We all know the story of the tech bubble of the late ’90s, when enthusiasm for the new digital economy inflated dot.com companies to extraordinary levels – and then the bubble burst. The explosion of AI on today’s tech scene is reminiscent of that earlier bubble.

But there are differences in the current situation, significant differences that suggest that the current enthusiasm for AI technology is a more enduring phenomenon. Firstly, the demand for AI remains constant in the world of technology, and secondly, the changes it introduces are almost certain to be lasting.

In a recent commentary, Wedbush analyst Daniel Ives, a well-known technology expert, highlighted these differences, stating: “We have been covering technology on the Street since the late 90s and it is NOT a bubble but rather the start of a 4th industrial revolution. now upon us, this will have major growth ramifications for the technology sector, led by the moving software/use case phase… In our opinion, taking a step back, this is only the beginning of the first inning of a future AI market opportunity of over $1 trillion. on the shores of the technology sector over the next few years, led by the enterprise market and followed by consumer use cases (Apple, Meta, Google, Amazon) expected to be rolled out in the coming years.

Not surprisingly, Ives took these thoughts to their logical conclusion, making specific recommendations. According to Ives, C3.ai (NYSE:AI) and Palantir (NYSE:PLTR) are among the best AI stocks to buy right now. Here’s a closer look at the details.

C3.ai

We’ll start with C3.ai, a software company that has established itself as a leader in enterprise-scale AI applications. The Company’s product portfolio includes a wide range of AI-based software and tools, available through its AI Applications, AI Application Platform and AI Development Tools. C3.ai’s software is used across many industries, from customer engagement and fraud detection to predictive maintenance and supply chain optimization. The company markets its AI products to clients large and small, including big names like oilfield services company Baker Hughes, utility company ConEdison and even the U.S. Army and Air Force.

C3.ai is not only an industry leader in enterprise AI, but is also known as an innovator and driver of the ongoing digital transformation of the global economy. The company offers its AI applications and software a combination of efficiency and cost advantages that deliver value while supporting user operations, a wise combination for any technology provider. C3.ai customers experience benefits in terms of improved engagement with their own customers, cleaner monetary pathways and smoother supply chains. In short, C3.ai has placed itself at the center of the changes that AI technology is bringing to the world and the way we work in it.

C3.ai shares have been volatile this year, ranging from a high of $37 to a low of $20. However, the stock received a significant boost after releasing its 4Q24 financial results on May 29.

The increase came after C3.ai beat expectations for fourth-quarter results and fiscal 2025 guidance. The company reported revenue for the quarter of $86.6 million. of dollars, exceeding forecasts by $2.2 million and growing nearly 20% for the year. -year. The bottom line resulted in a net loss of 11 cents per share, based on non-GAAP measures. Although negative, this EPS beat estimates by 19 cents per share.

Looking ahead, the company provided fiscal 2025 revenue guidance well above consensus. Management projects revenue between $370 million and $395 million for fiscal 2025, compared to an expected $367.53 million.

Contacting Wedbush’s Daniel Ives, we find that he is optimistic about C3.ai’s performance and the company’s growth prospects.

“C3 delivered its 4Q24 (April) results with both top and bottom lines while expanding its market share across a myriad of industries, highlighting its growing market share at this early stage of the technology revolution. AI… The company also noted that during fiscal 4Q24, C3 recorded 50,000 requests for its generative AI solutions across 15 different industries, as the company continues to expand into new verticals and to improve its diversification between sectors. It was a step in the right direction,” Ives said.

Ives goes on to give the stock an Outperform (i.e. Buy) rating, along with a $40 price target that shows his confidence in a 28% upside over a 12-month horizon. (To see Ives’ track record, click here)

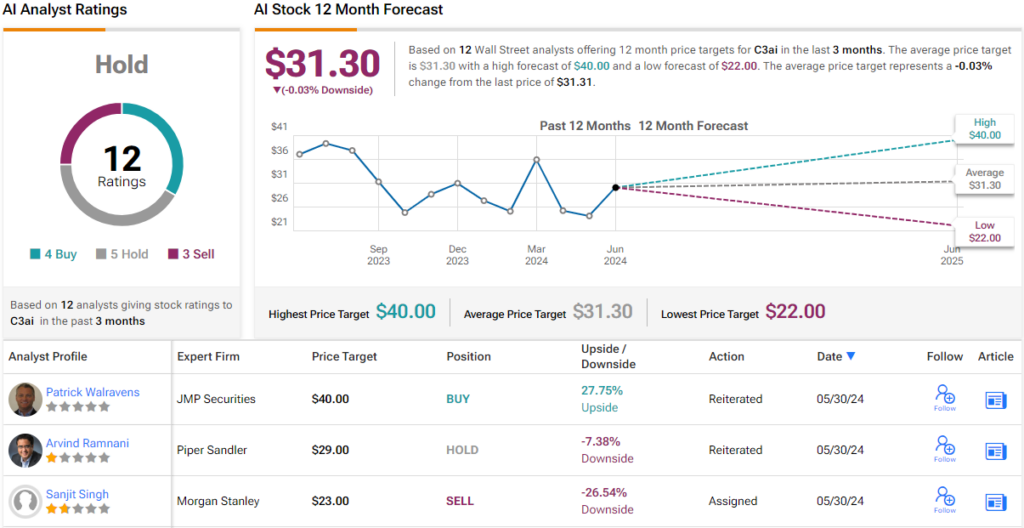

Although Ives is optimistic, Wall Street’s overall view is less so. The stock has 12 recent analyst reviews, which break down into 4 Buys, 5 Holds, and 3 Sells, for a Hold consensus rating. Analysts expect the shares to remain range-bound for the foreseeable future, as indicated by the $31.30 average price target. (See AI Stock Forecast)

Palantir

Next up is Palantir, a technology company founded by billionaire and prolific venture capitalist Peter Thiel. Palantir was founded in 2003 to use cutting-edge data analytics technology to provide actionable insights. The company is named after the magical seeing stones from Tolkien’s Lord of the Rings; stones are “those that look far,” and that sums up Palantir’s mission. The company’s advanced data analytics and AI software allows its customers to visualize underlying patterns of events in real time.

AI is at the center of everything it does, but Palantir neither ignores nor forgets the human factor. The company views AI technology as a way to augment human intelligence, not replace it, and strives to combine the two to reap the unique benefits each can offer. Palantir subscribers have access to a range of AI platforms, including the flagship AI platform (AI platform), built on this principle, using natural language processing to enable complex interactions with human users. The company’s products and tools can understand complex user questions and provide detailed, nuanced answers, a capability based on the human interaction model. The systems are designed to avoid the use of complex computer codes and scripts, as well as to avoid programming languages and statistical models; Palantir’s goal is to make high-end data analytics easily accessible to non-experts.

AI and data analytics are becoming increasingly valuable across a wide range of industries and for a wide variety of clients. Palantir’s services are in high demand, especially within the Ministry of Defense. On May 30, the company announced it had received an initial $153 million contract from the Department of Defense, with additional awards of up to $480 million over the next 5 years.

This contract win is a nice icing on the cake of Palantir’s latest quarterly results report, published in early May for 1Q24. The company reported revenue of $634 million, a gain of nearly 21% year-over-year. That was more than $16 million better than expected. The bottom line, non-GAAP EPS of 8 cents per share, was in line with expectations. By GAAP measures, Palantir’s first quarter was its sixth consecutive profitable quarter. The strong financial results were combined with a strong increase in the number of customers; Palantir grew its customer base by 42% year over year.

Daniel Ives is impressed with this AI company, especially its growing capacity for growth. He writes of Palantir: “We continue to see increased momentum in PLTR’s growth story, with AIP leading the charge in generating significant demand across the commercial and government landscapes, while being well positioned to gain further A big part of this $1 trillion opportunity is driven by AI. use cases are exploding globally.

Seeing a market like this ahead of Palantir, it’s no wonder Ives rates the stock as Outperform (i.e. Buy). He sets his price target at $35, implying an upside of around 47% over the next 12 months.

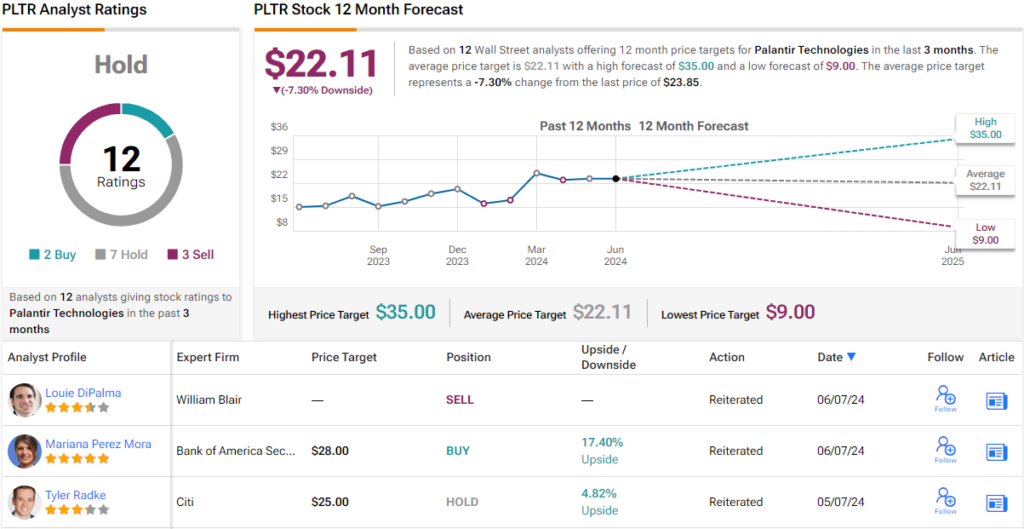

Once again, we’re looking at a stock whose Street consensus is significantly less bullish than Wedbush’s. The Hold consensus here is based on 12 analyst reviews, with just 2 Buys overbalanced by 7 Holds and 3 Sells. Shares are priced at $23.85 and their average target price of $22.11 suggests a 7% downside from that level. (See PLTR Stock Forecast)

To find good ideas for trading AI stocks at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ stock insights.

Disclaimer: The opinions expressed in this article are solely those of the analyst featured. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.