The road ahead is likely to be more difficult for the world’s leading artificial intelligence (AI) company.

Unless you’ve been living under a rock for the past year, you’ve probably noticed that the bulls are running wild on Wall Street. While the resilience of the U.S. economy has certainly played a role, the lion’s share of the gains have come from a policy focus on growth. Nasdaq Composite Index and reference S&P 500 can be attributed to the artificial intelligence (AI) revolution.

Simply put, AI uses software and systems for tasks that humans would normally oversee or undertake. What makes AI special and gives this technology such broad utility is the ability of these systems to learn over time without human intervention. This can allow AI software and systems to become more proficient at certain tasks and perhaps even evolve to acquire new skills.

Image source: Getty Images.

The widespread appeal of AI has excited analysts at PricewaterhouseCoopers (PwC) enough that they estimate that the innovative technology could add $15.7 trillion to the global economy by 2030. With dollar figures that big, there’s room for several big winners.

For now, no company is more directly associated with the rise of AI than the semiconductor giant. Nvidia (NVDA -0.36%).

The $64,000 question is: Will Nvidia be able to maintain its momentum or is a potential crash upon us?

Nvidia has grown like no other market leader before it

For a very brief period this month, Nvidia took the crown from Microsoft And Apple to become the most valuable publicly traded company. No small feat considering that Nvidia’s market cap was less than $360 billion when the curtain opened for 2023.

Nearly all of Nvidia’s $3 trillion market cap increase over the past 18 months and the recent need for a 10-for-1 stock split have been fueled by the popularity of its AI-focused graphics processing units (GPUs). In particular, the company’s H100 GPUs have become the go-to chip for companies looking to run generative AI solutions and train large language models in compute-intensive data centers. In terms of computability, Nvidia’s chips have not been outdone.

In addition to its first-mover advantages, Nvidia counts many of the country’s most influential companies among its major customers. Microsoft, Meta-platforms, AmazonAnd Alphabet represent about 40% of Nvidia’s net revenue. It’s a testament to Nvidia that major tech companies are lining up to use its GPUs in their AI-accelerated data centers.

We’re also talking about a company that enjoys supernatural pricing power for its chips. Even with a leading chip manufacturing company Semiconductor Manufacturing in Taiwan By significantly increasing its wafer-on-substrate chip production capacity, necessary for encapsulating high-bandwidth memories, Nvidia is not close to meeting enterprise demand for its GPUs. The price hike pushed its adjusted gross margin to a staggering 78.4% during the fiscal first quarter (ended April 28).

The cherry on the cake for Nvidia is that it has retained its innovative strengths. With external competitors like Intel And Advanced microsystems In a bid to compete with the H100, Nvidia is preparing to roll out its next-generation AI GPU architecture known as Blackwell.

Image source: Getty Images.

Will Nvidia Stock Crash in the Second Half of 2024?

On paper, Nvidia can seemingly do no wrong. The Wall Street AI leader has beaten every revenue and profit forecast it has been given for over a year. Yet despite this outperformance and the scaling of plans we have seen, the possibility of Nvidia stock collapsing in the second half of the year is still high. East within the potential range of results over the next six months.

History is the most important factor suggesting that Nvidia has a non-zero chance of collapsing in the second half. More specifically, I’m talking about the history of large-scale innovations/technologies and the history based on valorization.

About three decades ago, the proliferation of the Internet began to change the long-term growth arc of American businesses. While there’s no denying that the Internet was a game changer for businesses, it took time for the technology to mature and for companies to understand how they would use direct-to-consumer channels to drive sales and profits.

Every big innovation, technology and trend that has emerged since the advent of the Internet has generated lots of hype, big dollar figures, And An event that burst a bubble in its early days. Whether it’s genome decoding, Chinese stocks, nanotechnology, US real estate, 3D printing, cannabis stocks, blockchain technology, the metaverse, or the mid-1990s internet revolution, history shows us conclusively that all new trends and technologies need time to mature. Artificial intelligence should be no exception to this unspoken rule.

Even though Wall Street’s biggest firms aren’t shy about investing heavily in hardware for their high-computing data centers, most of them don’t have a concrete plan for how they count rely on AI to increase their sales and profits. This finding is consistent with previous major innovations of the previous three decades and provides further evidence of why financial bubbles formed at an early stage.

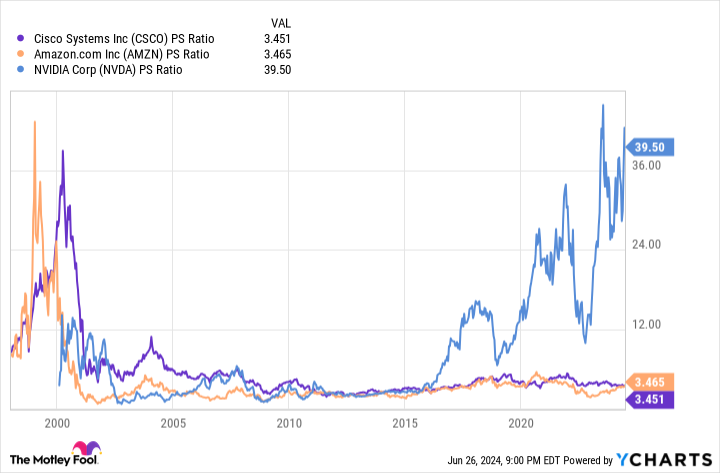

PS CSCO ratio data by YCharts. PS ratio = price/sales ratio.

The other historical problem for Nvidia concerns its valuation. In terms of earnings multiple for the coming year and price-to-earnings-to-growth ratio (PEG ratio), Nvidia is not raising any red flags. But increase its trailing 12 month (TTM) price-to-sales (P/S) ratio, and it’s a completely different story.

Before the Internet bubble burst, Cisco Systems» and Amazon’s TTM P/S ratios peaked in the 30s to 40s. Nvidia’s TTM P/S ratio peak occurred a little over a week ago, at virtually the same level ( approximately 42). Although history doesn’t repeat itself on Wall Street, it tends to rhyme. For market-leading companies, Nvidia is currently in a rarefied (and likely unviable) zone.

Unfortunately, history isn’t always so accurate when it comes to pinpointing when corrections and crashes will occur. While it has been very accurate over the past three decades when it comes to predicting the eventual bursting of the next big innovation and technology, there’s no guarantee that Nvidia’s stock will crash in the second half of 2024.

Even though Nvidia’s AI hardware could see some long-term success and its market capitalization could grow significantly, allowing history to be investors’ guide suggests that Nvidia’s path may become bumpier, at the very least, until the end of 2024.

Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Suzanne Frey, an executive at Alphabet, is a member of the board of directors of The Motley Fool. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Sean Williams holds positions at Alphabet, Amazon, Intel and Meta Platforms. The Motley Fool holds positions and recommends Advanced Micro Devices, Alphabet, Amazon, Apple, Cisco Systems, Meta Platforms, Microsoft, Nvidia and Taiwan Semiconductor Manufacturing. The Motley Fool recommends Intel and recommends the following options: long January 2025 $45 calls on Intel, long January 2026 $395 calls on Microsoft, short August 2024 $35 calls on Intel, and short $405 calls from January 2026 on Microsoft. The Motley Fool has a disclosure policy.