Nvidia (NASDAQ:NVDA) dominates the market for data center graphics processing units (GPUs), chips used to accelerate demanding workloads such as artificial intelligence (AI) applications. The Wall Street Journal recently reported that “Nvidia’s chips power all of the most advanced AI systems, giving the company an estimated market share of more than 80%.”

The company has been gaining momentum since the launch of ChatGPT in November 2022. This event brought generative AI into the spotlight and sparked unprecedented demand for AI hardware. Nvidia shares have surged 150% this year alone, accounting for nearly a third of last year’s gains. S&P 500.

Somewhat surprisingly, the story indicates that Nvidia shareholders could make more money in the second half of 2024, even after triple-digit gains in the first half. Keep reading to find out more.

History says Nvidia could continue to soar in the second half of 2024

Nvidia became a public company in 1999. The chart below shows its stock price appreciation (or depreciation) during the first and second half of each full year since its initial public offering (IPO). Nvidia generally performed better in the second half, as evidenced by the median values shown at the bottom of each column.

|

Year |

Return to the first semester |

Back in the second half |

|---|---|---|

|

2000 |

171% |

(48%) |

|

2001 |

183% |

44% |

|

2002 |

(74%) |

(33%) |

|

2003 |

99% |

1% |

|

2004 |

12% |

15% |

|

2005 |

13% |

37% |

|

2006 |

16% |

74% |

|

2007 |

12% |

24% |

|

2008 |

(45%) |

(57%) |

|

2009 |

40% |

65% |

|

2010 |

(45%) |

51% |

|

2011 |

3% |

36% |

|

2012 |

0% |

(11%) |

|

2013 |

15% |

14% |

|

2014 |

16% |

43% |

|

2015 |

0% |

64% |

|

2016 |

43% |

127% |

|

2017 |

35% |

34% |

|

2018 |

22% |

(44%) |

|

2019 |

23% |

43% |

|

2020 |

61% |

37% |

|

2021 |

53% |

47% |

|

2022 |

(48%) |

(4%) |

|

2023 |

190% |

17% |

|

Median |

15% |

36% |

Data source: YCharts.

Past performance never guarantees future results, but we can use the information in the chart to make educated guesses about how Nvidia will perform over the remaining months of 2024.

First, Nvidia has rarely followed an upbeat first half with a disappointing second half. Specifically, the stock has produced a positive first-half return over 18 years and a positive second-half return in 16 of those 18 years, or 89% of the time. In other words, history indicates that Nvidia shareholders will likely make money in the remaining months of 2024.

Second, Nvidia had a median return of 36% in the second half of the year, more than double its median return in the first half. However, when gains exceeded 100% in the first half of the year, the stock saw a median return of 17% in the second half. So history shows that Nvidia shareholders could see a 17% return on their investments over the remaining months of 2024.

Unfortunately, analyzing past Nvidia stock price appreciation is a poor way to predict the future. It neglects consequential variables such as current financial results, valuation and market sentiment. But Wall Street analysts have taken these variables into account and do not have a very clear view.

Wall Street analysts see very little upside for Nvidia shareholders

Among the 60 analysts who follow Nvidia, 90% rate the stock as a buy and 10% as a hold. No one is currently recommending the sale. However, the 12-month median price target of $127.50 per share only implies a 3% upside from its current price of $124 per share.

Analysts have consistently revised their targets upward as Nvidia has crushed its revenue and profit estimates. But the company can only beat estimates so many times before the market expects that result – and we may have already reached that point. Nvidia has beaten revenue and profit estimates by at least 6% and 10%, respectively, in four consecutive quarters.

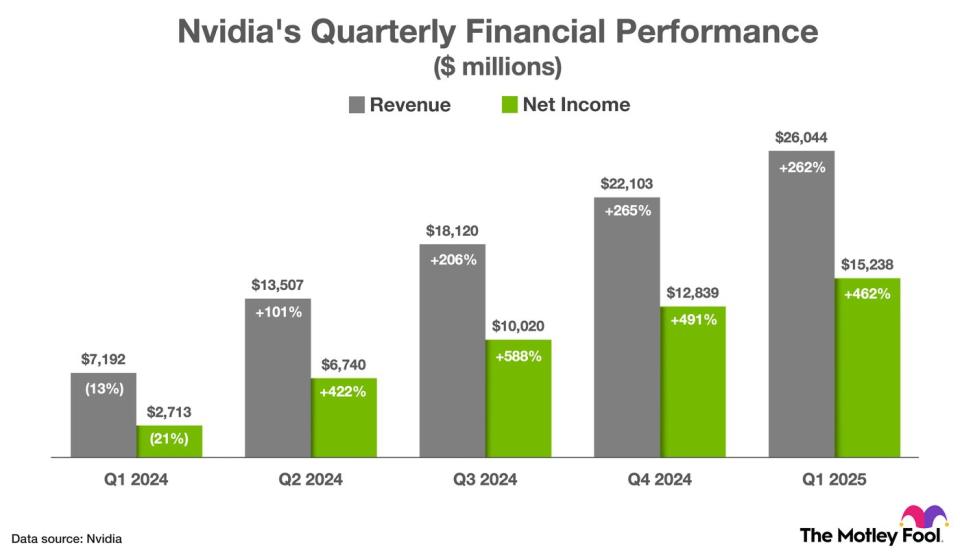

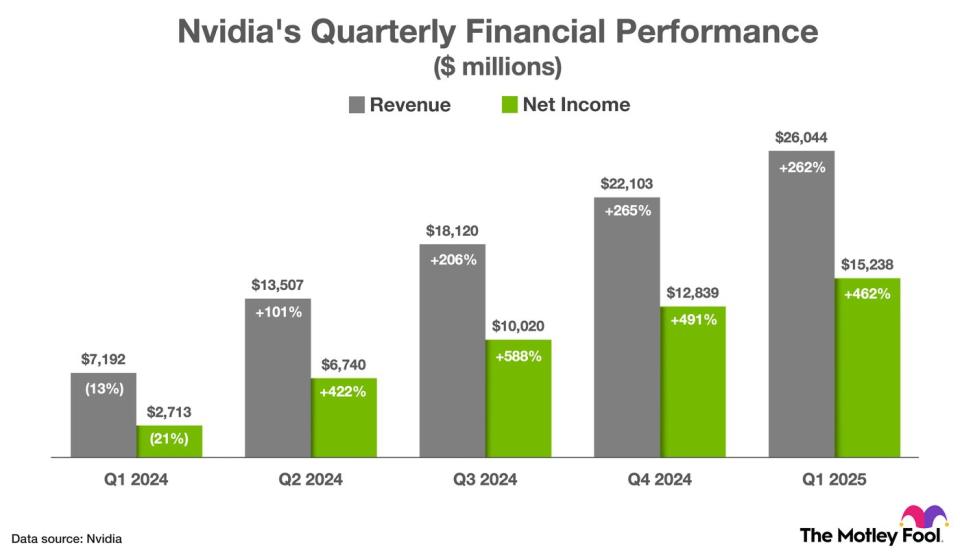

This is particularly impressive given that non-GAAP revenue and net income grew at a triple-digit pace during these quarters, as shown in the chart below.

Here’s the bottom line: At some point, investors will be disappointed when Nvidia reports its financial results, either because revenue and/or earnings beat estimates too modestly or because those metrics don’t match estimates. When that day comes, stocks will likely fall sharply, at least temporarily.

Despite everything, the argument in favor of Nvidia is simple. UBS analysts recently predicted that artificial intelligence would be “the most profound innovation and one of the greatest investment opportunities in human history.” Nvidia’s graphics processing units are the gold standard for accelerating AI workloads. Analysts at Forrester Research recently wrote: “Without Nvidia GPUs, modern AI would not be possible.”

Wall Street analysts expect Nvidia to grow its earnings per share by 33% annually over the next three to five years. This forecast makes its current valuation of 70 times earnings quite reasonable.

Nvidia may or may not be a profitable investment in the second half of 2024. However, from its current price, I believe the stock can beat the market over the next three to five years.

Should you invest $1,000 in Nvidia right now?

Before buying Nvidia stock, consider this:

THE Motley Fool, securities advisor The analyst team has just identified what they think is the 10 best stocks for investors to buy now…and Nvidia wasn’t one of them. The 10 selected stocks could produce monster returns in the years to come.

Consider when Nvidia I made this list on April 15, 2005…if you invested $1,000 at the time of our recommendation, you would have $772,627!*

Stock Advisor provides investors with an easy-to-follow plan for success, including portfolio building advice, regular analyst updates, and two new stock picks each month. THE Equity Advisor the service has more than quadrupled the return of the S&P 500 since 2002*.

See the 10 values »

*Stock Advisor returns June 24, 2024

Trevor Jennewine holds positions at Nvidia. The Motley Fool Ranks and Recommends Nvidia. The Motley Fool has a disclosure policy.

Nvidia Stock Is Up 150% in 2024. History Says AI Stock Will Do That in the Second Half of the Year (Hint: This Might Shock You) was originally published by The Motley Fool