting more than 50% of their workloads to be in the cloud by the end of 2025, up from 36% today. (Source: Jefferies Cloud Survey Research Note, dated July 8)It goes without saying that as the world’s largest cloud company, Amazon is expected to be a major beneficiary of favorable cloud spending trends.

Jefferies

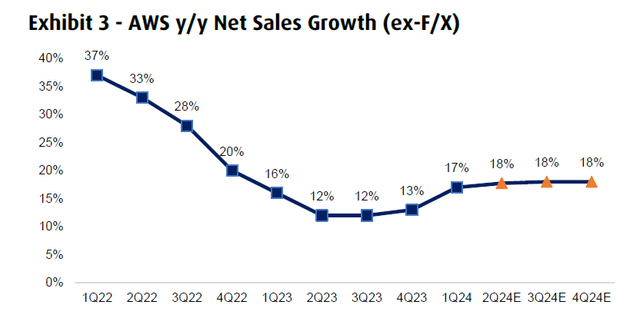

Financially, AWS’s importance is now tied to a growth and value argument: For Q2 2024, AWS is expected to report revenue of about $26 billion, with revenue growth accelerating to 18% year-over-year (BMO estimates; source BMO, AMZN research note dated July 10). On the profitability side, AWS’s operating income is expected to reach $9.5 billion, implying a staggering growth of about 77% year-over-year

BMO

Strong consumption supports retail growth

On the retail front, I see Amazon continuing to grow its market share in both B2C and B2B segments as it capitalizes on emerging e-commerce verticals and expands its presence in international markets, especially emerging markets. As a reminder, in 2023, Amazon delivered approximately 7 billion units on same-day and next-day orders, which is expected to grow by double digits to approximately 8 billion in 2024. In my view, this should be a testament to Amazon’s efficiency and USP in retail, as delivery speeds drive increased consideration and purchase frequency among consumers.

In the second quarter, I expect Amazon’s North American segment to generate approximately $91 billion to $93 billion in sales, representing double-digit growth over the same period a year ago. My forecast is based on healthy U.S. consumer sentiment and healthy Prime membership trends. According to TD Cowen, there were approximately 84 million U.S. households with Prime memberships in the second quarter of 2024, up from 78 million in the same period a year ago. This increase in Prime membership is correlated with strong visitation and purchase trends, with 94% of Prime members visiting Amazon monthly and 86% making monthly purchases (Source: TD Cowen, Amazon research note dated July 10). Additionally, consumer health is also evidenced by Amazon Prime’s record-breaking day in July, with consumers spending an estimated $14.2 billion during the two-day event, according to data from Adobe Analytics. I expect the company’s international segment to generate revenue in the $33 billion to $34 billion range.

Valuation Update: Price Target at $201

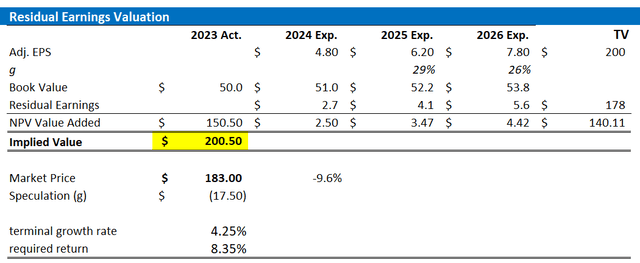

Consistent with my projections of strong revenue and earnings momentum for Amazon, I have updated my residual earnings model for the e-commerce and cloud giant’s stock. For fiscal 2024, 2025, and 2026, I now forecast EPS of approximately $4.8, $6.2, and $7.8, respectively. These EPS estimates are approximately 10% to 15% above consensus, primarily due to underestimates of Amazon’s advertising and cloud momentum. Additionally, I am maintaining a terminal growth rate of 3.5% beyond 2026 and have adjusted my cost of equity assumption downward by 50 basis points to 8.5%, aligning it with the broader Magnificent Seven group. With these updated EPS projections, I calculate a fair implied share price for Amazon at $201.

To put this in context, the “Speculation” value is just the difference from the implied fair value. A positive value implies a premium; or in other words, the markets are speculating to price in a more fundamental upside to my estimates. Additionally, I would point out that my new valuation model projects EPS for Amazon only through 2026, versus a long-term projection through 2028 previously. I view the new calculation methodology as less risky, as the projection horizon has been reduced by 2 years. At the same time, however, this adjustment has caused my target price to drop by about $4.

Refinitiv; Company Financials; Cavenagh Research EPS Estimates and Calculations

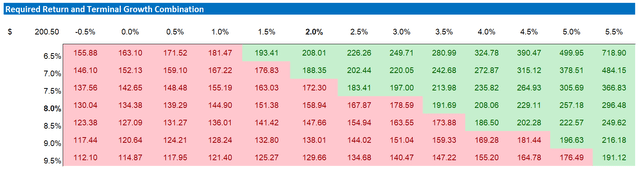

Also below you will find the updated sensitivity table.

Refinitiv; Company Financials; Cavenagh Research EPS Estimates and Calculations

The risks for my thesis

In my view, the main risk to this thesis is increased competition in the e-commerce and cloud markets, which could weigh on Amazon’s market share and profitability, particularly if competitors improve their delivery capabilities and cloud offerings. Another risk is the possibility of macroeconomic slowdowns or changes in consumer behavior, which could negatively impact Amazon’s sales forecast, particularly in the North American and international markets, resulting in a revenue shortfall compared to the $151 billion forecast.

What investors think

Overall, Amazon’s core retail business is well positioned for continued growth: the company’s strategic focus on improving delivery speeds, expanding Prime membership, and leveraging its advertising platform are driving solid share gains, while the overall market environment is healthy (particularly in the company’s largest market, the U.S.). Personally, I expect revenue of $91 billion to $93 billion for the North America segment and $33 billion to $34 billion for the International markets segment. As for Amazon’s cloud business, I maintain that AWS continued its strong growth trajectory from the March quarter into the second quarter, driven by product releases and positive market sentiment toward cloud computing. I expect AWS to report revenue of $26 billion in the second quarter. As a result, my projections call for group revenue of $151 billion, while consensus expects $149 billion. In conclusion, I set my price target for Amazon ahead of the Q2 results, and I view the stock as undervalued below $200. “Buy.”