Nvidia shares have fallen 20% from their all-time intraday high. How far could Wall Street’s artificial intelligence (AI) darling fall before it finds its footing?

While the stock split euphoria has settled into 2024, there is no bigger trend on Wall Street than the rise of artificial intelligence (AI).

AI is defined as the use of software and systems in place of humans for specific tasks. What gives this technology such vast potential, spanning virtually every sector and industry in the global economy, is the ability of AI-driven software and systems to learn without human intervention. By becoming more proficient at existing tasks over time, or even acquiring new skills, AI has the potential to add an estimated $15.7 trillion to the global economy by 2030, according to analysts at PwC.

No company has benefited more directly from this revolutionary innovation than the semiconductor colossus Nvidia (NVDA 0.69%).

Image source: Getty Images.

Nvidia has evolved at a truly phenomenal pace.

Since the start of 2023, Nvidia’s stock has gained more than $2.4 trillion in market value, or 668%, as of the close on July 25, 2024. Nvidia also completed a 10-for-1 stock split in June to make its shares more affordable for ordinary investors.

This historic increase in Nvidia’s valuation is linked to the fact that its graphics processing units (GPUs) are the preferred choice for companies operating AI-driven data centers. While estimates vary, analysts at TechInsights estimate that Nvidia is responsible for nearly all but 90,000 of the 3.85 million GPUs shipped for use in data centers last year.

To dig deeper, Wall Street’s AI darling is falling far short of corporate demand for its chips. When demand for a good or service far outstrips supply, it’s only natural that the price of that good or service will rise. Nvidia’s phenomenal pricing power helped boost its adjusted gross margin by nearly 14 percentage points over the five quarters ended April 28.

Nvidia’s next-generation data center hardware is also generating a lot of excitement. The company’s Blackwell platform, which accelerates computing in a half-dozen key areas, including generative AI solutions, is expected to roll out to customers later this year. By 2026, the Rubin GPU architecture, which is expected to run on an entirely new processor (“Vera”), is expected to hit the market. In other words, Nvidia’s product lineup suggests that the company can maintain its competitive advantage, at least in terms of compute capabilities.

Despite this historic expansion for Nvidia, the company’s stock has recently taken a nosedive.

Image source: Getty Images.

Nvidia Is In Correction Zone: Here’s How Far History Suggests It Could Fall

As of the close of trading on July 25, Nvidia stock was trading at $112.28 per share. While this is, as noted, a 668% gain since January 1, 2023, the stock is down 20.2% from its all-time intraday high of $140.76 set on June 20. In other words, Nvidia stock is in the midst of a correction.

While there is no predictive tool or metric that can predict with 100% accuracy where Nvidia’s stock will bottom out, 25 years of history offer clear clues as to what might await this AI leader in the months and quarters ahead.

Over the past quarter century, we have seen the rise and fall of many fad technologies and trends. While some of these innovations and trends have made investors significantly richer in the long run, one of the main constants of major innovations is that the investment community overestimated their adoption and usefulness from the outset.

While it’s easy to get carried away by grandiose numbers about addressable markets (for example, AI will add $15.7 trillion to the global economy by 2030), it’s important to recognize that all new technologies and trends need time to mature. While there’s no way to know in advance how long it will take for an innovation to mature, the simple fact that most companies don’t have a clear roadmap for their AI investments suggests we’re seeing the next stage in a long series of bubbles.

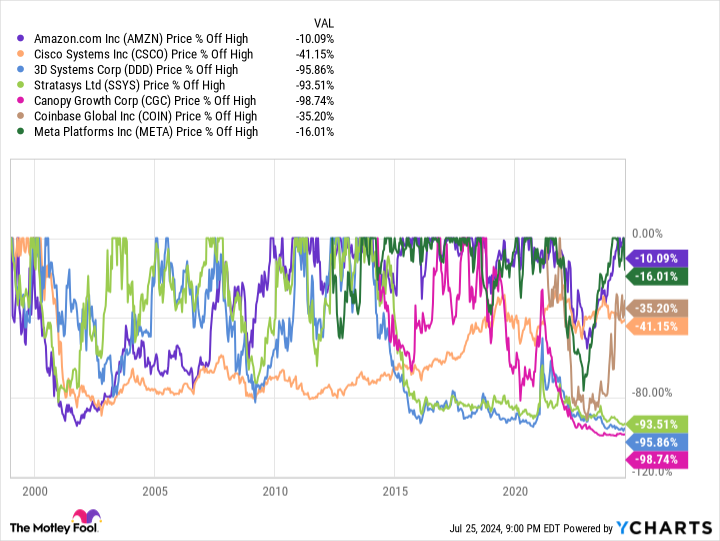

AMZN data by YCharts.

Specifically, 25 years of major innovations have shown that market leaders within these trends tend to be hit the hardest:

- When the Internet bubble burst, the leading player in e-commerce Amazon and networking giant Cisco Systems each lost about 90% of its value on a peak-to-trough basis.

- While genome-decoding stocks like Celera and Human Genome Sciences no longer exist—both were acquired years ago—these two companies followed in the footsteps of Amazon and Cisco and lost most of their value after the euphoria surrounding genome decoding faded.

- While e-commerce and networking have been profitable long-term investments, the excitement around 3D printing has evaporated. After their peak, both 3D Systems And Stratasys have lost more than 90% of their respective value.

- Although cannabis is not a new technology, its legalization in Canada was seen as a money-making opportunity for an entire generation. Unfortunately, the Canadian licensed producer Canopy growth ultimately fell 99% from its peak valuation.

- Cryptocurrency Exchange Coinbase Global served as the stock market face of the crypto revolution. When the buzz around crypto and blockchain technology died down, the company’s shares fell nearly 90%.

- Meta-platforms spearheaded the rise of the metaverse, a 3D virtual environment in which people can interact with each other and create an entirely new ecosystem. However, because the technology needed time to mature, Meta’s stock price eventually fell about 80% before rebounding to new highs.

From what we’ve observed in cutting-edge innovations and trends over the past 25 years, market leaders tend to lose 80% or more of their peak market value once the bubble bursts.

The good news for Nvidia is that it had several well-established sales channels before AI became its primary growth driver. These channels include its GPUs used for gaming and crypto mining, as well as its professional visualization and automotive/robotics solutions. If the AI bubble were to burst, like every other major trend of the last 30 years, Nvidia would likely find more downside support than many of the market leaders that came before it.

Still, there is precedent for market-leading stocks to crash when it becomes apparent that a hot technology needs time to mature. At a minimum, history shows that Nvidia loses at least half its value on a peak-to-trough basis. That would take its stock price down to $70 and imply significant inconvenience.

But while Nvidia is no exception, history suggests it could fall below a $1 trillion market cap in the years ahead.

Randi Zuckerberg, former head of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams holds positions at Amazon and Meta Platforms. The Motley Fool holds positions at and recommends Amazon, Cisco Systems, Coinbase Global, Meta Platforms, and Nvidia. The Motley Fool recommends 3d Systems. The Motley Fool has a disclosure policy.