This article is an on-site version of our Unhedged newsletter. Premium subscribers can sign up here to receive the newsletter every weekday. Standard subscribers can upgrade to Premium here, or explore all of the FT’s newsletters

Hello. Donald Trump has pledged to end the “persecution” of the crypto-finance industry, saying its rules should be “written by people who love[the]industry.” And thus ending Unhedged’s dreams of working at Trump’s SEC. Email us with comforting thoughts: robert.armstrong@ft.com and aiden.reiter@ft.com.

Inflation is down, the economy is strong, and the Fed doesn’t need to rush

Wednesday’s FOMC meeting is shaping up to be pretty boring. No one thinks there will be a rate cut, and everyone thinks the Fed will open the door to a rate cut in September.

If the next figures for consumer price inflation and personal spending come in below the Fed’s 2% target, we could well see a rate cut in September. But that’s not a certainty, and it shouldn’t be. The risks that the Fed will hold its rate a bit longer are modest, because growth looks solid and stable given the current level of rates.

Many observers, on Wall Street and elsewhere, are worried about the economy and fear that the Fed is making mistakes. Unhedged thinks they should calm down a bit.

Let’s review the numbers.

Inflation

U.S. inflation is close to the Fed’s target. June’s core CPI, Unhedged’s preferred measure, was particularly weak, rising 1% month-over-month and averaging just under 2% over the three months. The Fed’s preferred measure of inflation, the personal consumption expenditures price index, is almost as good, but not quite. It beat expectations slightly, rising 2.6% annually, the same as May. But the trend is similar. We don’t need things to get better, we just need the trend to continue.

Job

Those who think rate cuts should start now are mostly worried about rising unemployment.

The overall unemployment rate hit a two-year high of 4.1%. While small by historical standards, the increase was large enough to nearly trigger the Sahm Rule, a recession indicator that suggests a recession typically begins when the three-month moving average of unemployment is 0.5 percentage points higher than its lowest level in the previous 12 months. That measure hit 0.43 percentage points in June.

But Claudia Sahm, the rule’s inventor, doubts that its current value indicates an imminent recession. She told Unhedged:

We are not necessarily on the brink of a recession, but the chances of a recession in six months are higher… Complicating this is that we have a growing labor pool, some of it immigrant, which makes the labor market harder to gauge. And some migrants may take longer to find work, so we can expect the unemployment rate to return to normal (once they do). Immigration has increased at a pace and scale that is noticeably disruptive, making the employment numbers harder to read.

This cycle is strange. It is important to keep in mind that the unemployment rate, which is around 4%, is very low. It is hard to imagine that an economic disaster could occur when so many people have jobs.

Survey Data

Recent GDP numbers and early data from the Atlanta Fed’s GDPNow report suggest that overall growth is solid, and likely above trend. Still, the more nervous are concerned about the weakness in survey data.

The June ISM surveys of manufacturing and services both showed a decline in economic activity, including a surprising 12% drop in the services sub-index of economic activity, into contractionary territory. Manufacturing activity has contracted for three consecutive months, and at an accelerating pace. The employment components of both surveys are contracting.

But the Fed has been particularly focused on non-housing services inflation, and it will not relax its vigilance because of a single monthly ISM figure. The services component has been expanding for 16 of the last 18 months. The price subindexes are still expanding, both for manufacturing and services.

Is the consumer slowing down?

“US consumers show signs of running out of steam,” ran the headline in a Financial Times article published over the weekend. The article cited a range of factors, including weakening consumer sentiment surveys, a bleak outlook for consumer goods companies including Whirlpool, Lamb Weston and UPS, and reports of discounting by retail chains.

These arguments are all true and important. But these downturns look more like a normalization after periods of post-pandemic “revenge spending” than signs of widespread household austerity. And the weaknesses are associated with sectors that appear very robust.

The latest results from the University of Michigan’s consumer sentiment survey are admittedly weak. But those results have been hard to interpret since the pandemic. Over the past two years, there has been an upward trend, but it has been marked by increasing volatility, with higher highs and lower lows. The latest results don’t seem to break that trend.

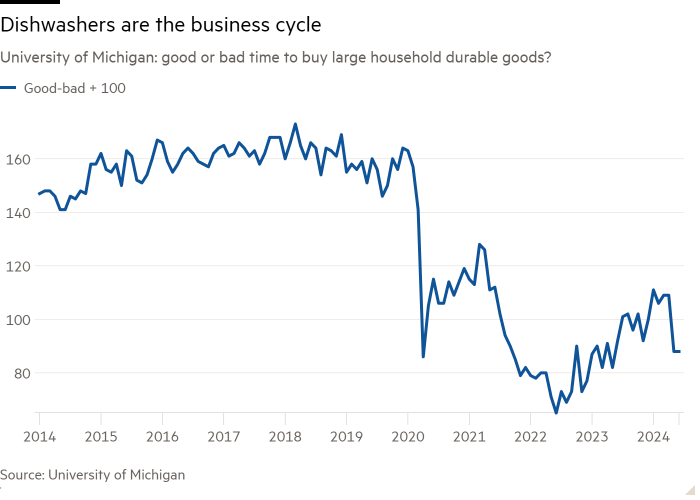

A key Michigan subsurvey asks consumers whether now is a good time to make a major household purchase, such as an appliance. Here, the trend is clearly downward. An early indicator of weakness ahead?

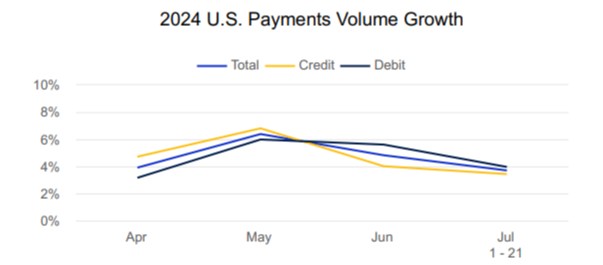

But the weakening sentiment is not reflected in the spending numbers. Real personal consumption expenditure growth continues to hover around 2.5% per year. Private data confirms that while spending has slowed slightly, it is still growing well. Here are Visa’s charts of spending in its U.S. networks:

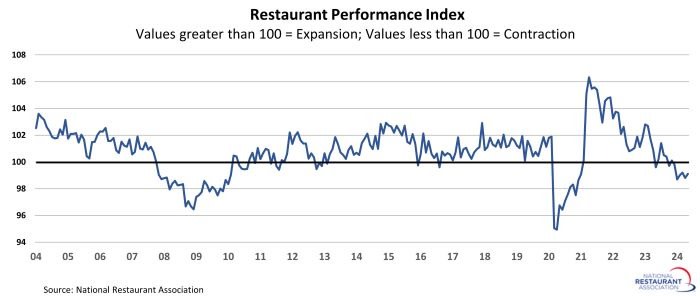

Last week, in our discussion of Lamb Weston, we noted a slowdown in restaurant traffic and evidence of competitive discounting among fast-food chains. This is reflected in the National Restaurant Association’s performance index, which has entered contraction:

This is striking, but it may be less a sign of macroeconomic weakness than a natural response to the extraordinary restaurant boom of 2022 and 2023. It’s hard to envision a general consumer pullback when airline passenger volumes look like this:

Although a few companies have released some disappointing reports in recent weeks, second-quarter earnings were generally quite strong: S&P 500 companies reported overall revenue growth of 5% and profit growth of nearly 10%, according to FactSet.

UPS’s weak quarter is generally a bad sign, since the company’s health is generally tied to the broader economy. But the company’s problems are more about costs than demand. The trend in U.S. parcel volumes has been improving for about a year, and parcel volumes increased in the second quarter for the first time in nine quarters.

While some companies, such as Lamb Weston, are facing significant pricing pressure, that’s not the case everywhere. Coca-Cola’s U.S. business grew 10% in the quarter, almost entirely driven by pricing. While some real estate-related companies, such as Whirlpool, are struggling, not all are. Paint retailer Sherwin-Williams had a strong quarter, with both volumes and prices up. Consumer packaged goods companies such as Colgate and Unilever reported strong results; Colgate cut some prices, but volumes were up sharply.

Financial conditions

In choosing its communications and monetary policy strategy, the Fed must consider the impact of financial conditions on growth. And while rising interest rates are clearly weighing on some sectors—primarily real estate and construction—financial conditions remain broadly accommodative. Stocks are within a few percentage points of their all-time highs. Credit spreads are tight. Implied volatility is low. The economy as a whole does not appear to be financially constrained.

In short

The Fed does not appear in danger of making the classic mistake of keeping rates too high for too long. The economy remains remarkably strong, with more strengths than weaknesses. Unemployment is low and businesses are thriving. The Fed can afford to wait a little longer—perhaps even longer than it did in September—to be sure that inflation is defeated.

(Armstrong and Reiter)

A good read

An Olympic Zen Master

FT Unhedged Podcast

Can’t get enough of Unhedged? Listen to our new podcast, for a 15-minute deep dive into the latest market news and financial headlines, twice a week. Catch up on previous editions of the newsletter here.

Recommended newsletters for you

Notes on the marshes — An expert perspective on the intersection of money and power in American politics. Register here

Chris Giles on Central Banks — Essential news and insights on central bank thinking, inflation, interest rates and money. Sign up here