Investing in equal shares of these five dividend stocks produces a dividend yield of 3.7%.

Generating passive income from quality dividend stocks doesn’t seem as attractive when the S&P500 And Nasdaq Composite indices reach new records. But the true value of dividend stocks lies not in their short-term performance relative to the market, but in how their consistency can help with financial planning and collecting passive income, no matter how the market performs. walk.

United Parcel Service (UPS -0.20%), Chevron (CVX -0.87%), ExxonMobil (XOM -0.88%), Target (TGT 1.92%)And McDonalds (MCD 2.20%) There are five dividend stocks that have been sold in the last three months. By investing $3,000 in each of these five stocks, you can expect to earn more than $2,000 in cumulative dividend income over the next four years. Here’s why the five falling dividend stocks are worth buying now.

Image source: Getty Images.

This parcel delivery giant still has a long way to go to restore investor confidence

UPS is getting dangerously close to a four-year low. Operating margins have collapsed as UPS seeks to cut costs and set realistic expectations for customer demand, after vastly overestimating a sustained increase in small package delivery volumes.

UPS has outlined a new plan to restore margins and return to growth by 2026. Healthcare plays a key role in this. But UPS said it would rely on organic growth and acquisitions to boost the segment, putting pressure on the company’s ability to execute.

UPS is out of favor for good reasons, but it’s important to remember that it operates in a cyclical industry. With a yield of 4.8% and a price-to-earnings (P/E) ratio of 19.4, UPS is enticing investors to buy and hold the stock while it turns its fortunes around.

Big oil, big capital return programs

It’s been a good showing for integrated oil majors like Chevron and ExxonMobil, which have seen their stock prices rise from a 15-year low to an all-time high between 2020 and 2023. But both stocks have cooled recently and have been roughly stable over the last period. year despite a strong increase in the market as a whole.

Chevron and Exxon are returning a ton of cash to shareholders in the form of buybacks and dividends. They have announced spectacular mergers and acquisitions (M&A) in an effort to increase cash flow to accelerate growth and their capital return programs.

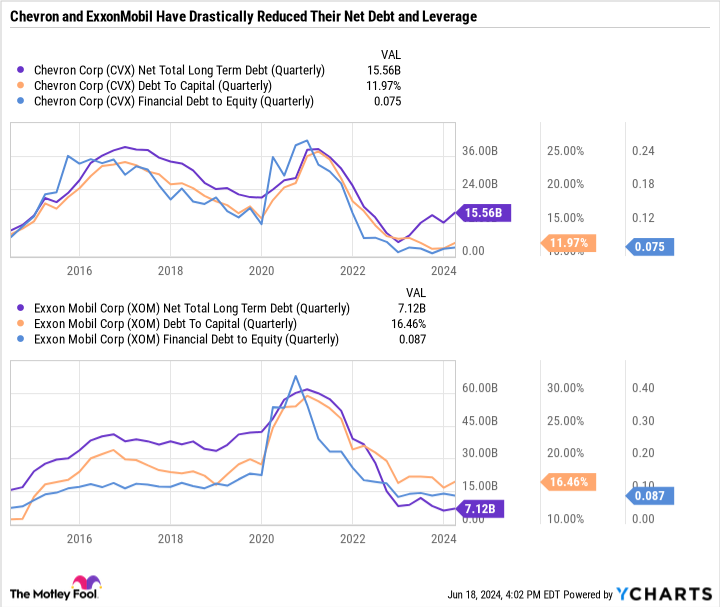

Perhaps the biggest appeal of both companies is their balance sheets. Before the pandemic, Chevron was in a stronger financial position and had less debt than Exxon. But Exxon has arguably benefited more from rising oil prices in recent years and has paid down much of its debt. As a result, both companies are currently in excellent shape, with very low leverage.

CVX data on total net long-term debt (quarterly) by YCharts

Both companies have strategies to generate strong free cash flow and cover dividends even if oil and gas prices fall to $50 a barrel.

Chevron lost 4.3%, exceeding ExxonMobil’s 3.5%. However, ExxonMobil has a clearer mid-term business plan. Instead of choosing between the two, it might be better to simply buy a 50/50 split of the two stocks.

The target slowly turns around

Earlier this month, Target increased its dividend for the 53rd consecutive year to a record $4.48 per share, representing a forward yield of 3.1%. This places Target in an elite category of companies known as Dividend Kings – which includes Procter & Gamble, Coca-Colaand many other pillars who have increased their payouts for at least 50 consecutive years.

If you look through the Dividend Kings list, you’ll find many consumer staples, utilities, and legacy industrial companies. So it’s particularly impressive that Target has been able to pay and grow its dividend for so long, given its discretionary product line.

Target has recovered from its late October lows, but is only up 6.5% last year, compared with a gain of more than 30% for its peer. Walmart. Target also has a forward P/E ratio of 15.2 compared to Walmart’s 27.8 and a yield of over 1.2% for Walmart.

Target has already reduced inventory and increased margins, but the recovery could accelerate if interest rates fall and consumer spending improves. Either way, it’s a good long-term stock thanks to Target’s dividend quality, valuation, and strong brand.

McDonald’s addresses the elephant in the room

Down more than 15% since the start of the year, McDonald’s was one of the worst performing establishments Dow Jones Industrial Average components so far this year. Similar to Target, McDonald’s has hit a wall with price increases and faced bad press in response to price comparisons between now and before the pandemic.

Admittedly, McDonald’s responded to these claims, saying many of them were exaggerated or downright false and that its price increases had not exceeded the rate of inflation. According to McDonald’s, its input costs have increased by 40% over the past five years, and so the company has also increased its prices by 40%.

The McDonald’s brand is all about value, convenience and taste. But value is arguably the most important of all. McDonald’s is hyper aware of the need to slow/block price increases and create value options to attract customers again. Meanwhile, the stock has a P/E ratio of 21.3, a dividend yield of 2.7%, and 47 consecutive years of dividends. is increasing – putting it just a few years away from becoming a dividend king.

Ideal Candidates for a Passive Income Portfolio

UPS, Chevron, ExxonMobil, Target and McDonald’s may not be the flashiest companies. But they pay reliable dividends, which can come in handy when stock prices fall. This valuable feature is easily forgotten when major indices reach new highs. However, long-term investors know that dividends are a great way to generate predictable and stable income, which can be reinvested or supplement income in retirement.

All five companies boast high yields and inexpensive valuations, making them ideal choices for investors looking for bargains without compromising quality.