Want to learn more about Jordan Love’s historic contract with the Green Bay Packers? Confused by some of the structuring? Interested in what this deal means in the short and long term? You’ve come to the right place.

To explain the key points of Love’s new contract, we asked Ken Ingalls, an accountant who closely follows the salary cap and Packers contracts, to answer five questions about the details. His answers should help clarify anything interesting or confusing about the deal.

First, here are some important details to know:

— Love’s contract includes a $75 million signing bonus and an average of $55 million per year.

— The extension added four years to his old contract — he is under contract in Green Bay through 2028.

— Love’s salary cap hit per year: $20,257,731 in 2024, $29,757,731 in 2025, $36,157,731 in 2026, $42,457,731 in 2027 and $74,200,000 in 2028.

— The Packers added three years of vacation time. In 2029, when those are canceled, a salary cap of $34.7 million will apply.

Over the Cap presents the full contract structure as reported.

Now here’s our Q&A with Ingalls on the Love deal:

Jordan Love in contract extension talks with Green Bay Packers

Ingalls: The Packers were able to keep Jordan Love’s salary cap hit low for a few reasons. First, while it’s a four-year extension, the contract covers five years in total, allowing them to spread the impact of his new league-record $75 million signing bonus over five years. So the cost of the $75 million cash payment only amounts to $15 million per year on their salary cap.

Then, his second-year cash is relatively low at (just) $13 million compared to the $79 million he gets to play in 2024. That puts his 2025 salary cap hit under $30 million since the Packers simply aren’t paying him much for his services this year.

By 2026, the large mid-contract cash flows start to ramp up and costs start to accrue in the final years, but allow for three years of reasonable cap costs for a record contract.

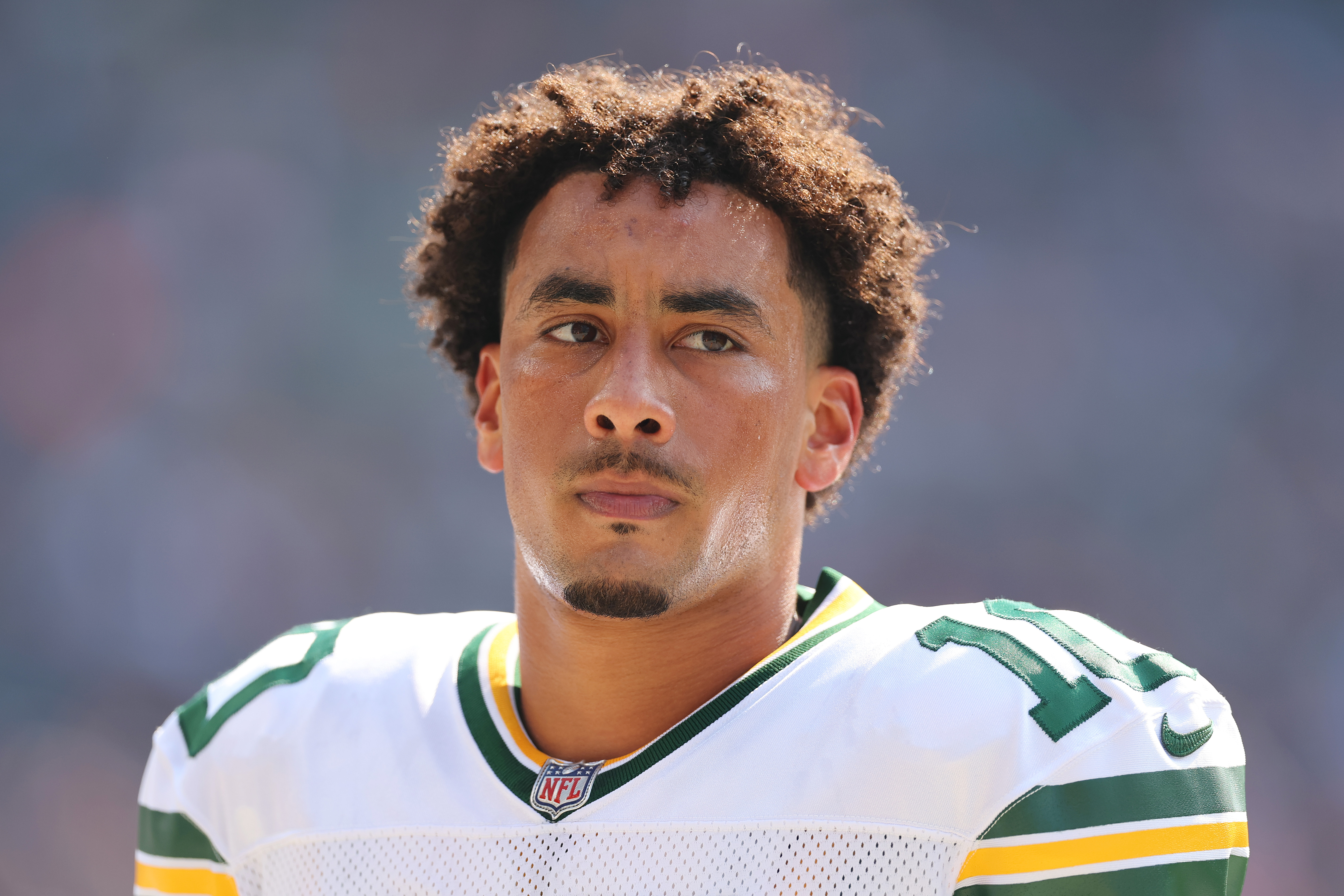

CHICAGO, ILLINOIS – SEPTEMBER 10: Jordan Love #10 of the Green Bay Packers looks on prior to the game against the Chicago Bears at Soldier Field on September 10, 2023 in Chicago, Illinois. (Photo by Michael Reaves/Getty Images)

Ingalls: It’s true, the Packers typically don’t guarantee money outside of the initial signing bonus. Off the top of my head, I can’t think of a recent example other than Aaron Rodgers, but as is the case in the NFL, quarterbacks are typically the exception to most rules.

For Jordan Love, the Packers were pushed out of their comfort zone in terms of guarantees, but they still got a much lower amount than the recent highest contracts on the market. Love gets $100.8 million guaranteed at signing time, which ranks ninth in the NFL, despite having the highest new signing bonus in NFL history at $75 million and the highest overall contract value at $55 million per year.

The Packers make up for that difference by inserting “rollover guarantees” into the deal for years three and four of the contract. These kick in midway through the contract and are therefore not part of the initial $100.8 million in stated guarantees. For Jordan Love, he’ll get an additional $39.5 million guaranteed for 2026 if he’s still under contract in March 2025, and an additional $20 million guaranteed for 2027 if he’s still under contract in March 2026. There are technical reasons for not doing all of this up front, but overall, the amount of guarantees in this deal should be considered a major negotiating win for Jordan Love and his agents.

GREEN BAY, WISCONSIN – JUNE 04: Jordan Love #10 of the Green Bay Packers participates in drills during Green Bay Packers minicamp at Ray Nitschke Field on June 04, 2024 in Green Bay, Wisconsin. (Photo by Stacy Revere/Getty Images)

Ingalls: Jordan Love’s contract contains two large mid-contract option bonuses in Years 3 and 4. If we leave “options” aside for now and simply consider them “bonuses,” then this deal is very typical of what the Packers like to do with their top contracts — in fact, it’s hard to find a significant veteran Packers deal without them. Recent deals for Rashan Gary, Jaire Alexander, Kenny Clark, Elgton Jenkins, Xavier McKinney, Preston Smith, Josh Jacobs and Keisean Nixon all include multi-million dollar mid-contract bonuses.

In recent years, when facing severe salary cap constraints, the Packers have restructured nearly all of their contract bonuses into midseason signing bonuses. This move is just an accounting trick and doesn’t change the amount or timing of the players’ bonuses. But calling it a signing bonus means the Packers can spread the money out over the remainder of the contract, typically five years, creating short-term cap savings as a desired outcome.

Now back to Jordan Love. Instead of paying his teammates big bonuses, the Packers are essentially “pre-restructuring” those bonuses to achieve the desired short-term salary cap savings that are already baked into the contract. There are a few additional technicalities and complexities surrounding option bonuses that I won’t attempt to get into here, but what’s important for salary cap purposes is that the assumption is that the option will be triggered in a way that gives the team a short-term cap gain but translates into higher salary cap impacts in the long run.

Green Bay Packers quarterback Jordan Love throws the ball during practice Saturday, July 27, 2024, at Ray Nitschke Field in Ashwaubenon, Wis. Love signed a four-year, $220 million contract extension Friday after sitting out the team’s first four practices while his contract was being negotiated.

Tork Mason/USA TODAY-Wisconsin Network

Ingalls: I’d love to get my hands on the contract to read the exact wording of the options and offset guarantees, because that would help paint a more accurate picture — so far, I have some vague numbers. But overall, it’s safe to say that with Jordan Love’s dual-option bonus restructuring, the highest signing bonus ever and a total of $160 million in built-in guarantees, this isn’t an easy contract to get out of.

The amount of salary cap pain varies depending on the timing and nature of a potential exit. If things went that bad and the Packers had to part ways with Jordan Love, it would be a disaster. Financially, it would be so crippling (up to $127 million in dead salary cap in 2025) that they should avoid opting out at all costs.

The trade numbers are better because the new team would assume future guarantees, but it’s still very costly. The Aaron Rodgers trade cost the Packers $40.3 million in salary cap space when he left the club. The average cost of moving Jordan Love between 2025 and 2028 is about $60 million assuming they’re not responsible for option bonuses — otherwise, it would be much more. Overall, the goal here is for Jordan Love to at least play through the contract years and not even be considered for a move until he’s 30.

Green Bay Packers quarterback Jordan Love (10) congratulates head coach Matt LaFleur after throwing a touchdown pass during the second quarter of their game against the Chicago Bears, Sunday, Jan. 7, 2024, at Lambeau Field in Green Bay, Wis.

Ingalls: It’s safe to assume that Jordan Love won’t play through 2028 on his current deal as written. If Love plays the next four years and all option bonuses are triggered, then the Packers are looking at a $74.2 million salary cap increase for Jordan Love’s services in his final year. If they do any other cap-saving restructuring in the middle of the contract, that will only increase. All the “cap-friendly” aspects at the beginning of the contract start to become less cap-friendly at the end.

So, one way or another, the contract will be changed. If things go south and the Packers don’t want to extend him, they could consider trading him or reducing him to a cost of $63.9 million. Let’s hope it doesn’t happen that way!

Otherwise, if they extend his contract, the salary cap will be much lower than the projected $74.2 million, but unfortunately, there will be bills to pay to account for the increased salary cap cost. By 2028, there will be $29.2 million in deferred salary costs locked in 2028 from previously paid bonuses that are added to the salary cost before a dime is even paid. Another $34.7 million is scheduled for 2029-31, which will be added to the future amounts of the new contract. So if/when we get to a second major contract for Jordan Love, it will be weighed down a bit by the “kicks on goal” they will have to account for under this current major contract.

The best financial “window” for the Packers in the near future is 2024-26. That’s not to say they can’t fix things after that, but the next few years where Love’s contract is reasonable on the salary cap will open up an advantage the Packers could try to exploit in the short term.