Nvidia (NASDAQ: NVDA) has come a long way in the past five years. Five years ago, the company was nearing the bottom of a cycle due to a collapse in the cryptocurrency market. Now, it’s hitting new highs as its graphics processing units (GPUs) are in high demand for building artificial intelligence (AI) models.

It would have been nearly impossible to predict all the paths Nvidia has taken over the past five years, but I’m going to speculate on what the company might do in the next five years. While this prediction is likely wrong in some ways, it’s good to at least develop an investment thesis for the most dominant company in the market right now.

Nvidia’s best-in-class GPUs are about to face some competition

Nvidia GPUs are, hands down, the best in class. There’s a reason why all of the biggest companies that provide the tools to build AI models or build them in-house almost exclusively use Nvidia GPUs. However, that exclusivity may be waning.

Because GPUs can perform multiple computations in parallel, they are ideal for building AI models. However, if the GPU’s sole task is to train AI models, there are more efficient hardware options. For example, Google Cloud’s Tensor Processing Unit (TPU) is more efficient at training AI models than a GPU. if the workload is configured to run on a TPU.

So there remains a use case for GPUs, which are fantastic for running initial models. However, custom-designed AI chips like TPUs can outperform GPUs when used for specific purposes.

Google Cloud isn’t the only one creating these custom chips. Amazon Web services, Microsoft Azure and Meta Platforms also create their own custom-designed chips. could This will pose a problem for Nvidia over the next five years, as many of its largest customers are integrating these designs in-house. Demand for Nvidia GPUs will likely remain high, but it may not be as high as it is now.

The silver lining for Nvidia is that all of the record-breaking GPUs it sold last year will eventually need to be replaced. While there’s no hard and fast rule, it’s common for these GPUs to last three to five years in a data center. After that, they’ll either need to be replaced (whether with an in-house design or Nvidia’s latest product) or retired.

The computing power needed to run these models continuously isn’t going away, so decommissioning these GPUs isn’t an option. This will essentially create a long-term subscription effect, and within five years, Nvidia will likely see another wave of replacements for the products it currently sells.

Not to mention all the technological improvements that will likely come between now and then, as new chip technologies (like Taiwan SemiconductorsThe 2-nanometer chip technology (which will be more efficient than the previous generation) will create more powerful and efficient GPUs that will help its users in the long run.

But is all this already incorporated into the share price?

Nvidia’s Profit Margins Are Ripe for Competition

It’s no secret that Nvidia stock is expensive. Shares trade at 73 times forward earnings and 46 times forward earnings, meaning significant growth is already priced into the stock.

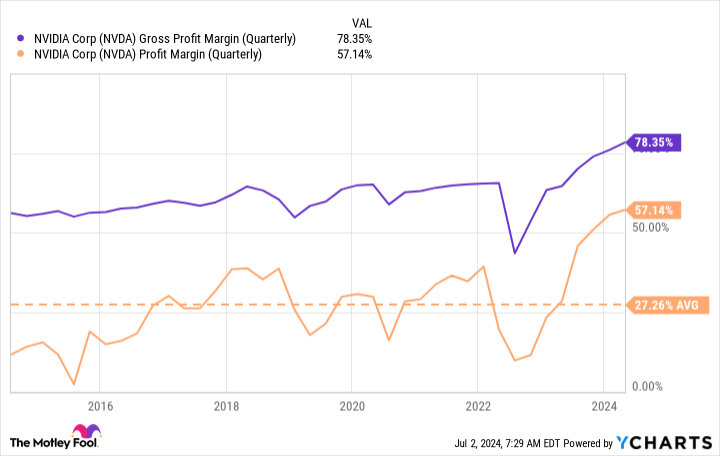

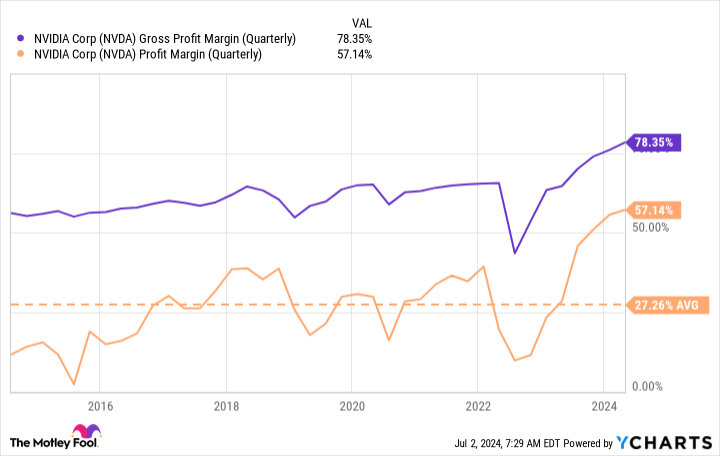

However, Nvidia’s record margins aren’t often talked about. Nvidia’s profit margin levels of close to 60% are incredible and are a major reason why many companies are starting to design their chips in-house.

With demand for Nvidia’s GPUs currently so strong, the company can afford to charge more for its products. But eventually, that won’t be the case, and its profit margins will likely shrink over the next five years.

When this happens, its price-to-earnings (PE) ratio increases due to either slower or declining earnings growth. This is a huge risk associated with the stock, as the market believes that Nvidia’s revenue will continue to grow indefinitely.

While demand for Nvidia products will likely remain high, don’t be surprised if Nvidia faces challenges with in-house solutions in the coming years. There’s an old saying that a company’s margins are a competitor’s opportunities, and when Nvidia’s margins reach these levels, it’s inevitable that there will be competition soon.

As a result, Nvidia’s stock could come under some pressure over the next five years. This incredible explosion in demand won’t last forever, and the opportunity is simply too great for any company to sit back and watch Nvidia take its money.

Don’t miss this second chance at a potentially lucrative opportunity

Ever feel like you missed the boat by buying the best-performing stocks? Then you’re going to want to hear this.

In rare cases, our team of expert analysts issues a “Double Down” Action Investors recommend companies that they believe are about to make their mark. If you’re worried you’ve already missed your chance to invest, now is the best time to buy before it’s too late. And the numbers speak for themselves:

-

Amazon: If you invested $1,000 when we doubled our efforts in 2010, you would have $22,254!*

-

Apple: If you invested $1,000 when we doubled our efforts in 2008, you would have $41,863!*

-

Netflix: If you invested $1,000 when we doubled our investments in 2004, you would have $368,072!*

Right now, we’re issuing “Double Down” alerts for three incredible companies, and there may not be another chance like this anytime soon.

See 3 “Double Down” actions »

*Stock Advisor returns as of July 2, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, former director of market development and spokesperson for Facebook and sister of Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool’s board of directors. Keithen Drury holds positions at Alphabet, Amazon, Meta Platforms, and Taiwan Semiconductor Manufacturing. The Motley Fool holds positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Fool recommends the following options: long January 2026 $395 calls on Microsoft and short January 2026 $405 calls on Microsoft. The Motley Fool has a disclosure policy.

Where Will Nvidia Stock Be in 5 Years? was originally published by The Motley Fool