Over the long term, Wall Street has proven to be a true creator of wealth. Although other asset classes, like bonds and real estate, have made investors rich, nothing else comes remotely close to the average annual return that stocks have generated for more than a century.

Right now, Wall Street is experiencing another frenzied bull market. Since the green flag waved at the start of 2023, the timeless Dow Jones Industrial Average (^DJI -0.12%)reference S&P500 (^GSPC -0.41%)and fueled by growth Nasdaq Composite (^IXIC -0.71%) increased by 18%, 43% and 71%, respectively, as of June 27, 2024.

Image source: Getty Images.

But if there’s one thing on Wall Street, it’s that stocks don’t move in straight lines. While artificial intelligence (AI) and stock split euphoria are fueling the current bull market, three predictive indicators that have historically been highly correlated with Wall Street’s downside seem to be pointing to a potential stock market crash in 2024.

A historic drop in the US M2 money supply

To be clear, no indicator can, with guaranteed accuracy, predict the short-term evolution of the main stock market indices. However, certain indicators have historically had the gift of predicting the decline of the Dow Jones, the S&P 500 and the Nasdaq Composite. The US M2 money supply is one such indicator.

The M2 money supply includes everything you’d find in M1—cash and coins in circulation, as well as demand deposits in a checking account—and adds money market accounts, savings accounts, and certificates of deposit (CDs) under $100,000. Think of M1 as money that can be spent on the spot, and M2 as money that can still be spent fairly easily but requires more work to get there.

For nine decades, the M2 money supply has increased virtually without interruption. In other words, more capital was needed in circulation to support a growing economy.

ATTENTION: the money supply is officially in contraction. 📉

This has only happened 4 times in the last 150 years.

Each time, a depression with double-digit unemployment rates followed. 😬 pic.twitter.com/j3FE532oac

— Nick Gerli (@nickgerli1) March 8, 2023

But since its April 2022 peak, M2 has declined significantly. While up 0.69% on an annual basis, the US M2 money supply has declined 3.49% on an aggregate basis since its all-time high. As you can see in Reventure Consulting CEO Nick Gerli’s article on X, this is only the fifth time since 1870 (when back-tested) that M2 has declined by at least 2% on an annual basis (1878, 1893, 1921, 1931-1933, and 2023).

The previous four cases where M2 fell by at least 2% correspond to periods of double-digit unemployment and economic depression. Although two of these cases occurred before the creation of the Federal Reserve and the probability of a depression is very low today, it must be concluded that the decrease in circulating capital leads to a decrease in discretionary purchases of consumers. In short, it’s the perfect recipe for a recession – and the stock market historically performs poorly once a recession is declared.

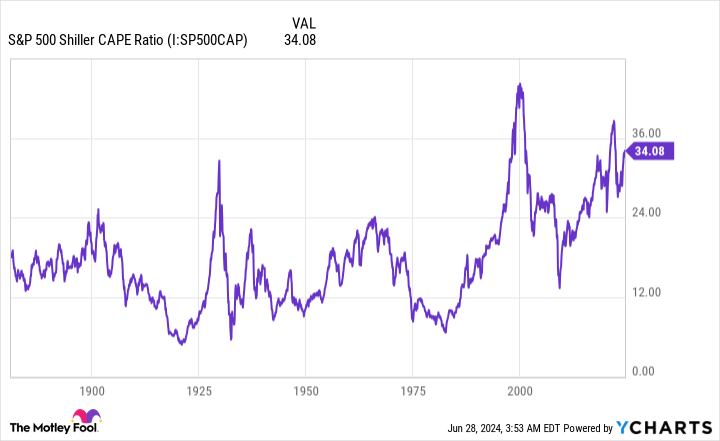

The longest yield curve inversion in the modern era

The second predictive tool that seems to portend trouble for Wall Street is the Treasury yield curve. Compared to M2 money supply, this is a much more popular indicator.

Typically, the Treasury yield curve slopes upward and to the right. This means that longer-term Treasury bonds (those maturing in 10 or 30 years) have higher yields than Treasury bonds maturing in one year or less. The longer your money is tied up in an interest-bearing asset, the higher the yield should be.

10-2 Year Treasury Yield Spread data by YCharts.

Since July 5, 2022, the spread (yield difference) between the 10-year bond and the 2-year Treasury bill has been underwater. In other words, 2-year Treasury securities have a higher yield than the 10-year Treasury bond. It’s called a yield curve inversion, and it’s the longest in the modern era.

The interesting thing about yield curve inversions is that they have preceded every U.S. recession since the end of World War II. About two-thirds of the S&P 500’s peak-to-trough declines have occurred during U.S. recessions.

However, and this is a big “However,” not every yield curve inversion has been followed by a recession. Consider the yield curve inversion as a necessary ingredient that signals that the U.S. economy is facing headwinds.

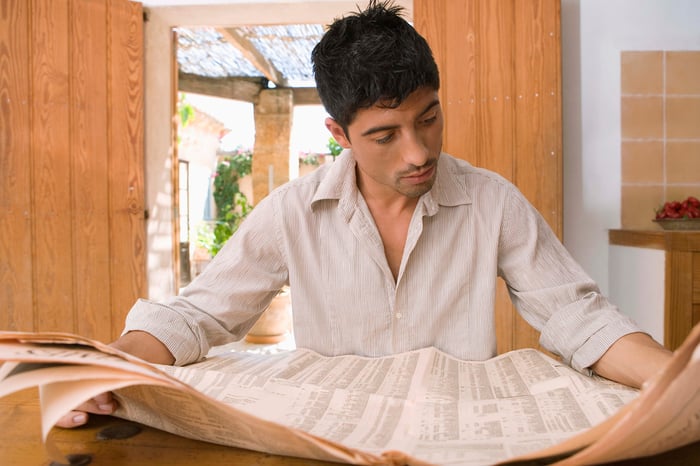

Stocks are exceptionally expensive

The third predictive indicator that suggests a potential stock market crash could occur is Shiller’s valuation-based price-to-earnings ratio (PER), also known as the cyclically adjusted price-to-earnings ratio (CAPE).

While the traditional P/E ratio focuses on earnings over the past 12 months, the Shiller P/E for the S&P 500 is based on inflation-adjusted average earnings over the prior 10 years. Looking at 10-year earnings history mitigates “hiccups” (e.g., the effects of COVID-19) that might otherwise distort investors’ perception of value.

S&P 500 Shiller CAPE ratio data from YCharts. CAPE = cyclically adjusted price/earnings ratio.

As of the close on June 27, the S&P 500’s Shiller P/E stood at 35.70. In some context, that’s more than double its back-tested average of 17.13 over the past 153 years.

The purpose of the Shiller price-earnings ratio is to examine how the major Wall Street stock indices have reacted when the price-earnings ratio has exceeded 30 during a bull market. Since 1871, this has happened six times: 1) August 1929 to September 1929, 2) June 1997 to August 2001, 3) September 2017 to November 2018, 4) December 2019 to February 2020, 5) August 2020 to May 2022, and 6) November 2023 to the present.

The previous five instances where the Shiller P/E ratio exceeded 30 ultimately caused the Dow Jones Industrial Average, S&P 500, and/or Nasdaq Composite to lose between 20% and 89% of their value.

As you can see from the dates of these six cases, there is no reason or reason why stocks can remain expensive. What is clear is that extended valuations do not sustain over the long term. When the Shiller P/E ratio of the S&P 500 rises above 30 for a period of time, it is historically a cautionary tale that a bear market and/or potential crash awaits.

Image source: Getty Images.

Time and perspective change everything

To reiterate, the three predictive measures above suggest that the ingredients exist for a potential stock market crash in 2024. What they do not do is guarantee anything. It is impossible to concretely predict what stocks will do in a week, a month, or even a year.

But when investors take a step back and broaden their perspectives, it becomes much easier to predict where stocks will collectively head.

Let’s take the business cycle as a good example. While workers hate the idea of slowdowns and recessions, they are perfectly normal. No amount of goodwill can prevent recessions from happening.

However, this boom-bust cycle for the economy is not linear. Since the end of World War II in September 1945, nine of the twelve recessions in the United States have been resolved in less than a year, and none of the remaining three recessions have lasted longer than 18 months. By comparison, most periods of economic growth have lasted for several years, with two expansions lasting more than 10 years. Being optimistic and betting on the growth of the American economy has undoubtedly been a wise decision.

This same dynamic is playing out on Wall Street.

It’s official. A new bull market is confirmed.

The S&P 500 is now up 20% from its closing low on October 12, 2022. The previous bear market saw the index fall 25.4% over 282 days.

Learn more at https://t.co/H4p1RcpfIn. pic.twitter.com/tnRz1wdonp

— Custom (@bespokeinvest) June 8, 2023

In June 2023, Bespoke Investment Group published the post you see above on X. It highlights the calendar duration of every S&P 500 bear and bull market since the start of the Great Depression in September 1929. What you’ll notice is that the average duration of bull markets (1,011 calendar days) for the S&P 500 is about 3.5 times longer than the typical S&P 500 bear market (286 calendar days).

Additionally, nearly half of the S&P 500 bull markets (13 of 27) have lasted longer than the longest bear market at 94 years.

An extensive data set from Crestmont Research investment advisors adds to the value of time and perspective. Crestmont analysts calculated the S&P 500’s rolling 20-year total returns, including dividends, after backtesting back to 1900. This research resulted in 105 rolling 20-year periods (1919-2023).

What this data showed was that the 105 rolling 20-year periods would have produced a positive annualized total return. Simply put, if you had hypothetically purchased an index tracking the S&P 500 at any time since 1900 and held that position for 20 years, you would have made money, without fail, every time.

As scary as the data or short-term forecasts may seem, time and perspective have not let investors down.