(Bloomberg) — The heated debate in Washington over whether President Joe Biden will abandon his reelection bid is spilling over to Wall Street, where traders are moving money in and out of the dollar (DX=F), Treasuries and other assets that would be impacted by Donald Trump’s return to power.

Bloomberg’s most read articles

The recalibration of portfolios began late last week after the disastrous debate between Biden and Trump, which heightened concerns that the 81-year-old Democrat was too old to serve another term. The trading that followed was particularly intense in the bond market, where 10-year Treasury yields jumped as much as 20 basis points in the days that followed.

As speculation rapidly intensifies that Biden will drop out of the race (betting markets estimate a less than 50% chance he will remain a candidate), investors are hastily drawing up contingency plans to respond to such an announcement during Thursday’s July 4 holiday and the following weekend.

One fund manager, speaking on condition of anonymity because of the sensitivity of the matter, said he was entering the holiday season with a preference for the dollar and short-term debt to protect against the increased risks he believed Biden would cause. No president has chosen not to seek a second term since Lyndon Johnson in 1968, and the election is still four months away.

“Markets have already repriced the chances of the election since the debate, so the news of the last 24 hours has only added fuel to the fire,” said Gennadiy Goldberg, head of U.S. rates strategy at TD Securities in New York.

The consensus among traders and strategists is that a re-election of Trump, a 78-year-old Republican, would boost trades that benefit from an inflationary mix of looser fiscal policy and greater protectionism: a strong dollar, higher U.S. bond yields and gains in banking, health care and energy stocks.

Even 10,000 miles away in Sydney, everyone is preparing. Rodrigo Catril, a strategist at National Australia Bank, said “everyone” is making business plans in case Biden ends his campaign.

“In any case, the market is betting on Trump winning,” Catril said. “It looks like Democrats are facing very difficult choices, none of them easy and none of them likely to lead to a better outcome.”

Here’s how the so-called “Trump trade” is playing out in the markets:

The Dollar Signal

The dollar (DXY) gave one of the first signals of how markets would adjust to a potential Trump victory, gaining ground in the hours after last week’s debate. While the greenback has benefited this year from indications from the Federal Reserve that it intends to keep interest rates high for longer, the currency rose sharply in real time as Trump dominated the head-to-head matchup with Biden.

Trump has floated the possibility of cutting taxes and imposing tariffs of 60% on imports from China and 10% on imports from the rest of the world. Jan Hatzius, chief economist at Goldman Sachs Group Inc., said this week that such tariffs could drive up inflation and force the Fed to raise rates about five times more than normal.

“A Trump victory raises the prospect of higher inflation and a stronger dollar, given his promise to increase tariffs and a tougher stance on immigration,” said JPMorgan Chase & Co. strategists led by Joyce Chang.

Potential losers from a rising dollar and Trump’s expected support for tariffs include the Mexican peso (MXN=X) and the Chinese yuan (CNY=X).

Trading on the yield curve

In the aftermath of the debate, money managers in the $27 trillion Treasury market responded by buying shorter-dated bonds and selling longer-dated ones — a bet known as the steepener trade.

Many Wall Street strategists have touted the strategy, including Morgan Stanley and Barclays Plc, urging clients to prepare for persistent inflation and higher long-term yields in another Trump term.

In two days starting late last week, 10-year yields rose about 13 basis points relative to 2-year rates, the steepest curve since October.

Signs that traders are preparing for near-term volatility in the Treasury market emerged Wednesday, via a buyer of a so-called “strangle” structure, which benefits from a rise or fall in futures through strike prices. In addition to the potential risk of the holiday weekend surrounding Biden’s candidacy, the expiration also factors in Friday’s U.S. jobs data and testimony next week from Fed Chair Jerome Powell.

Stocks are moving forward

The prospect of a Trump victory buoyed a myriad of stocks that could benefit from his perceived stances on the regulatory environment, mergers and trade relations. The broader market gained following the debate.

The shift in voting trends since last week has “led stocks higher, with Republicans generally seen as more pro-business,” said Tom Essaye, president and founder of Sevens Report.

Health insurers UnitedHealth Group Inc. (UNH) and Humana Inc. (HUM) and banks are expected to benefit from the easing of regulations. Discover Financial Services (DFS) and Capital One Financial Corp. (COF) are among the credit card companies that have gained optimism about Trump, given the pending deal between the two companies and speculation about possible changes to late-fee rules.

Energy stocks like Occidental Petroleum Corp. (OXY) rose after the debate as the former president was seen as having a pro-oil stance. Private prison stocks like GEO Group Inc. (GEO) reacted to his perceived tough immigration stance.

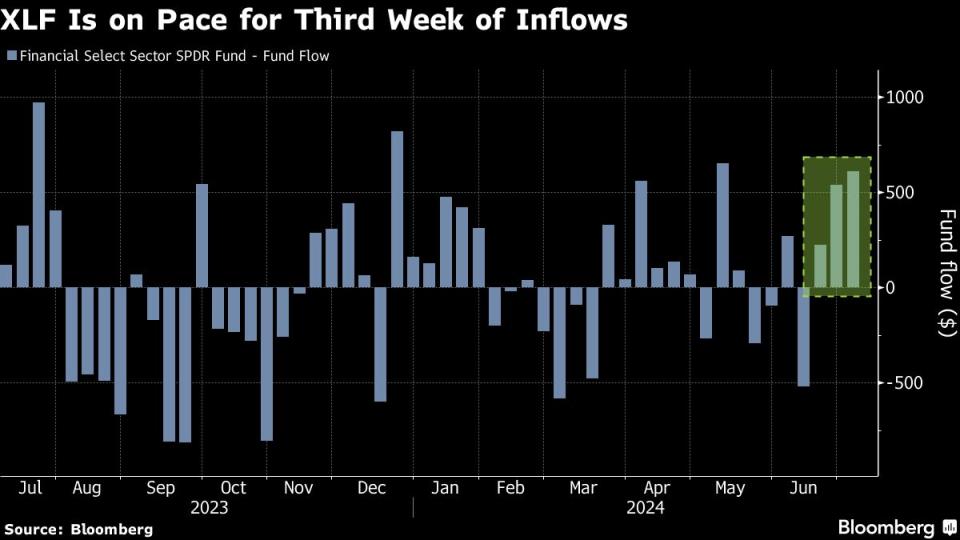

Financial ETFs

The exchange-traded fund market has recently shown a clear investment strategy: long banks are betting that Trump will spur deregulation and a steeper Treasury yield curve through his potentially inflationary agenda.

The $40 billion SPDR Financial Select Sector fund (ticker XLF) saw its largest inflow in more than two months last week, with investors adding about $540 million. So far this week, they’ve added $611 million amid the latest interest rate market gyrations.

Meanwhile, a thematic investing strategy designed to profit from the Trump case has struggled to gain traction. An ETF that sports the eye-catching MAGA symbol and invests in Republican-friendly stocks has been slow to accumulate assets and hasn’t seen any significant inflows this year, according to data compiled by Bloomberg.

Asian impact

Asian markets are not immune to speculation either, with tensions between the United States and China simmering and tariffs in play.

“Mr. Trump’s re-election is likely to be a negative factor for Chinese stocks, as Mr. Trump supports the idea of imposing significantly higher tariffs on U.S. imports from China,” said Tomo Kinoshita, global market strategist at Invesco Asset Management Japan. “In this regard, Japanese stocks with high exposure to the Chinese market are likely to be affected if Mr. Trump wins the election.”

Cryptocurrency Support

In recent weeks, Trump has shown his support for the cryptocurrency industry by meeting with industry executives and promising that he would ensure that any future Bitcoin mining is done in the United States.

That makes the Solana token (SOL-USD) — the fifth-largest cryptocurrency with a market cap of about $67 billion, according to CoinMarketCap — one of the potential beneficiaries of a Trump return to the White House. Asset managers VanEck and 21Shares have filed applications for ETFs that would invest directly in the digital currency.

While many see approval as a long-term prospect, some market participants believe a newly reelected Trump would appoint a Securities and Exchange Commission chairman more favorable to cryptocurrencies than Gary Gensler was under Biden. That’s an outcome that would make a Solana ETF — and a corresponding surge in the token — more likely.

The prospect of a Democratic ticket shakeup is also likely to boost Bitcoin, according to Stephane Ouellette, managing director of FRNT Financial.

“The crazier the American political system seems, the more interesting Bitcoin seems,” Ouellette said. “That’s the kind of vibe Bitcoin would be looking for. The craziness of the American political system is a favorable factor for Bitcoin.”

—With assistance from Emily Nicolle, Katie Greifeld, Edward Bolingbroke, Anya Andrianova, Jan-Patrick Barnert, Natalia Kniazhevich, Ruth Carson, Bre Bradham, Nazmul Ahasan, Winnie Hsu, Carter Johnson, Vildana Hajric, Liz Capo McCormick, and Ye Xie.

Bloomberg Businessweek’s Most Read Articles

©2024 Bloomberg LP