Alphabet is one of the cheapest mega-cap tech stocks, despite being a leader in AI.

Alphabet (GOOG 1.45%) (GOOGL 1.51%) is the technology conglomerate behind Google, YouTube, self-driving car company Waymo, and artificial intelligence (AI) developer DeepMind (to name a few of its subsidiaries).

Google remains the world’s dominant internet search engine, and has used that success to build other businesses like Google Cloud and Google Workspace (which includes Gmail and Google Docs). But as a window to the internet for more than 20 years, Google Search is also a repository of some of the most valuable data in cyberspace, giving Alphabet an incredible advantage in the AI race.

Alphabet is already generating billions of dollars in revenue from AI, and the best is likely yet to come. Its stock is dirt cheap by a widely used valuation metric, and when investors look back on this moment in five years, they may regret not buying it today.

Image source: Alphabet.

Alphabet Integrates AI Across Its Businesses

Google holds 91% of the global internet search market, but that share was threatened last year by the rapid adoption of OpenAI’s ChatGPT. AI-powered chatbots can provide direct answers to almost any question, creating a more convenient experience than Google search, which requires the user to scour web pages to find the information they need.

That prompted Alphabet to launch its own family of AI models called Gemini, which power a new Google search feature called AI Overviews. The overviews speed up the search experience by providing text answers at the top of Google’s traditional web results. They include reference links so the user can see the source of the information, and Alphabet says they get more clicks than links that appear in traditional search results. That could have positive implications for ad revenue when AI Overviews roll out more widely.

Gemini is also available in Google Workspace for an additional monthly fee. It integrates with productivity apps like Google Docs, Sheets, Slides, and Gmail, allowing users to quickly create content and speed up their workflows. Workspace customer Click Therapeutics uses Gemini to analyze patient feedback to create digital treatment plans, and the use cases are likely to expand further over time.

Google Cloud is another key part of Alphabet’s AI strategy. Like most major cloud providers, Google Cloud offers AI data center infrastructure powered by chips from leading vendors such as NvidiaHowever, Alphabet has also designed its own chips in-house, and its new Trillium Tensor Processing Unit (TPU) offers 5x the computing performance of the previous version.

Developers use this computing power to perform AI training and inference to deliver the most advanced AI models, so faster chips can mean cost savings and higher-quality results. Google Cloud also offers a library of ready-to-use large language models (LLMs), including Gemini, that developers can use to accelerate the creation of their applications.

Google Cloud has just reached an important milestone

Alphabet generated record revenue of $84.7 billion in the second quarter of 2024 (ended June 30), a 14% increase from the same period a year earlier. Google Search remained the dominant part of the conglomerate, accounting for more than half of that revenue.

Google Cloud, however, stood out, posting 29% revenue growth to $10.3 billion. This is the first time the segment has crossed the $10 billion mark, and AI played a key role in reaching that milestone. Alphabet said its AI infrastructure and solutions have already generated billions of dollars in revenue to date, with more than 2 million developers currently using them.

Both of these numbers are likely to increase in the future as more businesses integrate technology into their daily operations.

Alphabet continues to carefully manage its costs to improve profitability. Its total operating expenses rose 8.6% in the second quarter, and since that’s well below the pace of revenue growth, more money was pumped into the bottom line. As a result, the company’s earnings per share jumped 31% year over year to $1.89.

Capital expenditures are something investors are watching closely, as building AI infrastructure is extremely expensive. Alphabet spent $13 billion on capital expenditures in the second quarter and plans to spend at least $12 billion per quarter for the remainder of 2024. The company has warned that this could temporarily put pressure on its profit margins, but that the long-term benefits of greater AI capacity could outweigh any short-term negative effects.

Alphabet Stock Is Cheap

Alphabet has generated $6.97 in earnings per share over the past four quarters, and based on its stock price of $167.28 at the time of writing, it is trading at a price-to-earnings (P/E) ratio of 24. That represents a 24.7% discount to its Nasdaq-100 index, which has a price-to-earnings ratio of 31.9, implying that Alphabet is significantly undervalued relative to its big tech peers.

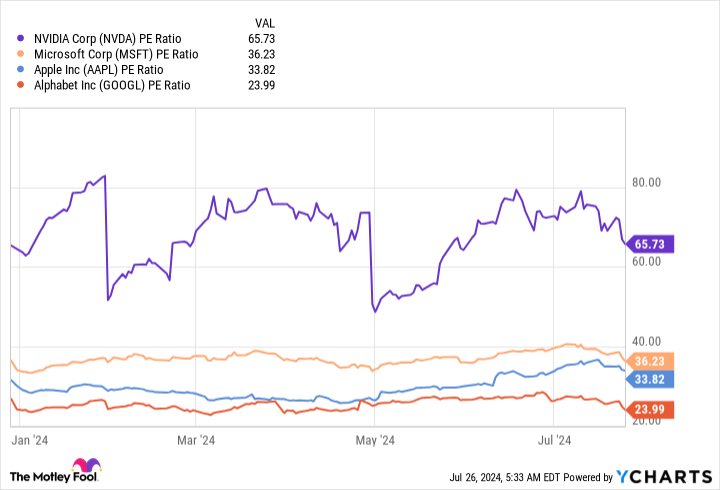

Alphabet’s price-to-earnings ratio is also the lowest of any company valued at least $2 trillion:

Price to Earnings Ratio data by YCharts

Nvidia, MicrosoftAnd Apple Alphabet stock is trading at an average P/E ratio of 45.2. This figure is heavily skewed by Nvidia, so I wouldn’t suggest Alphabet stock will climb that high. However, it might be appropriate for the stock to rise 45% to trade in line with Microsoft and Apple’s average P/E ratio of 35.

After all, Alphabet’s 31% profit growth in the second quarter was significantly faster than what Microsoft (8.9%) and Apple (13.5%) expect to achieve in the coming quarters. Plus, Alphabet may have an advantage over both companies in the AI space because it relies heavily on third-party developers like OpenAI for its AI software.

Simply put, aside from the fact that Alphabet is already generating strong growth with promising long-term potential from AI, it is clear that its shares should be trading much higher based on the valuations of some of its peers in the technology sector.

So when investors look back on this moment in a few years, they may be glad they bought Alphabet stock at its current price.