BING-JHEN HONG

Nvidia’s Outperformance Isn’t Just About Hype

NVIDIA Company (NASDAQ: NVDA) Investors who took advantage of the recent excitement surrounding NVDA’s stock split have been dealt a blow. As a result, NVDA has plunged into a bear market, falling more than 25% from its June highs. beyond this week’s lows. Down, but not eliminated, NVDA nevertheless significantly outperformed the S&P 500 (SPX, TO SPY) and its peers in the semiconductor sector (SMH, SOXX Act), with the stock having posted a total return of nearly 150% over the past year. Therefore, I believe the recent blow should be viewed as a welcome pullback rather than something more “sinister,” prefacing a potentially debilitating bearish reversal.

In my previous bullish NVDA article in May, I upgraded the stock and explained how I misunderstood its bearish thesis. The generative AI gold rush has gone from initial hype to sustained AI investments across multiple sectors and industries. This has also driven spending by hyperscalers to new heights as they race to develop the most advanced AI models to maintain their competitive advantages. Alphabet Inc. (GOOGLE, GOOG) highlighted the increase in AI spending, with capital expenditure increasing by more than 90% in Google releases second quarter results.

The momentum is expected to continue, highlighting the need to invest heavily in AI infrastructure to maintain leadership. Google CEO Sundar Pichai’s commentary highlights the monetization potential of its AI investments, saying they have “already generated billions in revenue and are used by over two million developers.” ServiceNow, Inc.’s (NOW) strong results demonstrate the immense AI opportunity for leading SaaS companies. CEO Bill McDermott called out the significant influence of its GenAI products, contributing to its strong execution, noting that the “extraordinary results” would not have been possible without GenAI.

Nvidia’s AI growth prospects broaden

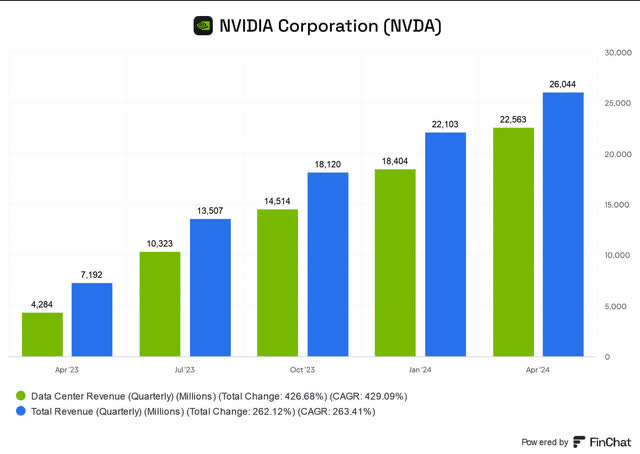

Nvidia Data Center Revenue (FinChat)

Therefore, I think this paves the way for Nvidia investors to have the confidence to buy in the event of a significant decline in the stock price. I also expect Huang and his team to clarify the dynamics of its upcoming product launch cadence, thereby reducing execution risks in the second half of the year.

Unless you’ve been living under a rock, I think you know how important the data center segment is to the company’s stellar performance. The segment accounted for over 85% of its revenue base in the first quarter, with Nvidia’s data center revenue surging 427% year-over-year and 23% quarter-over-quarter. As a result, investors should temper their expectations for another similar surge, even as the company prepares for a crucial second half, with NVDA beginning to ship its Blackwell platform.

Nvidia noted that Blackwell has moved to “full production and is the foundation for generative AI at trillion-parameter scale.” Nvidia’s full-stack ecosystem approach is built on the hardware foundation of “Grace processor, Blackwell GPUs, NVLink, Quantum, Spectrum, Mix, and high-speed switches and interconnects.” The company’s robust software ecosystem underpins its competitive advantage, which is further enhanced by the development of Nvidia AI Foundry. As a result, the company is committed to evolving its partner ecosystem across the stack to “support AI-driven digital transformation projects.”

Nvidia’s data center growth rate expected to slow

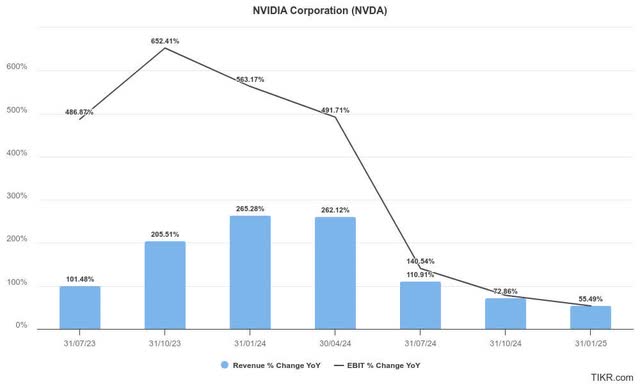

Nvidia (TIKR) Estimates

Despite my optimism, Nvidia investors should brace for a prolonged normalization phase, as its year-over-year growth momentum may have peaked in the first quarter. As noted above, the company is expected to report a potentially sharp slowdown in revenue growth when Nvidia next reports its second-quarter results on August 28.

However, the scale of the company’s growth prospects remains remarkable, with revenue and adjusted EBIT expected to increase by more than 100% in the second quarter. As a result, I don’t expect semiconductor investors to jump ship, although they shouldn’t expect similar revaluation opportunities over the past two years (the company has gained nearly 600% on a total return basis).

Nvidia investors should also consider the risks inherent in the company’s thesis. Tight supply-demand dynamics in Taiwan Semiconductor Manufacturing Company Limited’s (TSM) ability to produce its leading AI chips could hamper a more successful deployment of its next-generation architecture. The leading foundry has indicated tight supply through 2026, though I haven’t assessed the imminent risks to Nvidia’s shipment cadence.

Great rival Advanced Micro Devices, Inc. (AMD) is also expected to make further progress with its MI300 series AI chips in its bid to end Nvidia’s dominance. AMD’s open standards approach could be more favorable in helping customers avoid potential lock-ins and align with the FTC’s Open AI Models Framework. As a result, it could weaken the ability of dominant players like Nvidia to lock down the AI ecosystem.

Furthermore, the subsequent growth phase via AI factories and sovereign AI is still nascent. Given the unprecedented growth momentum in Nvidia’s AI data center business, the company is increasingly relying on this segment to drive its valuation. Therefore, unforeseen execution risks in emerging growth vectors could hamper its ability to maintain its current momentum, which could impact its valuation.

NVDA stock: not overvalued after adjusting for growth

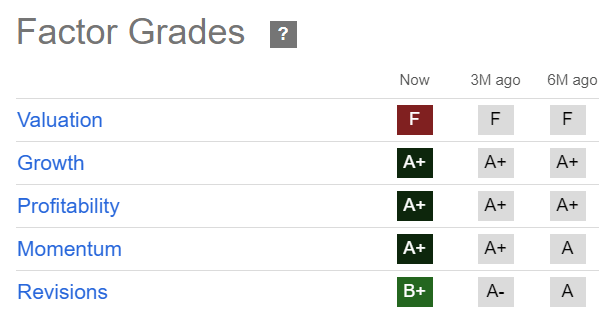

NVDA Quantitative Ratings (Seeking Alpha)

Don’t be fooled by looking at NVDA’s supposedly “expensive” valuation, because that’s what I’ve done in the past. Ask yourself why NVDA has outperformed the market over the last two years. Is the market really that stupid that it couldn’t tell the difference between hype and reality?

Additionally, Nvidia’s demonstrated revenue and profitability growth numbers should have silenced pessimistic investors who thought it was just hype. The growth prospects from increased spending on hyperscalers, Sovereign AI growth, and AI factory developments are needed to push the boundaries of GenAI even further. Combined with NVDA’s solid execution (earnings revision B+), the AI chip leader also enjoys best-in-class profitability.

I encourage investors to consider the growth-adjusted valuation metrics for these growth stocks. NVDA’s adjusted PEG ratio of 1.25 is more than 30% below the tech sector median. In addition, it is also significantly below its 5-year average of 2.1. As a result, I do not consider NVDA to be overvalued when factoring in its growth prospects. On the other hand, the market appears to have already priced in potential execution risks in the company’s next phase of growth as it seeks to further expand AI growth vectors.

Is NVDA Stock a Buy, Sell, or Hold?

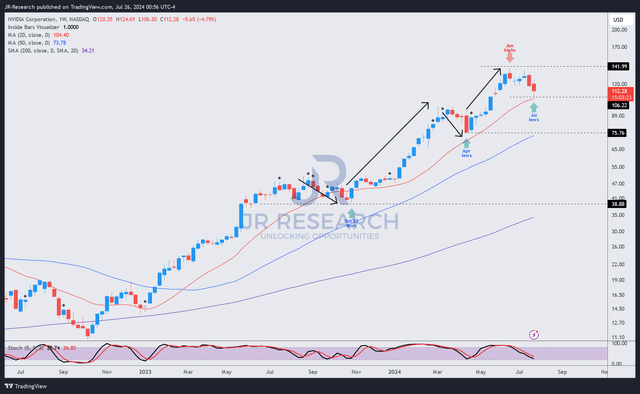

NVDA Price Chart (Weekly, Mid-Term, Dividend Adjusted) (TradingView)

NVDA’s price action remains incredibly resilient, with no signs of a bull trap. Previous pullbacks led to solid buying enthusiasm at its October 2023 and April 2024 lows. Subsequent rallies followed, helping NVDA maintain its incredible outperformance in the market.

The stock recently entered a bear market after its split in June 2024. However, this should not be interpreted negatively, as the stock remains in an uptrend. There is a possibility of a bottom above the $110 level, although we do not have any bullish reversal validation yet.

A further decline towards a support zone between the $75 and $110 levels is also possible, but this is not my base case scenario at the moment. Therefore, I view the pullback in NVDA constructively, corroborated by the stock’s remarkable “A+” buying momentum.

Stock Rating: Hold Buy.

Important Note: Investors are reminded to conduct their own due diligence and not rely on the information provided as financial advice. Consider this article as a supplement to your required research. Please always exercise independence of mind. Note that the rating is not intended to time any specific entry/exit at the time of writing unless otherwise stated.

Give me your news

Do you have constructive feedback to improve our thesis? Spotted a critical gap in our perspective? Saw something important that we didn’t see? Do you agree or disagree? Comment below in order to help everyone in the community learn better!

Editor’s Note: This article discusses one or more securities that are not traded on a major U.S. exchange. Be aware of the risks associated with these securities.