Anant Yardi will not be involved in any private jet misdeeds like Adam Neumann. The low-key California software mogul is poised to take over WeWork on Thursday when a federal bankruptcy court hands over control of the coworking business that Neumann once ran to his creditors.

Yardi, an engineer who immigrated from India in 1968, quietly amassed a multibillion-dollar fortune over four decades selling property management software to commercial and residential landlords. Yardi Systems, the company he started with his wife Eileen, remains a family business even though its annual turnover approaches $3 billion.

Less than two years ago, Yardi invested more than $200 million in equity and debt through an unnamed vehicle to support WeWork. He agreed to inject an additional $337.5 million two months ago to counter an offer from Neumann, who wanted to return to the company that financed his jet-setting lifestyle until his abrupt departure in 2019 .

Yardi preferred economy seats on commercial flights until back problems recently sent him to business class. But by taking control of one of the most polarizing companies in recent memory, he will become a central figure shaping the future of urban real estate, with a public visibility he is not accustomed to.

“WeWork is such a popular and well-known brand that it didn’t seem right to drop it,” Yardi explained in an interview with the Financial Times. “I realize that financial decisions are not made between right and wrong. But there is also a tremendous opportunity in terms of WeWork’s turnaround.

Judge John Sherwood of the District of New Jersey Bankruptcy Court is expected to confirm on Thursday a reorganization plan that will erase $4 billion in existing WeWork loans and bonds. This will end a seven-month process in which WeWork reduced its overall rent obligations by a projected $12 billion.

In April, WeWork advisers set the official value of its new company at around $750 million, significantly below its peak private market valuation of $47 billion, and projected that its Annual business would double to $2.5 billion by 2028.

Neumann, in court filings, disputed those prospects, calling them too optimistic, but Yardi said he was comfortable with the numbers. WeWork’s operating costs have “been under control,” he said: “(WeWork) is in a good position.” The results seem very good to us.

The billions of equity invested in WeWork as a private company and when it went public through a special purpose acquisition company are gone. Holders of its pre-bankruptcy debt could recover just 5 cents on the dollar.

The bankruptcy proved costly enough that creditors were asked to bring in $450 million in new liquidity. Yardi Systems invested the largest share, giving it a majority stake in the new WeWork. Other lenders, including SoftBank and King Street, will hold minority stakes.

Post-bankruptcy, Yardi wants to expand WeWork’s marketing to small businesses and adopt technologies used by hotels, such as real-time reservations. The company also hopes to launch an affiliate program in which it would partner with other coworking operators.

“Our vision for coworking is that it is an interesting combination of hospitality, apartment rental and commercial rental,” he said.

This is new territory for Yardi’s Asset-Light software company, but he said he has no doubt he can make WeWork a success. “If there had been doubt, I think we would have been much more careful.”

The companies will be managed as separate entities.

Office buildings have been under pressure, but Yardi told the FT their owners should embrace flexible spaces to make better use of vacant space. Over time, he said, “office buildings will continue to be in demand and flexibility will be an integral part of all office buildings.”

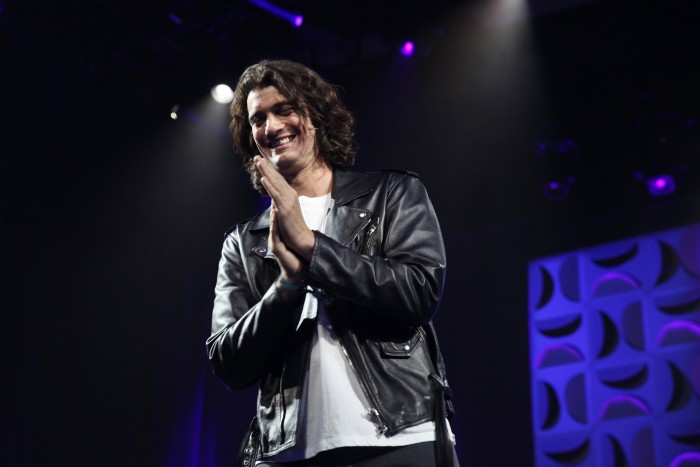

He has kept a low profile, in stark contrast to Neumann’s penchant for appearing in the media, sometimes with celebrities, to promote his start-up. Neumann attempted throughout the bankruptcy to gain a foothold in WeWork, first by offering $200 million in financing and then with an unsolicited offer of more than $550 million.

During the proceedings, Neumann opposed the company’s plan to let existing lenders, including Yardi, determine WeWork’s fate, calling Yardi a “potential insider.”

Yardi declined to comment on the allegation. Neumann withdrew his objection on Tuesday and abandoned his offer.

“For several months, we tried to work constructively with WeWork to create a strategy that would allow it to thrive,” he said in a statement. “Instead, the company appears to be emerging from bankruptcy with a plan that seems unrealistic and unlikely to succeed. »

The WeWork acquisition was not part of Yardi’s original plan, but happened unexpectedly in recent weeks after the company revealed its lack of cash flow, Yardi said.

Yardi Systems and WeWork partnered for the first time in 2022 on an office management and data analytics product. WeWork then turned to Yardi for help restructuring its debts in early 2023. At that time, the software group had agreed to purchase $175 million in secured notes and approximately $40 million shares through a legal entity called Cupar Grimmond.

His identity was a mystery until April, when the FT revealed that Yardi was behind the pseudonym. It combines Cupar, the town from which Eileen Yardi’s ancestors immigrated to Scotland, and Grimmond, a surname.

Then WeWork asked an even bigger question: whether Yardi would be willing to become its majority shareholder with the second investment, bringing its total commitment to more than $500 million.

Yardi Systems is happy to go unnoticed in most business circles, but it is well known in real estate circles as a back-end software company with a significant market share.

“Every commercial owner I’ve spoken to uses Yardi Systems. Anyone large – shopping mall, apartment building – uses Yardi,” said Daniel Gielchinsky, a partner at DGIM Law, who often advises on real estate matters.

Unlike WeWork’s race for growth, its evolution has been more measured. Yardi fondly remembers his wife writing his first technical manual and says the family has no interest in taking the company public.

“I hope that over time, most people will know about RentCafe and WeWork,” Yardi said, referring to the popular online rent payment platform run by Yardi Systems, which customers don’t associate with mother Society. “And Yardi can go into his shell.”