U.S. stocks jumped Wednesday after a new inflation figure showed consumer prices rose less than expected in May. The latest inflation snapshot comes hours before a highly anticipated afternoon Federal Reserve meeting provides the latest signal on where interest rates are moving.

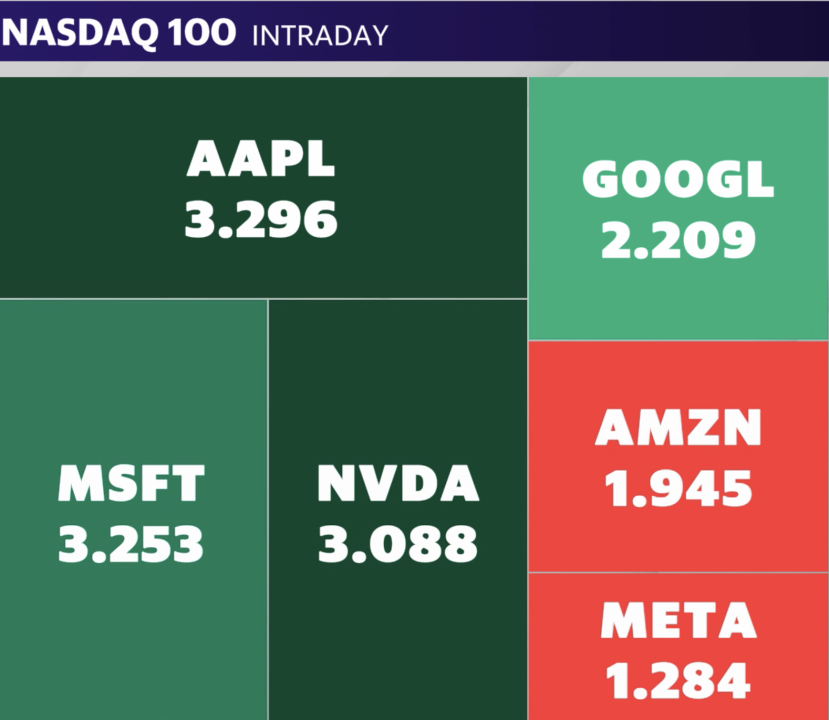

The S&P 500 (^GSPC) built on a record 27th close of the year, up more than 0.8%. The tech-heavy Nasdaq Composite (^IXIC) rose nearly 0.9%, also adding to a record close from the day before. The Dow Jones Industrial Average (^DJI) also jumped about 0.9%.

The consumer price index (CPI) remained stable over the previous month and increased 3.3% from a year earlier in May – a deceleration from the monthly increase of 0.3 % of April and the annual price increase of 3.4%. Both measures exceed economists’ expectations. On a “core” basis, which excludes the more volatile costs of food and gasoline, prices in May increased 0.2% from the previous month and 3.4% from last year, an increase lower than the April data. Both measures also turned out to be better than economists’ estimates.

This has changed market expectations for Fed rate cuts this year. After the data was released, markets were pricing in a roughly 69% chance that the Federal Reserve would begin cutting rates by its September meeting, according to data from the CME FedWatch tool. That’s an increase from the probability of about 53% the day before.

Subsequently, interest rate-sensitive areas of the market soared. Real Estate (XLRE) led all eleven sectors, up more than 2%.

Learn more: How does the labor market affect inflation?

But all that could change later this afternoon. The Fed’s decision is almost certain: the central bank should keep rates at their current 23-year levels. Investors will be paying closer attention to the release of the Fed’s updated economic projections in its dot plot – particularly the number of rate cuts it projects for the rest of the year.

The last time we heard it, in March, it was three o’clock. Policymakers are almost certain to reduce that amount, thanks in part to the aforementioned sticky inflation that will begin this year. These projections, along with what Fed Chairman Jerome Powell said during his press conference, could be the last notable events for the market on an extraordinarily busy day.

Live7 updates