The market simply does not have a global view of the situation. It will soon.

There is no doubt about it. Alphabet (GOOG -0.28%) (GOOGL -0.17%) is spending an uncomfortable amount of money. That’s why its stock fell after it released its latest quarterly results. In fact, despite revenue and earnings beating estimates for the past quarter, there’s simply a lot of money flowing out of its growing business.

The market may have lost some perspective. Alphabet’s recent stock decline is probably less of a warning than an opportunity for anyone willing to step back and look at the bigger picture.

Alphabet’s stock drop makes sense, at first glance

It would be great if Google’s parent company spent less and grew more. But overall, Alphabet CEO Sundar Pichai has had the right idea and balanced spending with potential. And his company continues to deliver solid, investment-worthy performance despite headwinds and fierce competition.

But let’s start at the beginning.

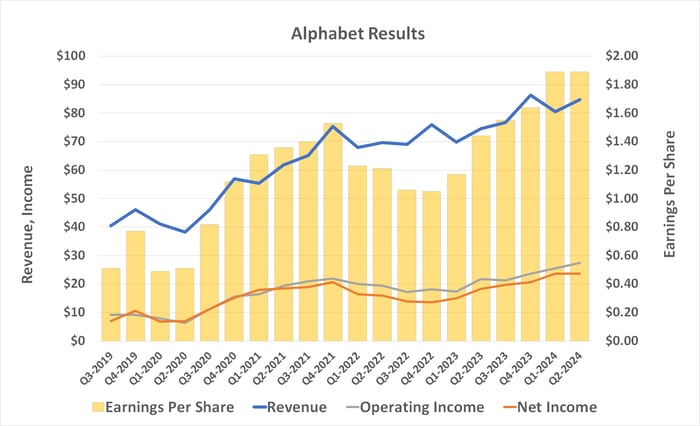

In the second quarter, which ended in June, Alphabet turned revenue of $84.7 billion into earnings of $1.89 per share. Both numbers were up from year-ago comparisons of $74.6 billion and $1.44 per share. And, perhaps more importantly, both numbers beat expectations, which had called for earnings of $1.84 per share on sales of $84.2 billion.

Data source: Alphabet Inc. Chart by author. Revenue and income figures are in billions of dollars.

Google’s cloud computing business posted particularly strong growth in revenue and operating profit, although the company’s core advertising business also grew well despite a modest increase in traffic acquisition costs.

There were There are some headwinds, though. One is YouTube’s slowdown. While its revenue in the latest quarter, nearly $8.7 billion, was up 13% from a year earlier, it’s less than analysts had expected from the ad-driven video platform. It’s also slower than its first-quarter sales growth of 20%.

Perhaps the biggest concern for investors regarding Alphabet’s second-quarter results is how much the company is still spending on major projects. CFO Ruth Porat explained on its second-quarter earnings call that $13.2 billion in capital expenditures — primarily investments in its artificial intelligence (AI) offerings — were made in the quarter, compared with only about $12 billion expected. That’s roughly the amount Alphabet plans to spend in each of the next few quarters, extending losses related to the development of its AI offerings.

Investors who focus on these two details, however, overlook a handful of other bullish nuances hidden in the company’s second-quarter numbers.

The glass is actually half full, and SO a few

One of these nuances has already been highlighted: traffic acquisition costs are not increasing as quickly as revenues. These expenses increased by only 6% year-on-year in the second quarter.

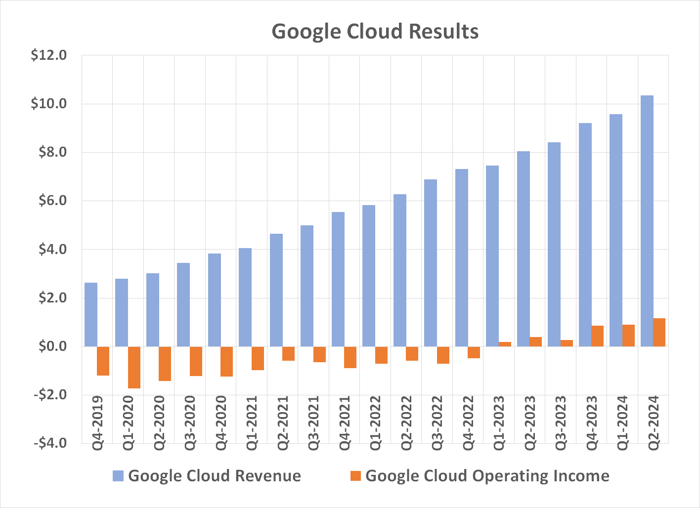

Another detail in the company’s second-quarter results is the amount of profit generated by Google’s cloud computing arm. While it remained in the red until the first quarter of last year, now that it’s in the green, a small amount of revenue growth is producing an exaggerated degree of net profit. Of Google Cloud’s $10.3 billion in revenue in the second quarter, nearly $1.2 billion was turned into operating income.

Data source: Alphabet Inc. Chart by author. Figures are in billions of dollars.

Given the trajectory of this segment’s sales and earnings, expect cloud to become an even more significant earnings contributor in the foreseeable future.

It’s also worth adding that while Alphabet is spending more money on AI-related investments than most investors would like, the company is keeping its other costs down without restricting its ability to operate. Sales and marketing costs last quarter were in line with the prior-year numbers, though advertising revenue increased, for example, while general and administrative expenses actually fell 9%, from nearly $3.5 billion to less than $3.2 billion this time around. Much of that decline reflects a reduction in Alphabet’s workforce.

But most importantly, investors should accept that all of Alphabet’s spending on AI will be handsomely rewarded. As Pichai explained on the company’s second-quarter earnings call, “the risk of underinvestment is significantly greater for us here than the risk of overinvestment.” These investments will not only allow Alphabet to continue building its free consumer-facing Gemini I platform, but also to continue developing revenue-generating AI chatbots and enterprise-specific assistants for years to come.

This is important, simply because this is where the commercial future of artificial intelligence lies. Precedence Research predicts that the global enterprise AI market will grow from about $14.5 billion this year to more than $270 billion by 2032, as potential customers recognize its value while developers like Google continue to refine their offerings. That’s an annualized growth rate of 44%, which is consistent with Mordor Intelligence’s forecast that enterprise AI will drive average annual sales growth of 52% over a similar period.

Don’t miss what everyone is watching beyond

So why are most investors viewing Alphabet’s second quarter only as bearish, extending a sell-off that was already underway well before the second-quarter numbers were released Tuesday night? First, because the market is fickle, prone to change its mind at the drop of a hat. The broad bearishness that has been brewing for several days may also have something to do with investors’ pessimistic mood.

But short-term noise doesn’t change the long-term reality. And the reality here is simply that Alphabet is still a powerhouse and is still well-positioned to thrive thanks to its strong leadership in the search advertising market. Improvements on the AI front will only solidify its leadership role in that arena.

In the meantime, cloud computing is rapidly becoming a significant growth driver with operating margins that could continue to climb before eventually catching up with those of Amazon And Microsoft. Only about a tenth of Google Cloud’s cloud sales in the second quarter translated into operating income, compared with 37% for Amazon Web Services and a similar figure for Microsoft’s Intelligent Cloud business (including Azure). That outlook doesn’t seem to be factored into Alphabet’s current share price at all.

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. James Brumley holds positions at Alphabet. The Motley Fool holds positions in and recommends Alphabet, Amazon, and Microsoft. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.