RapidEye/iStock via Getty Images

What if the AI craze in the stock market is coming to an end? What if the big winner of this boom has peaked and is ready to come crashing back down to earth? These are the questions Wall Street titans are asking Small investors ask themselves this question every day.

With NVIDIA (NASDAQ: NVDA) having reached an unprecedented market capitalization of more than $3.3 trillion in June, in the highly competitive and extremely cyclical semiconductor sector, the notion of “risk” should not escape investors. I remain convinced that one day Nvidia will fall from grace and come back to earth. The valuation of the stock will act as the lesson of the Greek tragedy Icaruswhere flying too high towards the sun has consequences.

Regardless, I’ve written about the valuation and psychology of Nvidia’s boom several times since last summer, and the stock price continues to steadily rising, with nothing but air now supporting the stocks (in effect, the hope of instant AI riches). My last mention was an article in June here On Nvidia’s short proposal for IRAs and 401-Ks, few investors are aware. ETF Graniteshares 2x Short NVDA Daily (MVN) is a simple way to protect yourself against a possible decline in the event of an AI collapse.

Well, the doomsday I warned was coming may be nigh. After a year and a half of astonishing and consistent technical strength, with indications of ultra-bullish momentum generally confirming the trend, the most serious cracks in the bull cycle since late 2022 have started to appear.

And if prices and buying momentum do not pick up next week, a very significant correction or even a crash could be the reality of late 2024. Why am I saying such things?

Technical chart down?

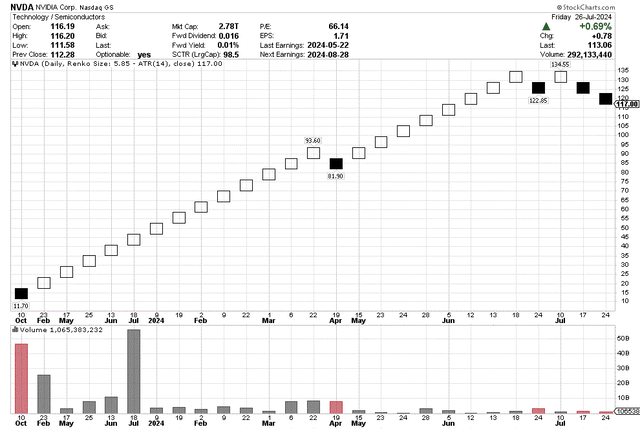

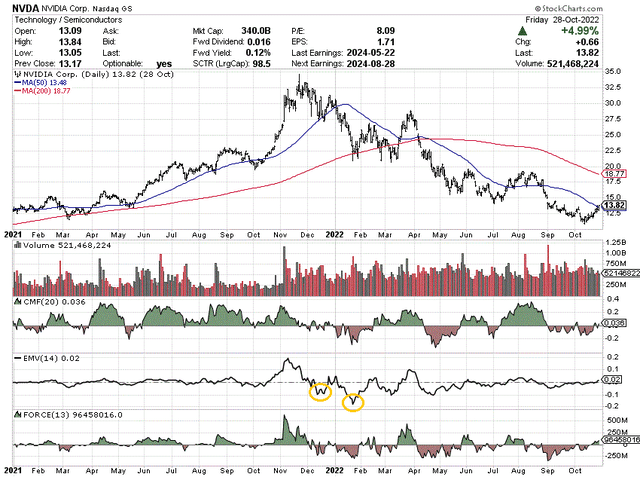

I want to review and explain three charts of Nvidia’s current trading action. The first is a standard Renko creation. Renko charts track the volume required to move the price by a set amount, with time values being less meaningful. The only downside is that this chart may look different a few months before or after a big move (up or down), because the sizes of the boxes depend on the prices depicted over the entire period being charted.

But from today’s perspective, we can see that the selloff since late June (black boxes) has been the most consequential in terms of raw price change since the massive rally began in October 2022. The open question is: will this selloff continue?

StockCharts.com – NVIDIA, Basic Renko Chart, October 2022

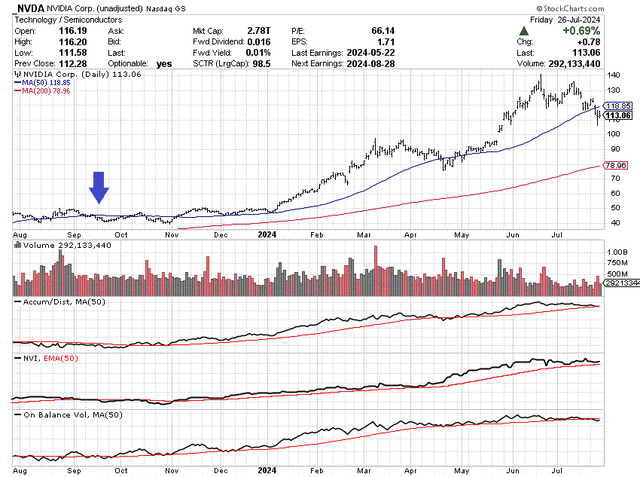

Further evidence of problems exists in the popular momentum indicators and calculations that I like to follow. I would say that the exceptional momentum trend, using a combination of strength in the Accumulation/distribution line, Negative volume indexAnd Equilibrium volume, over the eight months between October and June, was one of the strongest performances by a leading mega-cap company since Apple (AAPL) or You’re here (TSLA) in late 2020 and early 2021.

Still, the ADL, NVI, and OBV indicators have been up and down since their peak in mid-June. For reference, the last time these three indicators traded below their 50-day moving average was in September 2024, marked by a blue arrow below (on a 12-month chart of daily price and volume changes). Such a reversal could become a reality this week or next.

StockCharts.com – NVIDIA, 12 months of daily price and volume changes, author’s reference point

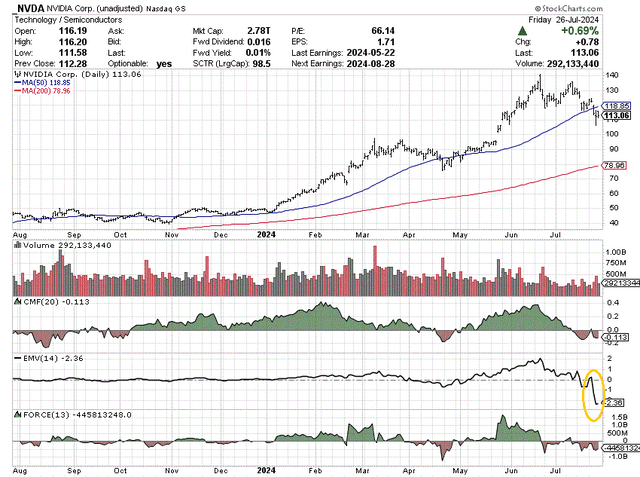

Perhaps most concerning for Nvidia bulls is the imbalance of selling in July, alongside a rare absence of buyers, highlighted by the materially negative 20-day chart. Chaikin Money Flow14 days Ease of movementand 13 days Strength Index Numbers.

The last time all three of these indicators were negative was right at the April low, just before the latest earnings release and the 10:1 stock split announcement. My point is that if you are bullish and long Nvidia, you should hope for another round of good news to reverse the price trend.

However, the shocking flashing red indicator of the day is the Ease of Movement calculation (circled in gold below). Basically, the price is down -20% over two weeks on exceptionally low volume, the lowest trading volume since October 2021 (a few days before Nvidia’s previous major price spike). Where have all the buyers gone? Stock market crashes either involve horrible operating news or a situation where buyers go on strike. The plummeting EMV reading indicates that buying interest has been completely exhausted and the stock’s peak price may have been reached in June. Now, is Icarus going to crash to the ground?

StockCharts.com – NVIDIA, 12 months of daily price and volume changes, author’s reference point

Don’t believe me? Nvidia’s latest growth spike in late 2021 witnessed the same EMV indicator breakout to all-time lows (at that time). On the chart below, you can easily see the EMV pattern parallels with July 2024 in the December 2021 and January 2022 bearish selloffs (circled in gold). To sum up, a buyer vacuum right after an unusual stock price spike is very problematic for the coming price months.

StockCharts.com – NVIDIA, Daily Price and Volume Changes, July 2021-October 2022, Author’s Reference Points

The current AI investment psychology of not missing out on an investment is not new. Three years ago, the over-enthusiasm over the shortage of high-end gaming chips during the pandemic, coupled with the increased demand from the rise in cryptocurrency mining usage, was the “unique” Nvidia product story to own.

But that decision ultimately backfired as the usual forces of semiconductor supply and demand rebalanced, reducing companies’ revenue levels for several quarters (due to reduced demand, inventory adjustments, and lower chip prices). Nvidia’s stock went on to fall from $34 to $11 (split-adjusted), generating a -70% loss for those unfortunate enough to buy near the November 2021 peak. Is history about to repeat itself?

Final Thoughts

The sharp drop in ease of movement over the past week for Nvidia is similar to declines in this indicator for Advanced microsystems (AMD) and Meta-platforms (META) since the spring, which I highlighted in articles here-AMD and here-META. It is in some ways the godfather model of the “kiss of death” in other leading ranking models discovered in my research over the years.

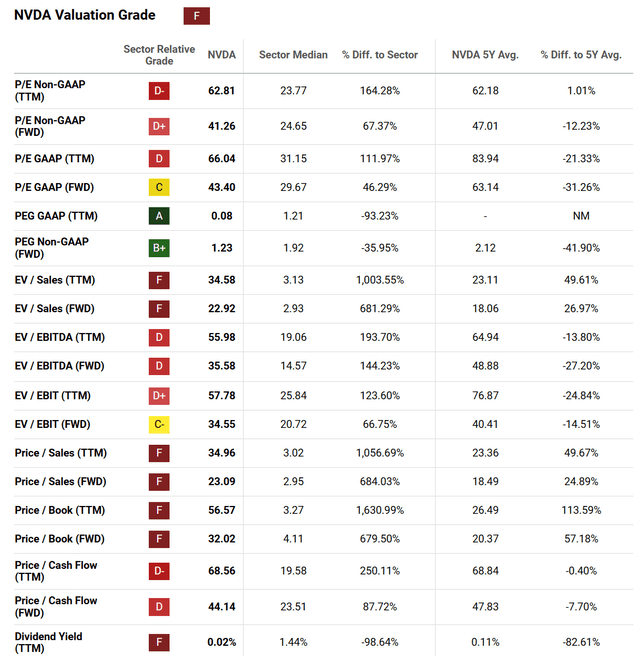

The valuation setup behind each stock is an “F” grade from Seeking Alpha’s Quant Sorter tool, comparing various fundamental analysis metrics to Nvidia’s 5-year trading history and current readings from peers and competitors.

Seeking Alpha Table – NVIDIA, Quant Valuation Grade, July 26, 2024

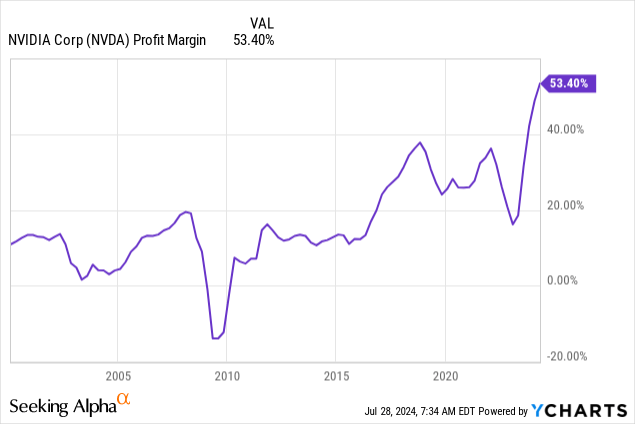

Furthermore, if earnings and profit margins peak in 2024, an adjusted score in 12 months looking back today could be an “F-”! With competition for AI chip inventions multiplying every week in every corner of the semiconductor world, Nvidia could certainly see nice sales growth in the years ahead, but also a collapse in profitability levels.

YCharts – NVIDIA, Final Profit Margin After Tax, Since 2000

This is how competition and the profit incentive work in capitalism. Two years ago, I warned Tesla investors that competition would eventually drive down its stock price, based on predictable economic forces. Nvidia will face the same problems over time.

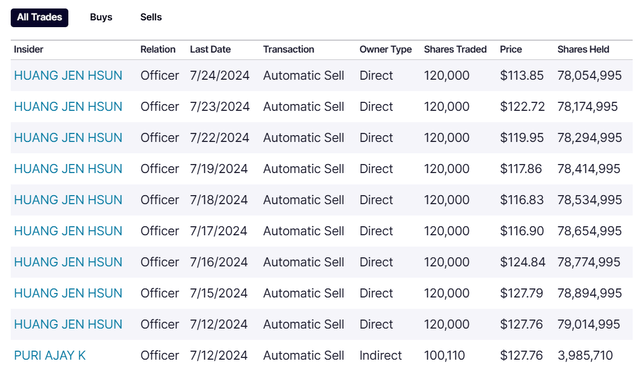

Another negative point is the CEO Jensen Huang decided to step back and sell shares almost daily in July. Of course, the number of shares sold compared to what he owns is relatively small. Still, he seems quite happy to cash in on shares that are priced above $110.

Nasdaq.com – NVIDIA, Insider Trading Activity, Mid-July 2024

My conclusion is that Nvidia bulls desperately need outsized buying volumes to manifest in the coming trading days, or the rout could accelerate. Large corrections and crashes involve emotional trading, where many long-term investors give up at the same time. We could eventually experience this phenomenon at Nvidia. The only real question is when, in my opinion. Remember, all booms turn into crashes – you can’t escape it.

Thank you for reading. Please consider this article as a first step in your due diligence process. It is recommended that you consult with a licensed and experienced investment advisor before making any transaction.