The new risk Google faces from AI challengers could play a role in the ultimate outcome of a landmark antitrust trial where a judge must decide whether the tech giant illegally monopolized online search.

The lawsuit, brought by the Justice Department and a group of U.S. states, focuses on the government’s argument that Google (GOOG, GOOGL) illegally prevented its rivals from competing. Google says it became the market leader in search because of the quality of its service.

But even as the company awaits a decision from U.S. District Court Judge Amit Mehta, new threats to its preeminence are emerging through new methods of searching the web.

Those threats could improve Google’s chances of mitigating consequences if Judge Mehta finds it liable for violating competition law, antitrust experts say.

“If a violation is found, Google will say the market is already fixing itself,” said William Kovacic, an antitrust law professor at George Washington University.

Last week, Microsoft (MSFT)-backed OpenAI launched a new search engine prototype called SearchGPT and positioned it as a new way to search the web — a potential threat to Google’s long-standing dominance in search.

Microsoft’s Bing also has generative AI capabilities powered by OpenAI’s ChatGPT, as do its Copilot and Prometheus software.

Google, for its part, offers generative AI features in its AI Insights, its latest search product based on its Gemini model. The company also offers its LaMDA, T5, PaLM, and GLaM models.

Other new ways to search the web are offered by AI-powered large language models (LLMs), such as OpenAI’s ChatGPT, introduced in November 2022, and Perplexity, an AI-powered search engine built using multiple LLMs that attracted significant funding from Amazon (AMZN) founder Jeff Bezos and Nvidia (NVDA) CEO Jensen Huang.

“Market developments are already solving problems”

The new search options won’t necessarily help Google defend its past behavior, but they could significantly mitigate a penalty if the U.S. government and states prevail in their antitrust lawsuit.

That’s because Google would have the opportunity to argue, at a separate phase of the trial, that the anticompetitive concerns identified in the complaint no longer exist or have diminished.

The argument Google can make to the judge is this: “You don’t need to do much here, because the development of new products, new technologies, the emergence of competitive alternatives means that market developments are already solving the problems identified,” Kovacic said.

Carl Hittinger, head of BakerHostetler’s antitrust and competition practice, agreed that market changes that open up more options for consumers could work in Google’s favor.

“If consumers switch to another product, if they have that option and they can, then there is no anticompetitive harm,” Hittinger said.

On the other hand, the judge cannot consider SearchGPT and emerging search platforms as direct competitors to Google Search since, for the time being, these products are not pre-installed by default on a variety of devices.

One of the key factors a judge must consider when crafting a solution, Hittinger said, is the public interest.

“It’s a huge responsibility”

The government has not yet specified what specific remedy it wants to apply if it wins.

Remedies may include injunctive relief, such as controls on the future conduct of a business, or structural relief, such as compelling divestments.

Federal rules also allow Google to ask Judge Mehta to reopen the case, before his ruling, to consider new material evidence. And even if an injunction is issued, new material evidence can be presented to the court to ask that it be modified.

If Google is found liable, it is likely to appeal the case. Google could then ask for the appeal phase to be suspended until the case is heard through the appeals process.

Kovacic predicted the government would prevail on at least some of its claims, and said that regardless of the outcome, Judge Mehta’s decision is important.

“You can imagine how difficult this issue is for the court,” Kovacic said. “Determining the fate of the entire research sector is a huge responsibility.”

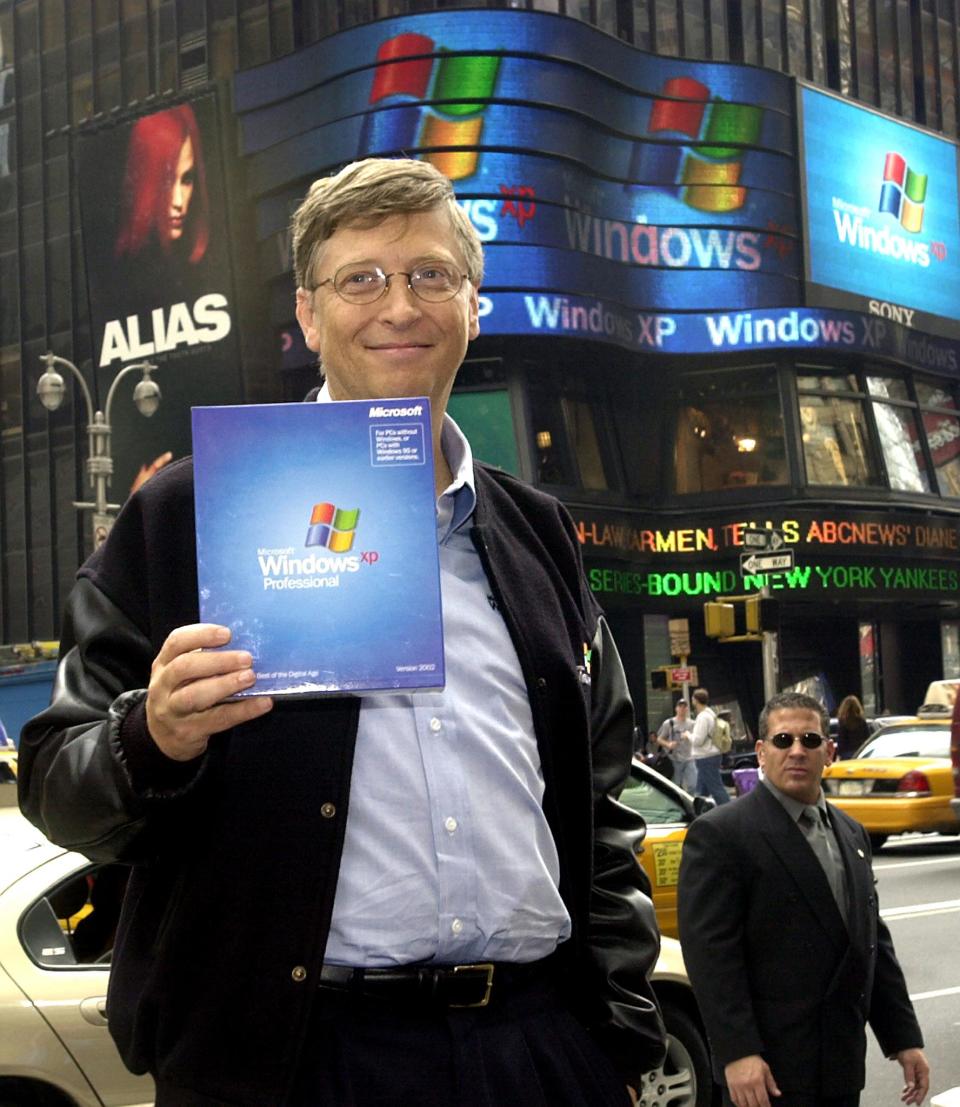

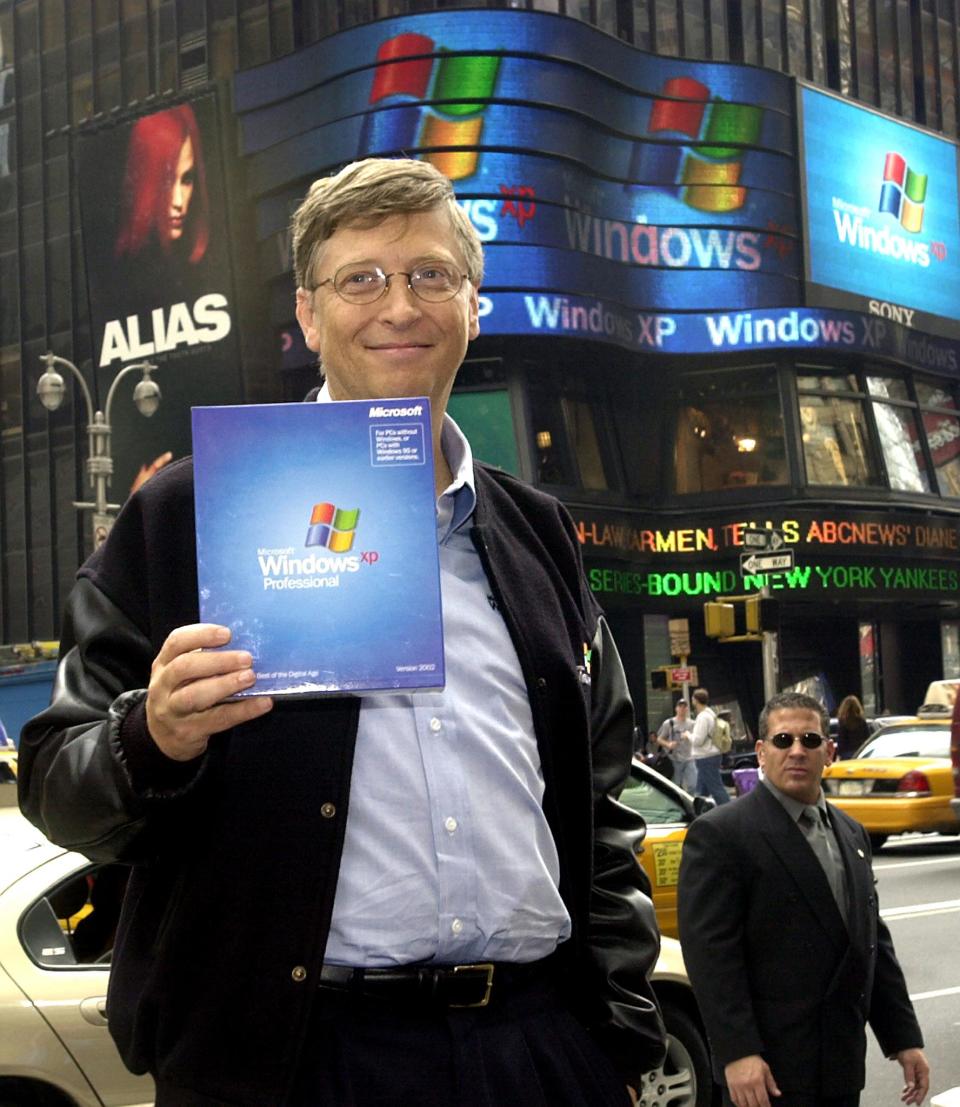

The Google antitrust trial is the most significant since another landmark case in the 1990s that ultimately forced Microsoft (MSFT) to strike a deal that opened up its computer operating system to rivals in the early 2000s.

“The landscape is changing”

It remains to be seen what the antitrust lawsuit and new rivals in the search industry will mean for Google and its parent company, Alphabet.

There is certainly a lot at stake. By 2023, Google’s search advertising business generated more than $175 billion in revenue.

Combined with Google’s YouTube ads and Google Network revenue, advertising accounted for $237 billion of the company’s $307 billion in total revenue.

But new threats to Google’s search empire still have a long way to go to dethrone the leader.

So far, LLMs and competing search platforms haven’t dramatically changed the way most people search the web. Bing has gained about 1% market share since Copilot launched, but Google still holds more than 90%.

Hittinger, who represented AT&T in another landmark antitrust case that ended in a breakup of the telecommunications giant in the 1980s, said technological changes tend to impact tough antitrust cases.

“While you are deciding the case, the world is changing and the landscape is changing,” he said.

Click here for the latest tech news that will impact the stock market

Read the latest financial and business news from Yahoo Finance